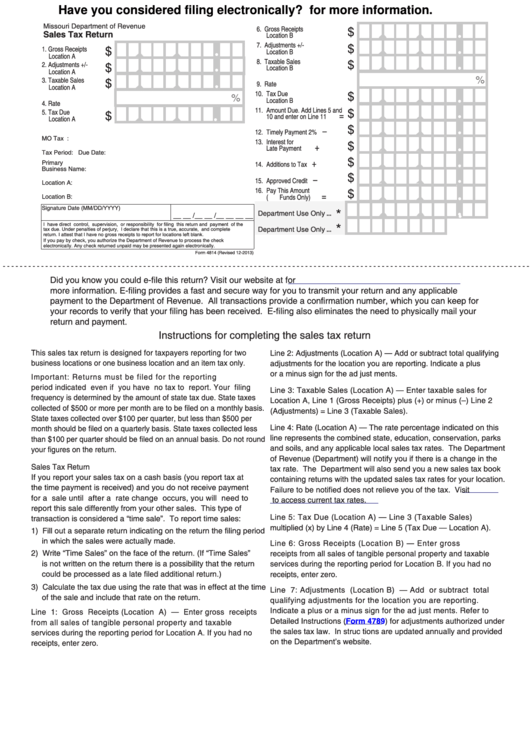

Have you considered filing electronically? Click here for more information.

Missouri Department of Revenue

$

6. Gross Receipts

Sales Tax Return

Location B .............................

•

7. Adjustments +/-

$

$

1. Gross Receipts

Location B .............................

•

•

Location A . ..............

8. Taxable Sales

$

$

2. Adjustments +/-

•

Location B .............................

•

Location A . ..............

%

$

3. Taxable Sales

9. Rate . ......................................

•

Location A . ..............

$

10. Tax Due

%

•

Location B ...............................

4. Rate . .......................

11. Amount Due. Add Lines 5 and

$

5. Tax Due

$

=

•

10 and enter on Line 11 ....

•

Location A . ..............

$

–

12. Timely Payment 2% ..........

•

MO Tax I.D. Number:

13. Interest for

$

+

Late Payment ....................

•

Tax Period:

Due Date:

$

+

Primary

14. Additions to Tax . ................

•

Business Name:

$

–

•

15. Approved Credit ................

Location A:

16. Pay This Amount

$

=

Location B:

(U.S. Funds Only) . ..............

•

Signature

Date (MM/DD/YYYY)

*

Department Use Only....

•

•

__ __ /__ __ /__ __ __ __

*

I have direct control, supervision, or responsibility for filing this return and payment of the

Department Use Only....

tax due. Under penalties of perjury, I declare that this is a true, accurate, and complete

return. I attest that I have no gross receipts to report for locations left blank.

If you pay by check, you authorize the Department of Revenue to process the check

electronically. Any check returned unpaid may be presented again electronically.

Reset Form

Print Form

Form 4814 (Revised 12-2013)

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

Did you know you could e-file this return? Visit our website at

for

more information. E-filing provides a fast and secure way for you to transmit your return and any applicable

payment to the Department of Revenue. All transactions provide a confirmation number, which you can keep for

your records to verify that your filing has been received. E-filing also eliminates the need to physically mail your

return and payment.

Instructions for completing the sales tax return

This sales tax return is designed for taxpayers reporting for two

Line 2: Adjustments (Location A) — Add or subtract total qualifying

business locations or one business location and an item tax only.

adjustments for the location you are reporting. Indicate a plus

or a minus sign for the ad just ments.

Important:

Returns

must

be

filed

for

the

reporting

period indicated even if you have no tax to report. Your filing

Line 3: Taxable Sales (Location A) — Enter taxable sales for

frequency is determined by the amount of state tax due. State taxes

Location A, Line 1 (Gross Receipts) plus (+) or minus (–) Line 2

collected of $500 or more per month are to be filed on a monthly basis.

(Adjustments) = Line 3 (Taxable Sales).

State taxes collected over $100 per quarter, but less than $500 per

Line 4: Rate (Location A) — The rate percentage indicated on this

month should be filed on a quarterly basis. State taxes collected less

line represents the combined state, education, conservation, parks

than $100 per quarter should be filed on an annual basis. Do not round

and soils, and any applicable local sales tax rates. The Department

your figures on the return.

of Revenue (Department) will notify you if there is a change in the

Sales Tax Return

tax rate. The Department will also send you a new sales tax book

If you report your sales tax on a cash basis (you report tax at

containing returns with the updated sales tax rates for your location.

the time payment is received) and you do not receive payment

Failure to be notified does not relieve you of the tax. Visit

for a sale until after a rate change occurs, you will need to

mo.gov/business/sales/rates/

to access current tax rates.

report this sale differently from your other sales. This type of

Line 5: Tax Due (Location A) — Line 3 (Taxable Sales)

transaction is considered a “time sale”. To report time sales:

multiplied (x) by Line 4 (Rate) = Line 5 (Tax Due — Location A).

1) Fill out a separate return indicating on the return the filing period

in which the sales were actually made.

Line 6: Gross Receipts (Location B) — Enter gross

2) Write “Time Sales” on the face of the return. (If “Time Sales”

receipts from all sales of tangible personal property and taxable

is not written on the return there is a possibility that the return

services during the reporting period for Location B. If you had no

could be processed as a late filed additional return.)

receipts, enter zero.

3) Calculate the tax due using the rate that was in effect at the time

Line 7: Adjustments (Location B) — Add or subtract total

of the sale and include that rate on the return.

qualifying adjustments for the location you are reporting.

Indicate a plus or a minus sign for the ad just ments. Refer to

Line 1: Gross Receipts (Location A) — Enter gross receipts

4789) for adjustments authorized under

Detailed Instructions

(Form

from all sales of tangible personal property and taxable

the sales tax law. In struc tions are updated annually and provided

services during the reporting period for Location A. If you had no

on the Department’s website.

receipts, enter zero.

1

1