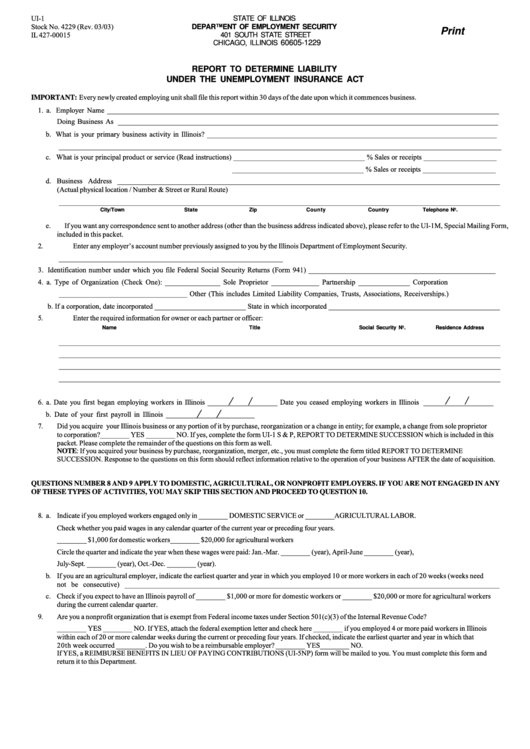

UI-1

STATE OF ILLINOIS

Stock No. 4229 (Rev. 03/03)

DEPARTMENT OF EMPLOYMENT SECURITY

Print

IL 427-00015

401 SOUTH STATE STREET

60605-1229

CHICAGO, ILLINOIS

REPORT TO DETERMINE LIABILITY

UNDER THE UNEMPLOYMENT INSURANCE ACT

IMPORTANT: Every newly created employing unit shall file this report within 30 days of the date upon which it commences business.

1. a. Employer Name ___________________________________________________________________________________________________________

Doing Business As ________________________________________________________________________________________________________

b. What is your primary business activity in Illinois? _______________________________________________________________________________

_________________________________________________________________________________________________________________________

c. What is your principal product or service (Read instructions) ____________________________________ % Sales or receipts ____________________

____________________________________ % Sales or receipts ____________________

d. Business Address ________________________________________________________________________________________________________

(Actual physical location / Number & Street or Rural Route)

____________________________________________________________________________________________________________________

City/Town

State

Zip

County

Country

Telephone No.

e. If you want any correspondence sent to another address (other than the business address indicated above), please refer to the UI-1M, Special Mailing Form,

included in this packet.

2.

Enter any employer’s account number previously assigned to you by the Illinois Department of Employment Security.

____________________________________________________________________

3. Identification number under which you file Federal Social Security Returns (Form 941) ___________________________________________________

4. a. Type of Organization (Check One): _______________ Sole Proprietor _____________ Partnership ______________ Corporation

___________________________________ Other (This includes Limited Liability Companies, Trusts, Associations, Receiverships.)

b. If a corporation, date incorporated _________________________ State in which incorporated _______________________________________________

5.

Enter the required information for owner or each partner or officer:

Name

Title

Social Security No.

Residence Address

Residence Telephone No.

_____________________________________________________________________________________________________________________

______________________________________________________________________________________________________________________

______________________________________________________________________________________________________________________

_____________________________________________________________________________________________________________________

6. a. Date you first began employing workers in Illinois ___________________ Date you ceased employing workers in Illinois ___________________

b. Date of your first payroll in Illinois ________________________

7.

Did you acquire your Illinois business or any portion of it by purchase, reorganization or a change in entity; for example, a change from sole proprietor

to corporation?________ YES ________ NO. If yes, complete the form UI-1 S & P, REPORT TO DETERMINE SUCCESSION which is included in this

packet. Please complete the remainder of the questions on this form as well.

NOTE: If you acquired your business by purchase, reorganization, merger, etc., you must complete the form titled REPORT TO DETERMINE

SUCCESSION. Response to the questions on this form should reflect information relative to the operation of your business AFTER the date of acquisition.

............................................................................................................................................................................................................................................

QUESTIONS NUMBER 8 AND 9 APPLY TO DOMESTIC, AGRICULTURAL, OR NONPROFIT EMPLOYERS. IF YOU ARE NOT ENGAGED IN ANY

OF THESE TYPES OF ACTIVITIES, YOU MAY SKIP THIS SECTION AND PROCEED TO QUESTION 10.

8. a. Indicate if you employed workers engaged only in ________ DOMESTIC SERVICE or ________AGRICULTURAL LABOR.

Check whether you paid wages in any calendar quarter of the current year or preceding four years.

________ $1,000 for domestic workers

________ $20,000 for agricultural workers

Circle the quarter and indicate the year when these wages were paid: Jan.-Mar. ________ (year), April-June ________ (year),

July-Sept. ________ (year), Oct.-Dec. ________ (year).

b. If you are an agricultural employer, indicate the earliest quarter and year in which you employed 10 or more workers in each of 20 weeks (weeks need

not be consecutive) ______________________________________________________________________________________________________

c. Check if you expect to have an Illinois payroll of ________ $1,000 or more for domestic workers or ________ $20,000 or more for agricultural workers

during the current calendar quarter.

9.

Are you a nonprofit organization that is exempt from Federal income taxes under Section 501(c)(3) of the Internal Revenue Code?

________ YES ________ NO. If YES, attach the federal exemption letter and check here ________ if you employed 4 or more paid workers in Illinois

within each of 20 or more calendar weeks during the current or preceding four years. If checked, indicate the earliest quarter and year in which that

20th week occurred ________. Do you wish to be a reimbursable employer? ________ YES________ NO.

If YES, a REIMBURSE BENEFITS IN LIEU OF PAYING CONTRIBUTIONS (UI-5NP) form will be mailed to you. You must complete this form and

return it to this Department.

1

1 2

2