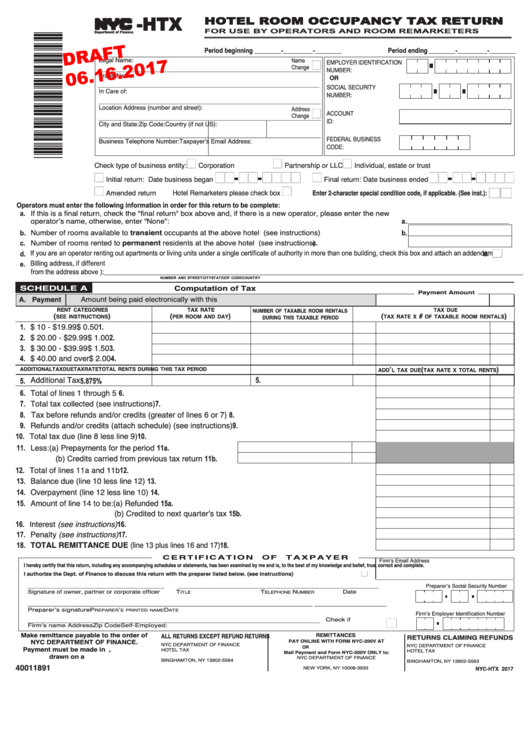

Form Nyc-Htx Draft- Hotel Room Occupancy Tax Return

ADVERTISEMENT

-HTX

HOTEL ROOM OCCUPANCY TAX RETURN

TM

F O R U S E B Y O P E R A T O R S A N D R O O M R E M A R K E T E R S

Department of Finance

Period beginning ________-_________-________

Period ending ________-_________-________

Legal Name:

Name

n

EMPLOYER IDENTIFICATION

Change

NUMBER:

____________________________________________________________________________

Trade Name:

OR

____________________________________________________________________________

SOCIAL SECURITY

In Care of:

NUMBER:

____________________________________________________________________________

Location Address (number and street):

Address

n

ACCOUNT

Change

____________________________________________________________________________

ID:

City and State:

Zip Code:

Country (if not US):

____________________________________________________________________________

FEDERAL BUSINESS

Business Telephone Number:

Taxpayer’s Email Address:

CODE:

n

n

n

Check type of business entity:

Corporation

Partnership or LLC

Individual, estate or trust

nn-nn-nnnn

nn-nn-nnnn

n

n

Initial return: Date business began

Final return: Date business ended

nn

n

n

Enter 2‑character special condition code, if applicable. (See inst.):

Amended return

Hotel Remarketers please check box

Operators must enter the following information in order for this return to be complete:

a. If this is a final return, check the "final return" box above and, if there is a new operator, please enter the new

operator’s name, otherwise, enter “None”:

a.

___________________________________________

.............................................................................................................................................................................................

b. Number of rooms available to transient occupants at the above hotel (see instructions)

b.

................................................................

c. Number of rooms rented to permanent residents at the above hotel (see instructions)

c.

n

d. If you are an operator renting out apartments or living units under a single certificate of authority in more than one building, check this box and attach an addendum:

d.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

e. Billing address, if different

from the address above ):___________________________________________________________________________________________________________________

NUMBER AND STREET

CITY

STATE

ZIP CODE

COUNTRY

SChEDUlE A

C o m p u t a t i o n o f T a x

Payment Amount

A. Payment

Amount being paid electronically with this return............................................................ A.

RENT CATEgORIES

TAx RATE

TAx DUE

NUMbER OF TAxAblE ROOM RENTAlS

(

)

(

)

(

#

)

SEE INSTRUCTIONS

PER ROOM AND DAy

TAx RATE x

OF TAxAblE ROOM RENTAlS

DURINg ThIS TAxAblE PERIOD

1. $ 10 - $19.99

$ 0.50

1.

.............................................................

2. $ 20.00 - $29.99

$ 1.00

2.

....................................................

3. $ 30.00 - $39.99

$ 1.50

3.

....................................................

4. $ 40.00 and over

$ 2.00

4.

..................................................

’

(

)

ADDITIONAl TAx DUE

TAx RATE

TOTAl RENTS DURINg ThIS TAx PERIOD

ADD

l TAx DUE

TAx RATE x TOTAl RENTS

5. Additional Tax

5.

5.875%

6. Total of lines 1 through 5

6.

......................................................................................................................................................................................................................................................

7. Total tax collected (see instructions)

7.

.................................................................................................................................................................................................................

8. Tax before refunds and/or credits (greater of lines 6 or 7)

8.

..............................................................................................................

9. Refunds and/or credits (attach schedule) (see instructions)

9.

...........................................................................................................

10. Total tax due (line 8 less line 9)

10.

.......................................................................................................................................................................................

11. Less: (a) Prepayments for the period

11a.

..............................................

(b) Credits carried from previous tax return

11b.

............

12. Total of lines 11a and 11b

12.

.....................................................................................................................................................................................................

13. Balance due (line 10 less line 12)

13.

...............................................................................................................................................................................

14. Overpayment (line 12 less line 10)

14.

............................................................................................................................................................................

15. Amount of line 14 to be: (a) Refunded

15a.

................................................................................................................................................................

(b) Credited to next quarter’s tax

15b.

.........................................................................................................

16. Interest (see instructions)

16.

.......................................................................................................................................................................................................

17. Penalty (see instructions)

17.

.......................................................................................................................................................................................................

18. TOTAl REMITTANCE DUE (line 13 plus lines 16 and 17)

18.

..................................................................................................................

C E R T I F I C A T I O N

O F

T A x P A y E R

Firm’s Email Address

I hereby certify that this return, including any accompanying schedules or statements, has been examined by me and is, to the best of my knowledge and belief, true, correct and complete.

I authorize the Dept. of Finance to discuss this return with the preparer listed below. (see instructions) .....................................yES

n

_____________________________________________

____________________________________

___________________

__________________

________________

Preparer’s Social Security Number

Signature of owner, partner or corporate officer

T

T

N

Date

ITLE

ELEPHONE

UMBER

_________________________________________

__________________________________

___________________

Preparer’s signature

P

’

D

REPARER

S PRINTED NAME

ATE

Firm’s Employer Identification Number

n

Check if

_____________________________

__________________________________

______________

Firm’s name

Address

Zip Code

Self-Employed:

Make remittance payable to the order of

All RETURNS ExCEPT REFUND RETURNS

REMITTANCES

RETURNS ClAIMINg REFUNDS

NyC DEPARTMENT OF FINANCE.

PAy ONlINE wITh FORM NyC-200V AT

NyC.gOV/ESERVICES

NYC DEPARTMENT OF FINANCE

Payment must be made in U.S. dollars,

NYC DEPARTMENT OF FINANCE

OR

HOTEL TAX

HOTEL TAX

Mail Payment and Form NyC-200V ONly to:

drawn on a U.S. bank.

P.O. BOX 5564

P.O. BOX 5563

NYC DEPARTMENT OF FINANCE

40011891

BINGHAMTON, NY 13902-5564

BINGHAMTON, NY 13902-5563

P.O. BOX 3933

NyC-hTx 2017

NEW YORK, NY 10008-3933

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5