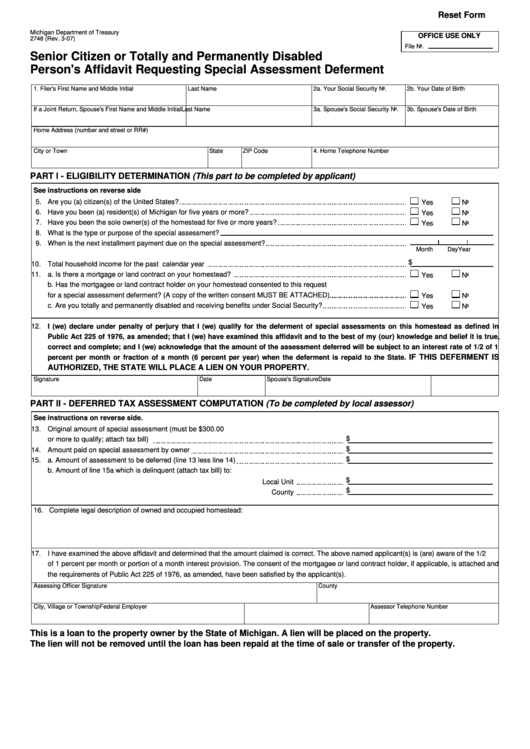

Reset Form

Michigan Department of Treasury

OFFICE USE ONLY

2748 (Rev. 3-07)

File No.

Senior Citizen or Totally and Permanently Disabled

Person's Affidavit Requesting Special Assessment Deferment

1. Filer's First Name and Middle Initial

Last Name

2a. Your Social Security No.

2b. Your Date of Birth

If a Joint Return, Spouse's First Name and Middle Initial Last Name

3a. Spouse's Social Security No.

3b. Spouse's Date of Birth

Home Address (number and street or RR#)

City or Town

State

ZIP Code

4. Home Telephone Number

PART l - ELIGIBILITY DETERMINATION (This part to be completed by applicant)

See instructions on reverse side

5.

Are you (a) citizen(s) of the United States?

Yes

No

6.

Have you been (a) resident(s) of Michigan for five years or more?

Yes

No

7.

Have you been the sole owner(s) of the homestead for five or more years?

Yes

No

8.

What is the type or purpose of the special assessment?

9.

When is the next installment payment due on the special assessment?

Month

Day

Year

$

10.

Total household income for the past calendar year

11.

a. Is there a mortgage or land contract on your homestead?

Yes

No

b. Has the mortgagee or land contract holder on your homestead consented to this request

for a special assessment deferment? (A copy of the written consent MUST BE ATTACHED)

Yes

No

c. Are you totally and permanently disabled and receiving benefits under Social Security?

Yes

No

12.

I (we) declare under penalty of perjury that I (we) qualify for the deferment of special assessments on this homestead as defined in

Public Act 225 of 1976, as amended; that I (we) have examined this affidavit and to the best of my (our) knowledge and belief it is true,

correct and complete; and I (we) acknowledge that the amount of the assessment deferred will be subject to an interest rate of 1/2 of 1

IF THIS DEFERMENT IS

percent per month or fraction of a month (6 percent per year) when the deferment is repaid to the State.

AUTHORIZED, THE STATE WILL PLACE A LIEN ON YOUR PROPERTY.

Signature

Date

Spouse's Signature

Date

PART ll - DEFERRED TAX ASSESSMENT COMPUTATION (To be completed by local assessor)

See instructions on reverse side.

13.

Original amount of special assessment (must be $300.00

$

or more to qualify; attach tax bill)

$

14.

Amount paid on special assessment by owner

$

15.

a. Amount of assessment to be deferred (line 13 less line 14)

b. Amount of line 15a which is delinquent (attach tax bill) to:

$

Local Unit

$

County

16. Complete legal description of owned and occupied homestead:

17.

I have examined the above affidavit and determined that the amount claimed is correct. The above named applicant(s) is (are) aware of the 1/2

of 1 percent per month or portion of a month interest provision. The consent of the mortgagee or land contract holder, if applicable, is attached and

the requirements of Public Act 225 of 1976, as amended, have been satisfied by the applicant(s).

Assessing Officer Signature

County

City, Village or Township

Federal Employer I.D. Number

Assessor Telephone Number

This is a loan to the property owner by the State of Michigan. A lien will be placed on the property.

The lien will not be removed until the loan has been repaid at the time of sale or transfer of the property.

1

1 2

2 3

3