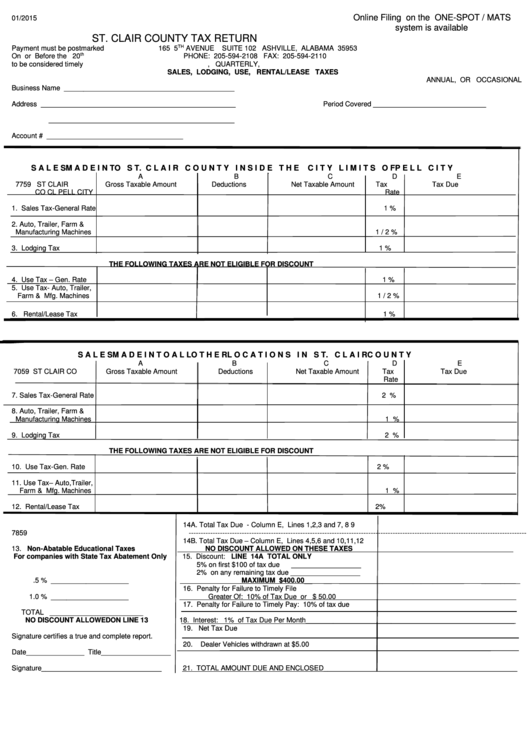

Sales, Lodging, Use, Rental/lease Taxes Form - St.clair County Tax Return - 2015

ADVERTISEMENT

Online Filing on the ONE-SPOT / MATS

01/2015

system is available

ST. CLAIR COUNTY TAX RETURN

TH

Payment must be postmarked

165 5

AVENUE

SUITE 102 ASHVILLE, ALABAMA 35953

th

On or Before the 20

PHONE: 205-594-2108 FAX: 205-594-2110

to be considered timely

MONTHLY, QUARTERLY,

SALES, LODGING, USE, RENTAL/LEASE TAXES

ANNUAL, OR OCCASIONAL

Business Name ____________________________________________

Address __________________________________________________

Period Covered _____________________________

________________________________________________

Account # ___________________________________

S A L E S M A D E

I N TO S T. C L A I R C O U N T Y I N S I D E T H E

C I T Y L I M I T S O F P E L L C I T Y

A

B

C

D

E

7759

ST CLAIR

Gross Taxable Amount

Deductions

Net Taxable Amount

Tax

Tax Due

CO CL PELL CITY

Rate

1. Sales Tax-General Rate

1 %

2. Auto, Trailer, Farm &

Manufacturing Machines

1 / 2 %

3. Lodging Tax

1 %

THE FOLLOWING TAXES ARE NOT ELIGIBLE FOR DISCOUNT

4. Use Tax – Gen. Rate

1 %

5. Use Tax- Auto, Trailer,

Farm & Mfg. Machines

1 / 2 %

6. Rental/Lease Tax

1 %

S A L E S

M A D E

I N T O

A L L O T H E R L O C A T I O N S I N S T. C L A I R C O U N T Y

A

B

C

D

E

7059 ST CLAIR CO

Gross Taxable Amount

Deductions

Net Taxable Amount

Tax

Tax Due

Rate

7. Sales Tax-General Rate

2 %

8. Auto, Trailer, Farm &

Manufacturing Machines

1 %

9. Lodging Tax

2 %

THE FOLLOWING TAXES ARE NOT ELIGIBLE FOR DISCOUNT

10. Use Tax-Gen. Rate

2 %

11. Use Tax– Auto,Trailer,

Farm & Mfg. Machines

1 %

12. Rental/Lease Tax

2 %

14A. Total Tax Due - Column E, Lines 1,2,3 and 7, 8 9

7859

-------------------------------------------------------------------------------------------------------------------------------------------

14B. Total Tax Due – Column E, Lines 4,5,6 and 10,11,12

13.

Non-Abatable Educational Taxes

NO DISCOUNT ALLOWED ON THESE TAXES_________________________________________

For companies with State Tax Abatement Only

15. Discount:

LINE 14A TOTAL ONLY

5% on first $100 of tax due

__________________

2% on any remaining tax due __________________

.5 % ____________________

MAXIMUM $400.00__

__

________________________________

__________

16. Penalty for Failure to Timely File

1.0 % ____________________

Greater Of: 10% of Tax Due or $ 50.00

17. Penalty for Failure to Timely Pay: 10% of tax due

TOTAL ________________________

NO DISCOUNT ALLOWED ON LINE 13

18. Interest: 1% of Tax Due Per Month______________________________________________________

19. Net Tax Due

Signature certifies a true and complete report.

20.

Dealer Vehicles withdrawn at $5.00

Date_______________ Title__________________

Signature_______________________________

21. TOTAL AMOUNT DUE AND ENCLOSED__________________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2