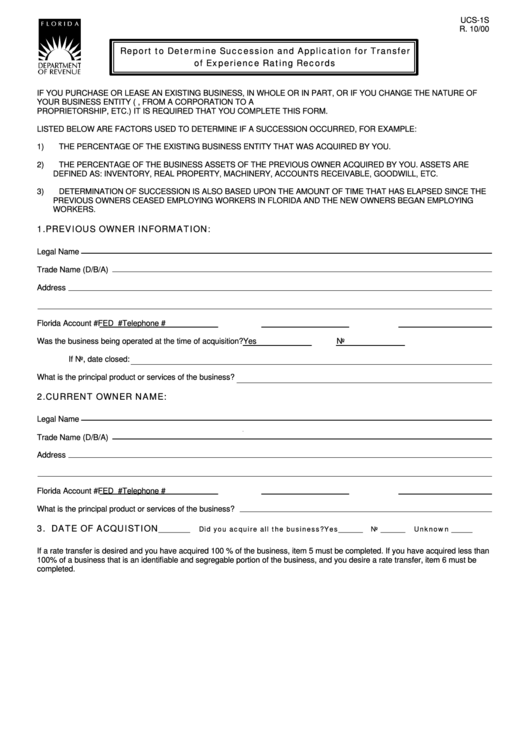

Form Ucs-1s - Report To Determine Succession And Application For Transfer Of Experience Rating Records - Florida Department Of Revenue

ADVERTISEMENT

UCS-1S

R. 10/00

Report to Determine Succession and Application for Transfer

of Experience Rating Records

IF YOU PURCHASE OR LEASE AN EXISTING BUSINESS, IN WHOLE OR IN PART, OR IF YOU CHANGE THE NATURE OF

YOUR BUSINESS ENTITY (e.g. FROM A PARTNERSHIP TO A CORPORATION, FROM A CORPORATION TO A

PROPRIETORSHIP, ETC.) IT IS REQUIRED THAT YOU COMPLETE THIS FORM.

LISTED BELOW ARE FACTORS USED TO DETERMINE IF A SUCCESSION OCCURRED, FOR EXAMPLE:

1)

THE PERCENTAGE OF THE EXISTING BUSINESS ENTITY THAT WAS ACQUIRED BY YOU.

2)

THE PERCENTAGE OF THE BUSINESS ASSETS OF THE PREVIOUS OWNER ACQUIRED BY YOU. ASSETS ARE

DEFINED AS: INVENTORY, REAL PROPERTY, MACHINERY, ACCOUNTS RECEIVABLE, GOODWILL, ETC.

3)

DETERMINATION OF SUCCESSION IS ALSO BASED UPON THE AMOUNT OF TIME THAT HAS ELAPSED SINCE THE

PREVIOUS OWNERS CEASED EMPLOYING WORKERS IN FLORIDA AND THE NEW OWNERS BEGAN EMPLOYING

WORKERS.

1. PREVIOUS OWNER INFORMATION:

Legal Name

Trade Name (D/B/A)

Address

Florida Account #

FED I.D. #

Telephone #

Was the business being operated at the time of acquisition?

Yes

No

If No, date closed:

What is the principal product or services of the business?

2. CURRENT OWNER NAME:

Legal Name

Trade Name (D/B/A)

Address

Florida Account #

FED I.D. #

Telephone #

What is the principal product or services of the business?

3. DATE OF ACQUISTION

_________

Did you acquire all the business?

Yes_______

No _______

Unknown ______

If a rate transfer is desired and you have acquired 100 % of the business, item 5 must be completed. If you have acquired less than

100% of a business that is an identifiable and segregable portion of the business, and you desire a rate transfer, item 6 must be

completed.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2