Affidavit Of Information To Support The Exoneration Request For Township Occupation Tax Form

ADVERTISEMENT

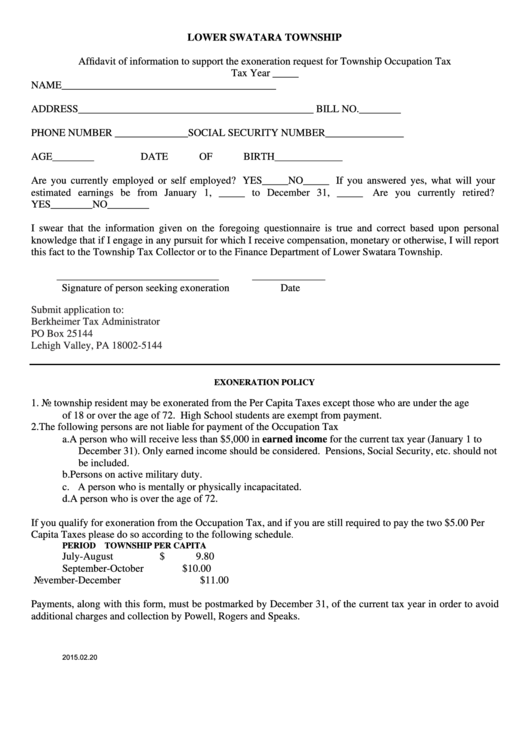

LOWER SWATARA TOWNSHIP

Affidavit of information to support the exoneration request for Township Occupation Tax

Tax Year _____

NAME_________________________________________

ADDRESS_____________________________________________ BILL NO.________

PHONE NUMBER ______________SOCIAL SECURITY NUMBER_______________

AGE________

DATE OF BIRTH_____________

Are you currently employed or self employed? YES_____NO_____ If you answered yes, what will your

estimated earnings be from January 1, _____ to December 31, _____

Are you currently retired?

YES________NO________

I swear that the information given on the foregoing questionnaire is true and correct based upon personal

knowledge that if I engage in any pursuit for which I receive compensation, monetary or otherwise, I will report

this fact to the Township Tax Collector or to the Finance Department of Lower Swatara Township.

_______________________________

______________

Signature of person seeking exoneration

Date

Submit application to:

Berkheimer Tax Administrator

PO Box 25144

Lehigh Valley, PA 18002-5144

EXONERATION POLICY

1.

No township resident may be exonerated from the Per Capita Taxes except those who are under the age

of 18 or over the age of 72. High School students are exempt from payment.

2.

The following persons are not liable for payment of the Occupation Tax

a. A person who will receive less than $5,000 in earned income for the current tax year (January 1 to

December 31). Only earned income should be considered. Pensions, Social Security, etc. should not

be included.

b. Persons on active military duty.

c. A person who is mentally or physically incapacitated.

d. A person who is over the age of 72.

If you qualify for exoneration from the Occupation Tax, and if you are still required to pay the two $5.00 Per

Capita Taxes please do so according to the following schedule

.

PERIOD

TOWNSHIP PER CAPITA

July-August

$ 9.80

September-October

$10.00

November-December

$11.00

Payments, along with this form, must be postmarked by December 31, of the current tax year in order to avoid

additional charges and collection by Powell, Rogers and Speaks.

2015.02.20

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1