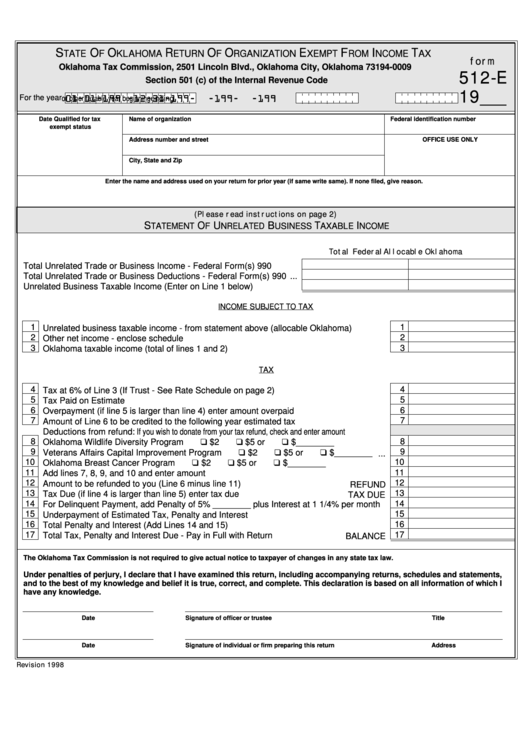

Form 512-E - Return Of Organization Exempt From Income Tax 1998

ADVERTISEMENT

S

O

O

R

O

O

E

F

I

T

TATE

F

KLAHOMA

ETURN

F

RGANIZATION

XEMPT

ROM

NCOME

AX

form

Oklahoma Tax Commission, 2501 Lincoln Blvd., Oklahoma City, Oklahoma 73194-0009

512-E

Section 501 (c) of the Internal Revenue Code

19___

01-01-199 -12-31-199

-

-199

-

-199

For the year

or other taxable year beginning

ending

Date Qualified for tax

Name of organization

Federal identification number

exempt status

Address number and street

OFFICE USE ONLY

City, State and Zip

Enter the name and address used on your return for prior year (if same write same). If none filed, give reason.

(Please read instructions on page 2)

S

O

U

B

T

I

TATEMENT

F

NRELATED

USINESS

AXABLE

NCOME

Total Federal

Allocable Oklahoma

Total Unrelated Trade or Business Income - Federal Form(s) 990

.........

Total Unrelated Trade or Business Deductions - Federal Form(s) 990

...

Unrelated Business Taxable Income (Enter on Line 1 below)

................

INCOME SUBJECT TO TAX

1

1

Unrelated business taxable income - from statement above (allocable Oklahoma)

...........

2

2

Other net income - enclose schedule

..................................................................................

3

3

Oklahoma taxable income (total of lines 1 and 2)

...............................................................

TAX

4

4

Tax at 6% of Line 3 (If Trust - See Rate Schedule on page 2)

............................................

5

5

Tax Paid on Estimate

..........................................................................................................

6

6

Overpayment (if line 5 is larger than line 4) enter amount overpaid

...................................

7

7

Amount of Line 6 to be credited to the following year estimated tax

..................................

Deductions from refund: If you wish to donate from your tax refund, check and enter amount

8

8

Oklahoma Wildlife Diversity Program

$2

$5 or

$________

..................

9

9

Veterans Affairs Capital Improvement Program

$2

$5 or

$________

...

10

10

Oklahoma Breast Cancer Program

$2

$5 or

$________

....................

11

11

Add lines 7, 8, 9, and 10 and enter amount

.........................................................................

12

12

Amount to be refunded to you (Line 6 minus line 11)

.........................................

REFUND

13

13

Tax Due (if line 4 is larger than line 5) enter tax due

.........................................

TAX DUE

14

14

For Delinquent Payment, add Penalty of 5% ________ plus Interest at 1 1/4% per month

15

15

Underpayment of Estimated Tax, Penalty and Interest

......................................................

16

16

Total Penalty and Interest (Add Lines 14 and 15)

..............................................................

17

17

Total Tax, Penalty and Interest Due - Pay in Full with Return

..........................

BALANCE

The Oklahoma Tax Commission is not required to give actual notice to taxpayer of changes in any state tax law.

Under penalties of perjury, I declare that I have examined this return, including accompanying returns, schedules and statements,

and to the best of my knowledge and belief it is true, correct, and complete. This declaration is based on all information of which I

have any knowledge.

Date

Signature of officer or trustee

Title

Date

Signature of individual or firm preparing this return

Address

Revision 1998

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1