Form Il-1120-Es - Estimated Income And Replacement Tax Payments For Corporations - 2011

ADVERTISEMENT

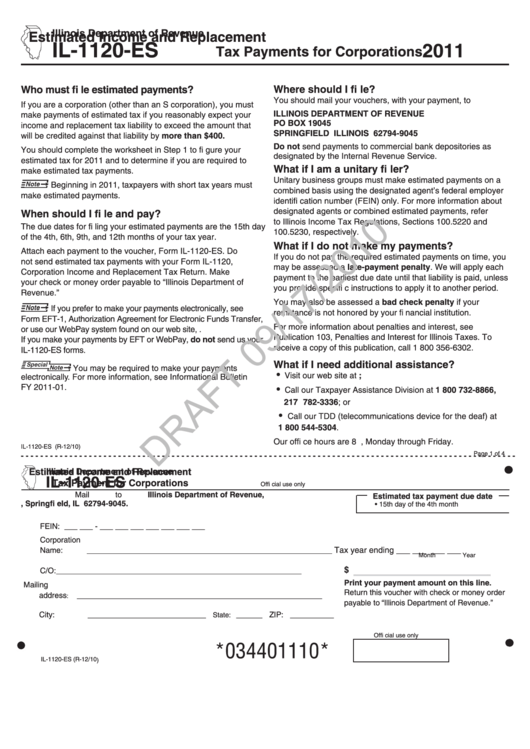

Illinois Department of Revenue

Estimated Income and Replacement

IL-1120-ES

2011

Tax Payments for Corporations

Where should I fi le?

Who must fi le estimated payments?

You should mail your vouchers, with your payment, to

If you are a corporation (other than an S corporation), you must

ILLINOIS DEPARTMENT OF REVENUE

make payments of estimated tax if you reasonably expect your

PO BOX 19045

income and replacement tax liability to exceed the amount that

SPRINGFIELD ILLINOIS 62794-9045

will be credited against that liability by more than $400.

Do not send payments to commercial bank depositories as

You should complete the worksheet in Step 1 to fi gure your

designated by the Internal Revenue Service.

estimated tax for 2011 and to determine if you are required to

What if I am a unitary fi ler?

make estimated tax payments.

Unitary business groups must make estimated payments on a

Beginning in 2011, taxpayers with short tax years must

combined basis using the designated agent’s federal employer

make estimated payments.

identifi cation number (FEIN) only. For more information about

designated agents or combined estimated payments, refer

When should I fi le and pay?

to Illinois Income Tax Regulations, Sections 100.5220 and

The due dates for fi ling your estimated payments are the 15th day

100.5230, respectively.

of the 4th, 6th, 9th, and 12th months of your tax year.

What if I do not make my payments?

Attach each payment to the voucher, Form IL-1120-ES. Do

If you do not pay the required estimated payments on time, you

not send estimated tax payments with your Form IL-1120,

may be assessed a late-payment penalty. We will apply each

Corporation Income and Replacement Tax Return. Make

payment to the earliest due date until that liability is paid, unless

your check or money order payable to “Illinois Department of

you provide specifi c instructions to apply it to another period.

Revenue.”

You may also be assessed a bad check penalty if your

If you prefer to make your payments electronically, see

remittance is not honored by your fi nancial institution.

Form EFT-1, Authorization Agreement for Electronic Funds Transfer,

For more information about penalties and interest, see

or use our WebPay system found on our web site, tax.illinois.gov.

Publication 103, Penalties and Interest for Illinois Taxes. To

If you make your payments by EFT or WebPay, do not send us your

receive a copy of this publication, call 1 800 356-6302.

IL-1120-ES forms.

What if I need additional assistance?

You may be required to make your payments

•

Visit our web site at tax.illinois.gov;

electronically. For more information, see Informational Bulletin

FY 2011-01.

•

Call our Taxpayer Assistance Division at 1 800 732-8866,

217 782-3336; or

•

Call our TDD (telecommunications device for the deaf) at

1 800 544-5304.

Our offi ce hours are 8 a.m. to 5 p.m., Monday through Friday.

IL-1120-ES (R-12/10)

Page 1 of 4

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

Illinois Department of Revenue

Estimated Income and Replacement

IL-1120-ES

Tax Payment for Corporations

Offi cial use only

Mail to Illinois Department of Revenue,

Estimated tax payment due date

P.O. Box 19045, Springfi eld, IL 62794-9045.

• 15th day of the 4th month

FEIN:

___ ___ - ___ ___ ___ ___ ___ ___ ___

Corporation

Name:

________________________________________________________

Tax year ending

___ ___ ___ ___

Month

Year

$

C/O:

________________________________________________________

Print your payment amount on this line.

Mailing

Return this voucher with check or money order

address

________________________________________________________

:

payable to “Illinois Department of Revenue.”

City:

___________________________

______ ZIP: __________

State:

Offi cial use only

*034401110*

IL-1120-ES (R-12/10 )

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4