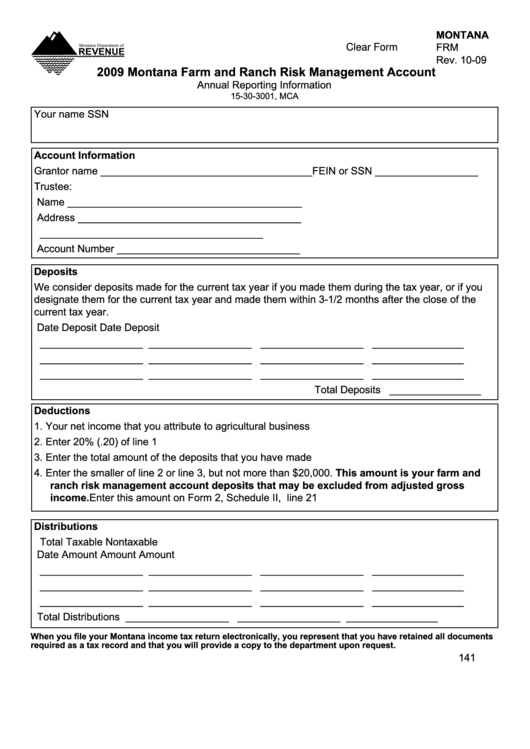

Montana

FRM

Clear Form

Rev. 10-09

2009 Montana Farm and Ranch Risk Management account

Annual Reporting Information

15-30-3001, MCA

Your name

SSN

account Information

Grantor name _____________________________________ FEIN or SSN __________________

Trustee:

Name _________________________________________

Address _______________________________________

_______________________________________

Account Number ________________________________

Deposits

We consider deposits made for the current tax year if you made them during the tax year, or if you

designate them for the current tax year and made them within 3-1/2 months after the close of the

current tax year.

Date

Deposit

Date

Deposit

__________________

__________________

__________________

________________

__________________

__________________

__________________

________________

__________________

__________________

__________________

________________

Total Deposits

________________

Deductions

1. Your net income that you attribute to agricultural business .........................1. ________________

2. Enter 20% (.20) of line 1 .............................................................................2. ________________

3. Enter the total amount of the deposits that you have made ........................3. ________________

4. Enter the smaller of line 2 or line 3, but not more than $20,000. this amount is your farm and

ranch risk management account deposits that may be excluded from adjusted gross

income. Enter this amount on Form 2, Schedule II, line 21 ......................4. ________________

Distributions

Total

Taxable

Nontaxable

Date

Amount

Amount

Amount

__________________

__________________

__________________

________________

__________________

__________________

__________________

________________

__________________

__________________

__________________

________________

Total Distributions

__________________

__________________

________________

When you file your Montana income tax return electronically, you represent that you have retained all documents

required as a tax record and that you will provide a copy to the department upon request.

141

1

1