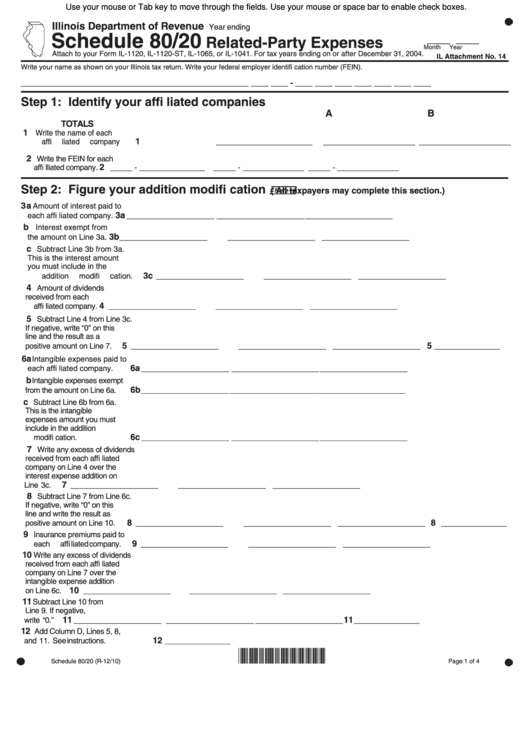

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

Year ending

Schedule 80/20

____ ____

Related-Party Expenses

Month

Year

Attach to your Form IL-1120, IL-1120-ST, IL-1065, or IL-1041. For tax years ending on or after December 31, 2004.

IL Attachment No. 14

Write your name as shown on your Illinois tax return.

Write your federal employer identifi cation number (FEIN).

____________________________________________________

____ ____ - ____ ____ ____ ____ ____ ____ ____

Step 1: Identify your affi liated companies

A

B

C

D

TOTALS

1

Write the name of each

.

1

affi liated company

______________________ _____________________

_____________________

2

Write the FEIN for each

2

affi lliated company.

_____ - _______________ _____ - ______________

_____ - ______________

Step 2: Figure your addition modifi cation

(

All taxpayers may complete this section.)

3 a

Amount of interest paid to

3a

each affi liated company.

____________________

____________________

____________________

b

Interest exempt from

3b

the amount on Line 3a.

____________________

____________________

____________________

c

Subtract Line 3b from 3a.

This is the interest amount

you must include in the

3c

addition modifi cation.

____________________

____________________

____________________

4

Amount of dividends

received from each

4

affi liated company.

____________________

____________________

____________________

5

Subtract Line 4 from Line 3c.

If negative, write “0” on this

line and the result as a

5

5

positive amount on Line 7.

____________________

____________________

____________________

_______________

6a

Intangible expenses paid to

6a

each affi liated company.

____________________

____________________

____________________

b

Intangible expenses exempt

6b

from the amount on Line 6a.

____________________

____________________

____________________

c

Subtract Line 6b from 6a.

This is the intangible

expenses amount you must

include in the addition

6c

modifi cation.

____________________

____________________

____________________

7

Write any excess of dividends

received from each affi liated

company on Line 4 over the

interest expense addition on

7

Line 3c.

____________________

____________________

____________________

8

Subtract Line 7 from Line 6c.

If negative, write “0” on this

line and write the result as

8

8

positive amount on Line 10.

____________________

____________________

____________________

_______________

9

Insurance premiums paid to

9

each affi liated company.

____________________

____________________

____________________

10

Write any excess of dividends

received from each affi liated

company on Line 7 over the

intangible expense addition

10

on Line 6c.

____________________

____________________

____________________

11

Subtract Line 10 from

Line 9. If negative,

11

11

write “0.”

____________________

____________________

____________________

_______________

12

Add Column D, Lines 5, 8,

12

and 11. See instructions.

_______________

*034301110*

Schedule 80/20 (R-12/10)

Page 1 of 4

1

1 2

2