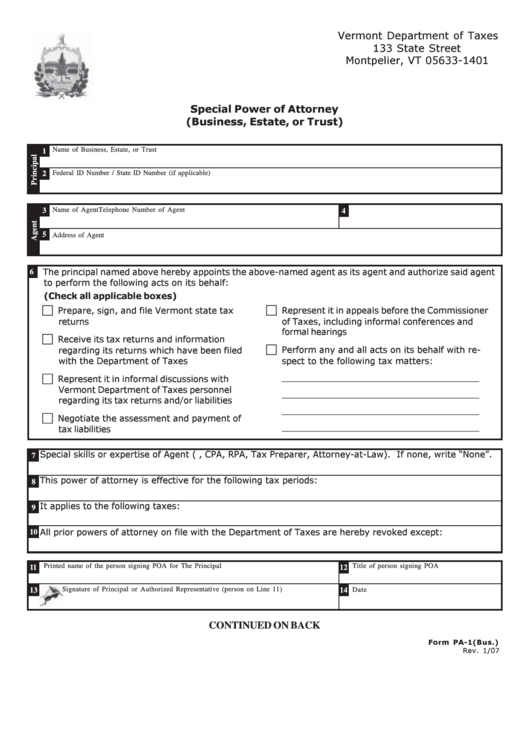

Form Pa-1 - Special Power Of Attorney (Business, Estate, Or Trust)

ADVERTISEMENT

Vermont Department of Taxes

133 State Street

Montpelier, VT 05633-1401

Special Power of Attorney

(Business, Estate, or Trust)

Name of Business, Estate, or Trust

1

Federal ID Number / State ID Number (if applicable)

2

Name of Agent

Telephone Number of Agent

3

4

5

Address of Agent

The principal named above hereby appoints the above-named agent as its agent and authorize said agent

6

to perform the following acts on its behalf:

(Check all applicable boxes)

Represent it in appeals before the Commissioner

Prepare, sign, and file Vermont state tax

returns

of Taxes, including informal conferences and

formal hearings

Receive its tax returns and information

Perform any and all acts on its behalf with re-

regarding its returns which have been filed

with the Department of Taxes

spect to the following tax matters:

____________________________________

Represent it in informal discussions with

Vermont Department of Taxes personnel

____________________________________

regarding its tax returns and/or liabilities

____________________________________

Negotiate the assessment and payment of

____________________________________

tax liabilities

Special skills or expertise of Agent (i.e., CPA, RPA, Tax Preparer, Attorney-at-Law). If none, write “None”.

7

This power of attorney is effective for the following tax periods:

8

It applies to the following taxes:

9

All prior powers of attorney on file with the Department of Taxes are hereby revoked except:

10

Printed name of the person signing POA for The Principal

Title of person signing POA

11

12

Signature of Principal or Authorized Representative (person on Line 11)

13

14

Date

CONTINUED ON BACK

Form PA-1(Bus.)

Rev. 1/07

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2