Suggested Purchaser'S Exemption Certificate Form - Electricity Or Steam Used To Manufacture Items For Sale

ADVERTISEMENT

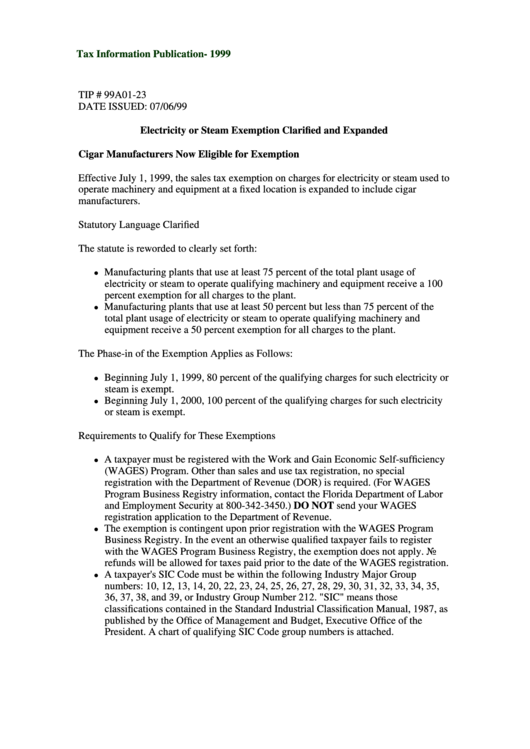

Tax Information Publication- 1999

TIP # 99A01-23

DATE ISSUED: 07/06/99

Electricity or Steam Exemption Clarified and Expanded

Cigar Manufacturers Now Eligible for Exemption

Effective July 1, 1999, the sales tax exemption on charges for electricity or steam used to

operate machinery and equipment at a fixed location is expanded to include cigar

manufacturers.

Statutory Language Clarified

The statute is reworded to clearly set forth:

Manufacturing plants that use at least 75 percent of the total plant usage of

electricity or steam to operate qualifying machinery and equipment receive a 100

percent exemption for all charges to the plant.

Manufacturing plants that use at least 50 percent but less than 75 percent of the

total plant usage of electricity or steam to operate qualifying machinery and

equipment receive a 50 percent exemption for all charges to the plant.

The Phase-in of the Exemption Applies as Follows:

Beginning July 1, 1999, 80 percent of the qualifying charges for such electricity or

steam is exempt.

Beginning July 1, 2000, 100 percent of the qualifying charges for such electricity

or steam is exempt.

Requirements to Qualify for These Exemptions

A taxpayer must be registered with the Work and Gain Economic Self-sufficiency

(WAGES) Program. Other than sales and use tax registration, no special

registration with the Department of Revenue (DOR) is required. (For WAGES

Program Business Registry information, contact the Florida Department of Labor

and Employment Security at 800-342-3450.) DO NOT send your WAGES

registration application to the Department of Revenue.

The exemption is contingent upon prior registration with the WAGES Program

Business Registry. In the event an otherwise qualified taxpayer fails to register

with the WAGES Program Business Registry, the exemption does not apply. No

refunds will be allowed for taxes paid prior to the date of the WAGES registration.

A taxpayer's SIC Code must be within the following Industry Major Group

numbers: 10, 12, 13, 14, 20, 22, 23, 24, 25, 26, 27, 28, 29, 30, 31, 32, 33, 34, 35,

36, 37, 38, and 39, or Industry Group Number 212. "SIC" means those

classifications contained in the Standard Industrial Classification Manual, 1987, as

published by the Office of Management and Budget, Executive Office of the

President. A chart of qualifying SIC Code group numbers is attached.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4