Form Ga-110lmp - Claim For Refund

Download a blank fillable Form Ga-110lmp - Claim For Refund in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form Ga-110lmp - Claim For Refund with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

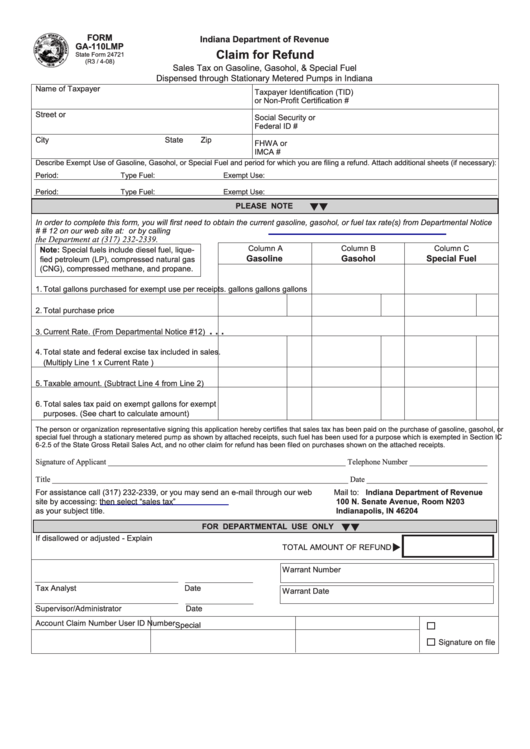

foRm

Indiana Department of Revenue

ga-110lmP

Claim for Refund

State Form 24721

(R3 / 4-08)

Sales Tax on Gasoline, Gasohol, & Special Fuel

Dispensed through Stationary Metered Pumps in Indiana

Name of Taxpayer

Taxpayer Identification (TID)

or Non-Profit Certification #

Street or P.O. Box

Social Security or

Federal ID #

City

State

Zip

FHWA or

IMCA #

Describe Exempt Use of Gasoline, Gasohol, or Special Fuel and period for which you are filing a refund. Attach additional sheets (if necessary):

Period:

Type Fuel:

Exempt Use:

Period:

Type Fuel:

Exempt Use:

PlEaSE NoTE

▼

▼

In order to complete this form, you will first need to obtain the current gasoline, gasohol, or fuel tax rate(s) from Departmental Notice

#12.You may review Departmental Notice # 12 on our web site at:

or by calling

the Department at (317) 232-2339.

Column A

Column B

Column C

Note: Special fuels include diesel fuel, lique-

gasoline

gasohol

Special fuel

fied petroleum (LP), compressed natural gas

(CNG), compressed methane, and propane.

1.

Total gallons purchased for exempt use per receipts.

gallons

gallons

gallons

2.

Total purchase price ................................................

.

.

.

3.

Current Rate. (From Departmental Notice #12) ......

4.

Total state and federal excise tax included in sales.

(Multiply Line 1 x Current Rate ) .............................

5.

Taxable amount. (Subtract Line 4 from Line 2) .......

6.

Total sales tax paid on exempt gallons for exempt

purposes. (See chart to calculate amount) .............

The person or organization representative signing this application hereby certifies that sales tax has been paid on the purchase of gasoline, gasohol, or

special fuel through a stationary metered pump as shown by attached receipts, such fuel has been used for a purpose which is exempted in Section IC

6-2.5 of the State Gross Retail Sales Act, and no other claim for refund has been filed on purchases shown on the attached receipts.

Signature of Applicant _____________________________________________________________ Telephone Number ____________________

Title ____________________________________________________________________________ Date _______________________________

For assistance call (317) 232-2339, or you may send an e-mail through our web

Mail to: Indiana Department of Revenue

site by accessing:

then select “sales tax”

100 N. Senate avenue, Room N203

as your subject title.

Indianapolis, IN 46204

foR DEPaRTmENTal uSE oNly

▼

▼

If disallowed or adjusted - Explain

TOTAL AMOUNT OF REFUND

Warrant Number

Tax Analyst

Date

Warrant Date

supervisor/Administrator

Date

Account

Claim Number

User ID Number

Special

Signature on file

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1