Form Rpd-41114 - E911 Services Surcharge Return

ADVERTISEMENT

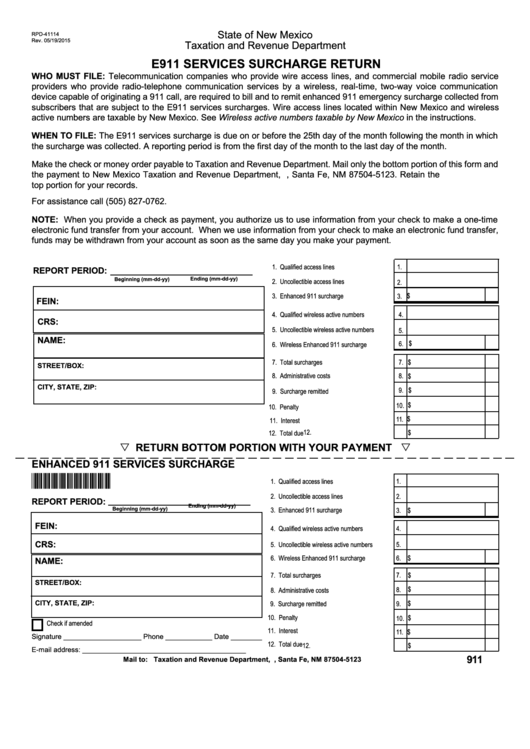

State of New Mexico

RPD-41114

Rev. 05/19/2015

Taxation and Revenue Department

E911 SERVICES SURCHARGE RETURN

WHO MUST FILE: Telecommunication companies who provide wire access lines, and commercial mobile radio service

providers who provide radio-telephone communication services by a wireless, real-time, two-way voice communication

device capable of originating a 911 call, are required to bill and to remit enhanced 911 emergency surcharge collected from

subscribers that are subject to the E911 services surcharges. Wire access lines located within New Mexico and wireless

active numbers are taxable by New Mexico. See Wireless active numbers taxable by New Mexico in the instructions.

WHEN TO FILE: The E911 services surcharge is due on or before the 25th day of the month following the month in which

the surcharge was collected. A reporting period is from the first day of the month to the last day of the month.

Make the check or money order payable to Taxation and Revenue Department. Mail only the bottom portion of this form and

the payment to New Mexico Taxation and Revenue Department, P.O. Box 25123, Santa Fe, NM 87504-5123. Retain the

top portion for your records.

For assistance call (505) 827-0762.

NOTE: When you provide a check as payment, you authorize us to use information from your check to make a one-time

electronic fund transfer from your account. When we use information from your check to make an electronic fund transfer,

funds may be withdrawn from your account as soon as the same day you make your payment.

1.

1. Qualified access lines

REPORT PERIOD:

Beginning (mm-dd-yy)

Ending (mm-dd-yy)

2. Uncollectible access lines

2.

3. Enhanced 911 surcharge

3. $

FEIN:

4. Qualified wireless active numbers

4.

CRS:

5. Uncollectible wireless active numbers

5.

NAME:

6. $

6. Wireless Enhanced 911 surcharge

7. Total surcharges

7.

$

STREET/BOX:

8. Administrative costs

8.

$

CITY, STATE, ZIP:

9. $

9. Surcharge remitted

$

10.

10. Penalty

11. $

11. Interest

12.

$

12. Total due

RETURN BOTTOM PORTION WITH YOUR PAYMENT

ENHANCED 911 SERVICES SURCHARGE

*92150200*

1. Qualified access lines

1.

2. Uncollectible access lines

2.

REPORT PERIOD:

Ending (mm-dd-yy)

3. Enhanced 911 surcharge

Beginning (mm-dd-yy)

3. $

FEIN:

4. Qualified wireless active numbers

4.

CRS:

5. Uncollectible wireless active numbers

5.

6. Wireless Enhanced 911 surcharge

6. $

NAME:

7. Total surcharges

7.

$

STREET/BOX:

$

8.

8. Administrative costs

CITY, STATE, ZIP:

9. Surcharge remitted

9. $

10. Penalty

$

10.

Check if amended

11. Interest

11. $

Signature ____________________ Phone ____________ Date ________

12. Total due

$

12.

E-mail address: __________________________________________

911

Mail to: Taxation and Revenue Department, P.O. Box 25123, Santa Fe, NM 87504-5123

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2