Form 51a159 - On-Farm Facilities Certificate Of Exemption For Materials, Machinery And Equipment Form - Kentucky Department Of Revenue

ADVERTISEMENT

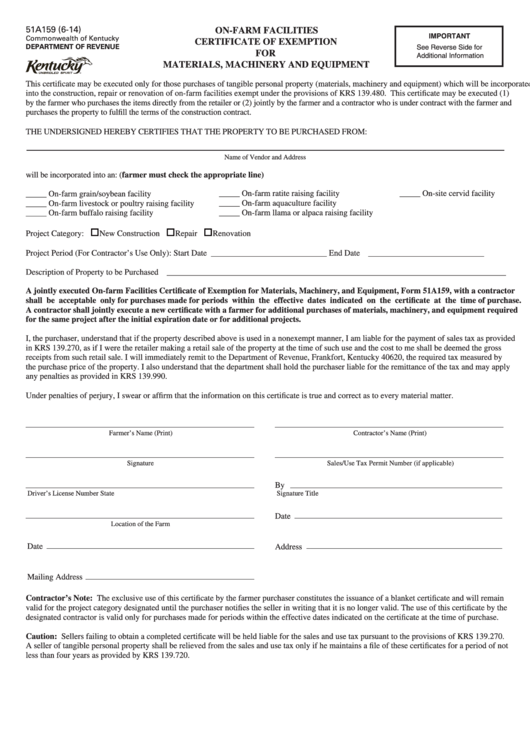

51A159 (6-14)

ON-FARM FACILITIES

IMPORTANT

Commonwealth of Kentucky

CERTIFICATE OF EXEMPTION

DEPARTMENT OF REVENUE

See Reverse Side for

FOR

Additional Information

MATERIALS, MACHINERY AND EQUIPMENT

This certificate may be executed only for those purchases of tangible personal property (materials, machinery and equipment) which will be incorporated

into the construction, repair or renovation of on-farm facilities exempt under the provisions of KRS 139.480. This certificate may be executed (1)

by the farmer who purchases the items directly from the retailer or (2) jointly by the farmer and a contractor who is under contract with the farmer and

purchases the property to fulfill the terms of the construction contract.

THE UNDERSIGNED HEREBY CERTIFIES THAT THE PROPERTY TO BE PURCHASED FROM:

Name of Vendor and Address

will be incorporated into an: (farmer must check the appropriate line)

_____

On-farm ratite raising facility

_____

On-site cervid facility

_____

On-farm grain/soybean facility

_____

On-farm livestock or poultry raising facility

_____

On-farm aquaculture facility

_____

On-farm llama or alpaca raising facility

_____

On-farm buffalo raising facility

Project Category:

New Construction

Repair

Renovation

Project Period (For Contractor’s Use Only):

Start Date

____________________________

End Date ____________________________

Description of Property to be Purchased __________________________________________________________________________________

A jointly executed On-farm Facilities Certificate of Exemption for Materials, Machinery, and Equipment, Form 51A159, with a contractor

shall be acceptable only for purchases made for periods within the effective dates indicated on the certificate at the time of purchase.

A contractor shall jointly execute a new certificate with a farmer for additional purchases of materials, machinery, and equipment required

for the same project after the initial expiration date or for additional projects.

I, the purchaser, understand that if the property described above is used in a nonexempt manner, I am liable for the payment of sales tax as provided

in KRS 139.270, as if I were the retailer making a retail sale of the property at the time of such use and the cost to me shall be deemed the gross

receipts from such retail sale. I will immediately remit to the Department of Revenue, Frankfort, Kentucky 40620, the required tax measured by

the purchase price of the property. I also understand that the department shall hold the purchaser liable for the remittance of the tax and may apply

any penalties as provided in KRS 139.990.

Under penalties of perjury, I swear or affirm that the information on this certificate is true and correct as to every material matter.

Farmer’s Name (Print)

Contractor’s Name (Print)

Signature

Sales/Use Tax Permit Number (if applicable)

By

Driver’s License Number

State

Signature

Title

Date

Location of the Farm

Date

Address

Mailing Address

Contractor’s Note: The exclusive use of this certificate by the farmer purchaser constitutes the issuance of a blanket certificate and will remain

valid for the project category designated until the purchaser notifies the seller in writing that it is no longer valid. The use of this certificate by the

designated contractor is valid only for purchases made for periods within the effective dates indicated on the certificate at the time of purchase.

Caution: Sellers failing to obtain a completed certificate will be held liable for the sales and use tax pursuant to the provisions of KRS 139.270.

A seller of tangible personal property shall be relieved from the sales and use tax only if he maintains a file of these certificates for a period of not

less than four years as provided by KRS 139.720.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1