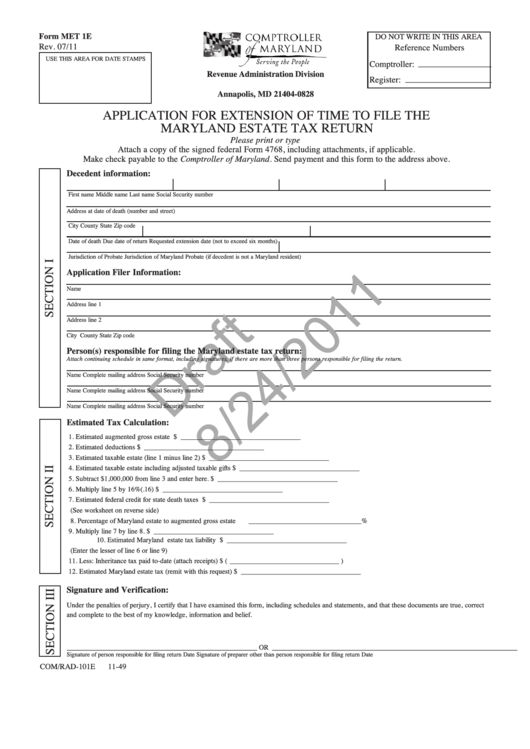

Form Met 1e Draft - Application For Extension Of Time To File The Maryland Estate Tax Return With Instructions

ADVERTISEMENT

DO NOT WRITE IN THIS AREA

Form MET 1E

Rev. 07/11

Reference Numbers

USE THIS AREA FOR DATE STAMPS

Comptroller: _____ _____ _____ _____ _____ __

Revenue Administration Division

Register: _____ _____ _____ _____ _____ _____ __

P.O. Box 828

Annapolis, MD 21404-0828

APPLICATION FOR EXTENSION OF TIME TO FILE THE

MARYLAND ESTATE TAX RETURN

Please print or type

Attach a copy of the signed federal Form 4768, including attachments, if applicable.

Make check payable to the Comptroller of Maryland. Send payment and this form to the address above.

Decedent information:

First name

Middle name

Last name

Social Security number

Address at date of death (number and street)

City

County

State

Zip code

Date of death

Due date of return

Requested extension date (not to exceed six months)

Jurisdiction of Probate

Jurisdiction of Maryland Probate (if decedent is not a Maryland resident)

Application Filer Information:

Name

Address line 1

Address line 2

City

County

State

Zip code

Person(s) responsible for filing the Maryland estate tax return:

Attach continuing schedule in same format, including signatures, if there are more than three persons responsible for filing the return.

Name

Complete mailing address

Social Security number

Name

Complete mailing address

Social Security number

Name

Complete mailing address

Social Security number

Estimated Tax Calculation:

1. Estimated augmented gross estate

$ __________________________________

2. Estimated deductions

$ __________________________________

3. Estimated taxable estate (line 1 minus line 2)

$ __________________________________

4. Estimated taxable estate including adjusted taxable gifts

$ __________________________________

5. Subtract $1,000,000 from line 3 and enter here.

$ __________________________________

6. Multiply line 5 by 16%(.16)

$ __________________________________

7. Estimated federal credit for state death taxes

$ __________________________________

(See worksheet on reverse side)

8. Percentage of Maryland estate to augmented gross estate

________________________________ %

9. Multiply line 7 by line 8.

$ __________________________________

10. Estimated Maryland estate tax liability

$ __________________________________

(Enter the lesser of line 6 or line 9)

11. Less: Inheritance tax paid to-date (attach receipts)

$ ( _______________________________ )

12. Estimated Maryland estate tax (remit with this request)

$ __________________________________

Signature and Verification:

Under the penalties of perjury, I certify that I have examined this form, including schedules and statements, and that these documents are true, correct

and complete to the best of my knowledge, information and belief.

______________________________________________________ OR _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Signature of person responsible for filing return

Date

Signature of preparer other than person responsible for filing return

Date

COM/RAD-101E

11-49

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4