Form Business Tax - General Instructions For Filing Business Tax Returns - 2001, Form Nh-1120 - Corporation Business Profits Tax Return - 2002,etc

ADVERTISEMENT

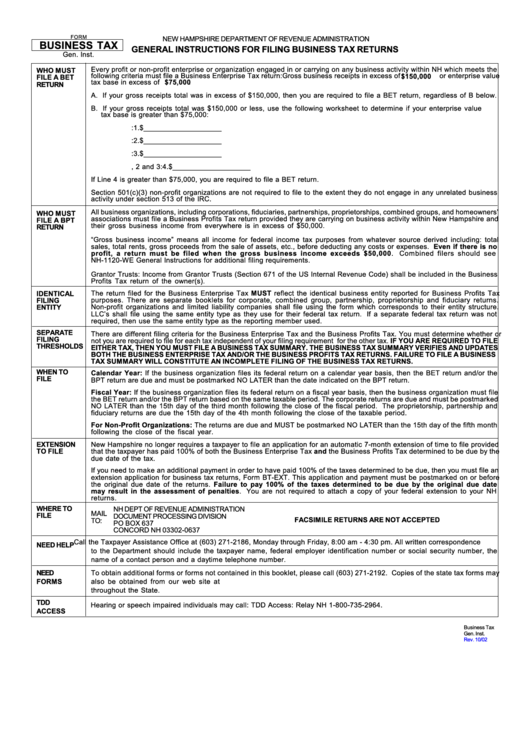

FORM

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

BUSINESS TAX

GENERAL INSTRUCTIONS FOR FILING BUSINESS TAX RETURNS

Gen. Inst.

Every profit or non-profit enterprise or organization engaged in or carrying on any business activity within NH which meets the

WHO MUST

following criteria must file a Business Enterprise Tax return:Gross business receipts in excess of

or enterprise value

$150,000

FILE A BET

tax base in excess of

$75,000

.

RETURN

A. If your gross receipts total was in excess of $150,000, then you are required to file a BET return, regardless of B below.

B. If your gross receipts total was $150,000 or less, use the following worksheet to determine if your enterprise value

tax base is greater than $75,000:

1. Total compensation paid or accrued:

1. $ ____________________

2. Total interest paid or accrued:

2. $ ____________________

3. Total dividends paid:

3. $ ____________________

4. Sum of Lines 1, 2 and 3:

4. $ ____________________

If Line 4 is greater than $75,000, you are required to file a BET return.

Section 501(c)(3) non-profit organizations are not required to file to the extent they do not engage in any unrelated business

activity under section 513 of the IRC.

All business organizations, including corporations, fiduciaries, partnerships, proprietorships, combined groups, and homeowners’

WHO MUST

associations must file a Business Profits Tax return provided they are carrying on business activity within New Hampshire and

FILE A BPT

their gross business income from everywhere is in excess of $50,000.

RETURN

“Gross business income” means all income for federal income tax purposes from whatever source derived including: total

sales, total rents, gross proceeds from the sale of assets, etc., before deducting any costs or expenses. Even if there is no

profit, a return must be filed when the gross business income exceeds $50,000. Combined filers should see

NH-1120-WE General Instructions for additional filing requirements.

Grantor Trusts: Income from Grantor Trusts (Section 671 of the US Internal Revenue Code) shall be included in the Business

Profits Tax return of the owner(s).

The return filed for the Business Enterprise Tax MUST reflect the identical business entity reported for Business Profits Tax

IDENTICAL

purposes. There are separate booklets for corporate, combined group, partnership, proprietorship and fiduciary returns.

FILING

Non-profit organizations and limited liability companies shall file using the form which corresponds to their entity structure.

ENTITY

LLC’s shall file using the same entity type as they use for their federal tax return. If a separate federal tax return was not

required, then use the same entity type as the reporting member used.

SEPARATE

There are different filing criteria for the Business Enterprise Tax and the Business Profits Tax. You must determine whether or

FILING

not you are required to file for each tax independent of your filing requirement for the other tax. IF YOU ARE REQUIRED TO FILE

THRESHOLDS

EITHER TAX, THEN YOU MUST FILE A BUSINESS TAX SUMMARY. THE BUSINESS TAX SUMMARY VERIFIES AND UPDATES

BOTH THE BUSINESS ENTERPRISE TAX AND/OR THE BUSINESS PROFITS TAX RETURNS. FAILURE TO FILE A BUSINESS

TAX SUMMARY WILL CONSTITUTE AN INCOMPLETE FILING OF THE BUSINESS TAX RETURNS.

WHEN TO

Calendar Year: If the business organization files its federal return on a calendar year basis, then the BET return and/or the

FILE

BPT return are due and must be postmarked NO LATER than the date indicated on the BPT return.

Fiscal Year: If the business organization files its federal return on a fiscal year basis, then the business organization must file

the BET return and/or the BPT return based on the same taxable period. The corporate returns are due and must be postmarked

NO LATER than the 15th day of the third month following the close of the fiscal period. The proprietorship, partnership and

fiduciary returns are due the 15th day of the 4th month following the close of the taxable period.

For Non-Profit Organizations: The returns are due and MUST be postmarked NO LATER than the 15th day of the fifth month

following the close of the fiscal year.

EXTENSION

New Hampshire no longer requires a taxpayer to file an application for an automatic 7-month extension of time to file provided

TO FILE

that the taxpayer has paid 100% of both the Business Enterprise Tax and the Business Profits Tax determined to be due by the

due date of the tax.

If you need to make an additional payment in order to have paid 100% of the taxes determined to be due, then you must file an

extension application for business tax returns, Form BT-EXT. This application and payment must be postmarked on or before

the original due date of the returns. Failure to pay 100% of the taxes determined to be due by the original due date

may result in the assessment of penalties. You are not required to attach a copy of your federal extension to your NH

returns.

WHERE TO

NH DEPT OF REVENUE ADMINISTRATION

MAIL

FILE

DOCUMENT PROCESSING DIVISION

FACSIMILE RETURNS ARE NOT ACCEPTED

TO:

PO BOX 637

CONCORD NH 03302-0637

Call the Taxpayer Assistance Office at (603) 271-2186, Monday through Friday, 8:00 am - 4:30 pm. All written correspondence

NEED HELP

to the Department should include the taxpayer name, federal employer identification number or social security number, the

name of a contact person and a daytime telephone number.

NEED

To obtain additional forms or forms not contained in this booklet, please call (603) 271-2192. Copies of the state tax forms may

FORMS

also be obtained from our web site at or by visiting any of the 21 Depository Libraries located

throughout the State.

TDD

Hearing or speech impaired individuals may call: TDD Access: Relay NH 1-800-735-2964.

ACCESS

Business Tax

Gen. Inst.

Rev. 10/02

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5