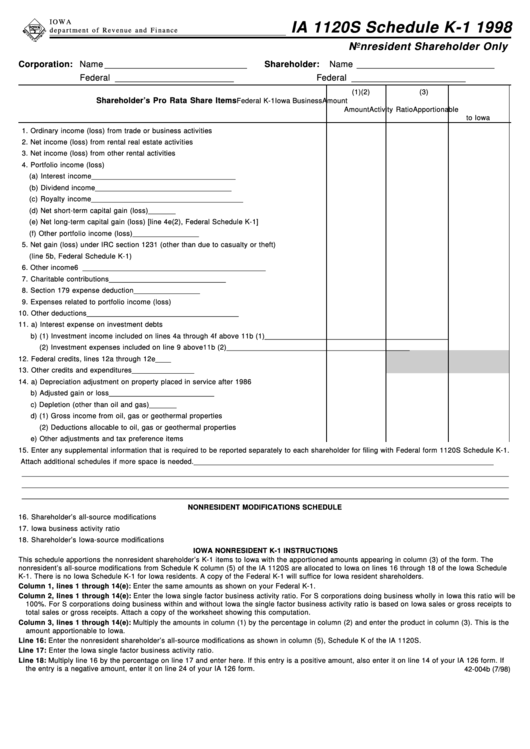

I OWA

IA 1120S Schedule K-1 1998

d e p a r t m e n t o f Reve nu e a n d F i n a n c e

Nonresident Shareholder Only

Corporation: Name ______________________________

Shareholder:

Name _____________________________

Federal I.D. _________________________

Federal I.D. ________________________

(1)

(2)

(3)

Shareholder’s Pro Rata Share Items

Federal K-1

Iowa Business

Amount

Amount

Activity Ratio

Appor tionable

to Iowa

1. Ordinary income (loss) from trade or business activities ....................................................... 1 _______________________________________________

2. Net income (loss) from rental real estate activities ................................................................. 2 _______________________________________________

3. Net income (loss) from other rental activities .......................................................................... 3 _______________________________________________

4. Portfolio income (loss)

(a) Interest income ................................................................................................................... 4a _______________________________________________

(b) Dividend income ................................................................................................................. 4b _______________________________________________

(c) Royalty income ..................................................................................................................... 4c _______________________________________________

(d) Net short-term capital gain (loss) ..................................................................................... 4d _______________________________________________

(e) Net long-term capital gain (loss) [line 4e(2), Federal Schedule K-1] ............................ 4e _______________________________________________

(f) Other portfolio income (loss) ............................................................................................... 4f _______________________________________________

5. Net gain (loss) under IRC section 1231 (other than due to casualty or theft) ...................... 5 _______________________________________________

(line 5b, Federal Schedule K-1)

6. Other income ............................................................................................................................... 6 _______________________________________________

7. Charitable contributions ............................................................................................................. 7 _______________________________________________

8. Section 179 expense deduction ................................................................................................ 8 _______________________________________________

9. Expenses related to portfolio income (loss) ............................................................................. 9 _______________________________________________

10. Other deductions ..................................................................................................................... 10 _______________________________________________

11. a) Interest expense on investment debts ............................................................................ 11a _______________________________________________

b) (1) Investment income included on lines 4a through 4f above .............................. 11b (1) _______________________________________________

(2) Investment expenses included on line 9 above ................................................. 11b (2) _______________________________________________

12. Federal credits, lines 12a through 12e .................................................................................. 12 _______________________________________________

13. Other credits and expenditures .............................................................................................. 13 _______________________________________________

14. a) Depreciation adjustment on property placed in service after 1986 ............................. 14a _______________________________________________

b) Adjusted gain or loss ........................................................................................................ 14b _______________________________________________

c) Depletion (other than oil and gas) .................................................................................... 14c _______________________________________________

d) (1) Gross income from oil, gas or geothermal properties ............................................ 14d _______________________________________________

(2) Deductions allocable to oil, gas or geothermal properties ..................................... 14d _______________________________________________

e) Other adjustments and tax preference items ................................................................. 14e _______________________________________________

15. Enter any supplemental information that is required to be reported separately to each shareholder for filing with Federal form 1120S Schedule K-1.

Attach additional schedules if more space is needed. _____________________________________________________________________________

_____________________________________________________________________________________________________________________________

_____________________________________________________________________________________________________________________________

_____________________________________________________________________________________________________________________________

NONRESIDENT MODIFICATIONS SCHEDULE

16. Shareholder’s all-source modifications .................................................................................................................................................... 16 _______________

17. Iowa business activity ratio ....................................................................................................................................................................... 17 _______________

18. Shareholder’s Iowa-source modifications ............................................................................................................................................... 18 _______________

IOWA NONRESIDENT K-1 INSTRUCTIONS

This schedule apportions the nonresident shareholder’s K-1 items to Iowa with the apportioned amounts appearing in column (3) of the form. The

nonresident’s all-source modifications from Schedule K column (5) of the IA 1120S are allocated to Iowa on lines 16 through 18 of the Iowa Schedule

K-1. There is no Iowa Schedule K-1 for Iowa residents. A copy of the Federal K-1 will suffice for Iowa resident shareholders.

Column 1, lines 1 through 14(e): Enter the same amounts as shown on your Federal K-1.

Column 2, lines 1 through 14(e): Enter the Iowa single factor business activity ratio. For S corporations doing business wholly in Iowa this ratio will be

100%. For S corporations doing business within and without Iowa the single factor business activity ratio is based on Iowa sales or gross receipts to

total sales or gross receipts. Attach a copy of the worksheet showing this computation.

Column 3, lines 1 through 14(e): Multiply the amounts in column (1) by the percentage in column (2) and enter the product in column (3). This is the

amount apportionable to Iowa.

Line 16: Enter the nonresident shareholder’s all-source modifications as shown in column (5), Schedule K of the IA 1120S.

Line 17: Enter the Iowa single factor business activity ratio.

Line 18: Multiply line 16 by the percentage on line 17 and enter here. If this entry is a positive amount, also enter it on line 14 of your IA 126 form. If

the entry is a negative amount, enter it on line 24 of your IA 126 form.

42-004b (7/98)

1

1