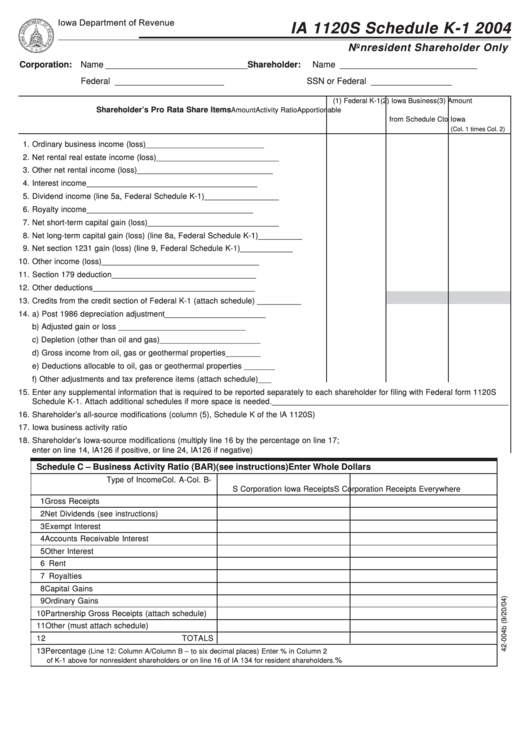

Form Ia 1120s - Schedule K-1 - Nonresident Shareholder Only - 2004

ADVERTISEMENT

Iowa Department of Revenue

IA 1120S Schedule K-1 2004

Nonresident Shareholder Only

Corporation: Name ______________________________

Shareholder:

Name _____________________________

Federal T.I.N. _______________________

SSN or Federal T.I.N. _________________

(1) Federal K-1

(2) Iowa Business

(3) Amount

Shareholder’s Pro Rata Share Items

Amount

Activity Ratio

Apportionable

from Schedule C

to Iowa

(Col. 1 times Col. 2)

1. Ordinary business income (loss) ............................................................................. 1 __________________________________________

2. Net rental real estate income (loss) ......................................................................... 2 __________________________________________

3. Other net rental income (loss) .................................................................................. 3 __________________________________________

4. Interest income ......................................................................................................... 4 __________________________________________

5. Dividend income (line 5a, Federal Schedule K-1) ................................................... 5 __________________________________________

6. Royalty income ......................................................................................................... 6 __________________________________________

7. Net short-term capital gain (loss) ............................................................................. 7 __________________________________________

8. Net long-term capital gain (loss) (line 8a, Federal Schedule K-1) .......................... 8 __________________________________________

9. Net section 1231 gain (loss) (line 9, Federal Schedule K-1) .................................. 9 __________________________________________

10. Other income (loss) ................................................................................................ 10 __________________________________________

11. Section 179 deduction ........................................................................................... 11 __________________________________________

12. Other deductions .................................................................................................... 12 __________________________________________

13. Credits from the credit section of Federal K-1 (attach schedule) ......................... 13 __________________________________________

14. a) Post 1986 depreciation adjustment ................................................................. 14a __________________________________________

b) Adjusted gain or loss ....................................................................................... 14b __________________________________________

c) Depletion (other than oil and gas) .................................................................... 14c __________________________________________

d) Gross income from oil, gas or geothermal properties .................................... 14d __________________________________________

e) Deductions allocable to oil, gas or geothermal properties ............................. 14e __________________________________________

f) Other adjustments and tax preference items (attach schedule) ...................... 14f __________________________________________

15. Enter any supplemental information that is required to be reported separately to each shareholder for filing with Federal form 1120S

Schedule K-1. Attach additional schedules if more space is needed. ______________________________________________________

16. Shareholder’s all-source modifications (column (5), Schedule K of the IA 1120S) ....................................................... 16 _____________

17. Iowa business activity ratio .............................................................................................................................................. 17 _____________

18. Shareholder’s Iowa-source modifications (multiply line 16 by the percentage on line 17;

enter on line 14, IA126 if positive, or line 24, IA126 if negative) .................................................................................... 18 _____________

Schedule C – Business Activity Ratio (BAR)

(see instructions)

Enter Whole Dollars

Type of Income

Col. A-

Col. B-

S Corporation Iowa Receipts

S Corporation Receipts Everywhere

1 Gross Receipts

2 Net Dividends (see instructions)

3 Exempt Interest

4 Accounts Receivable Interest

5 Other Interest

6 Rent

7 Royalties

8 Capital Gains

9 Ordinary Gains

10 Partnership Gross Receipts (attach schedule)

11 Other (must attach schedule)

12

TOTALS

13 Percentage

(Line 12: Column A/Column B – to six decimal places) Enter % in Column 2

%

of K-1 above for nonresident shareholders or on line 16 of IA 134 for resident shareholders.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1