Print

Clear

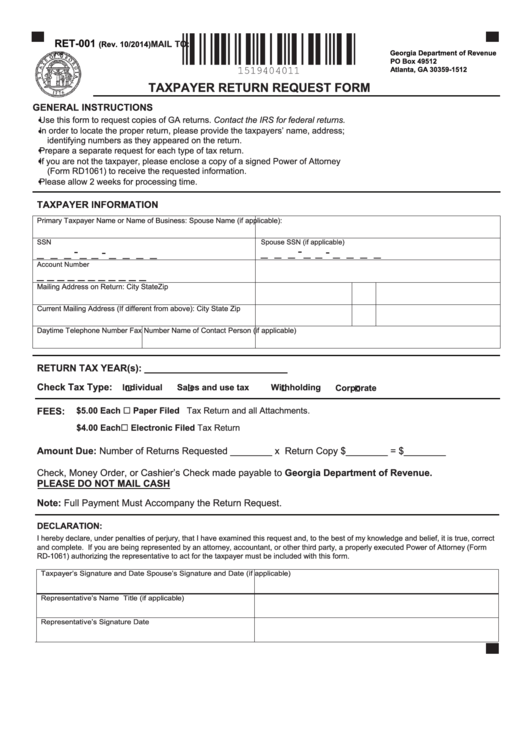

RET-001

MAIL TO:

(Rev. 10/2014)

Georgia Department of Revenue

FOR

PO Box 49512

Atlanta, GA 30359-1512

TAXPAYER RETURN REQUEST FORM

GENERAL INSTRUCTIONS

Use this form to request copies of GA returns. Contact the IRS for federal returns.

In order to locate the proper return, please provide the taxpayers’ name, address;

identifying numbers as they appeared on the return.

Prepare a separate request for each type of tax return.

If you are not the taxpayer, please enclose a copy of a signed Power of Attorney

(Form RD1061) to receive the requested information.

Please allow 2 weeks for processing time.

TAXPAYER INFORMATION

Primary Taxpayer Name or Name of Business:

Spouse Name (if applicable):

SSN

Spouse SSN (if applicable)

_ -

_ -

_ _ _

_ - _ _ _ _

_ _ _

_ - _ _ _ _

Account Number

_ _ _ _ _ _ _ _ _ _ _

Mailing Address on Return:

City

State

Zip

Current Mailing Address (If different from above):

City

State

Zip

Daytime Telephone Number

Fax Number

Name of Contact Person (if applicable)

_________________________

RETURN TAX YEAR(s):

Check Tax Type:

Individual

Sales and use tax

Withholding

Corporate

FEES:

$5.00 Each

Paper Filed Tax Return and all Attachments.

$4.00 Each

Electronic Filed Tax Return

Amount Due: Number of Returns Requested ________ x Return Copy $________ = $________

Check, Money Order, or Cashier’s Check made payable to Georgia Department of Revenue.

PLEASE DO NOT MAIL CASH

Note: Full Payment Must Accompany the Return Request.

DECLARATION:

I hereby declare, under penalties of perjury, that I have examined this request and, to the best of my knowledge and belief, it is true, correct

and complete. If you are being represented by an attorney, accountant, or other third party, a properly executed Power of Attorney (Form

RD-1061) authorizing the representative to act for the taxpayer must be included with this form.

Taxpayer’s Signature and Date

Spouse’s Signature and Date (if applicable)

Representative’s Name

Title (if applicable)

Representative’s Signature

Date

1

1