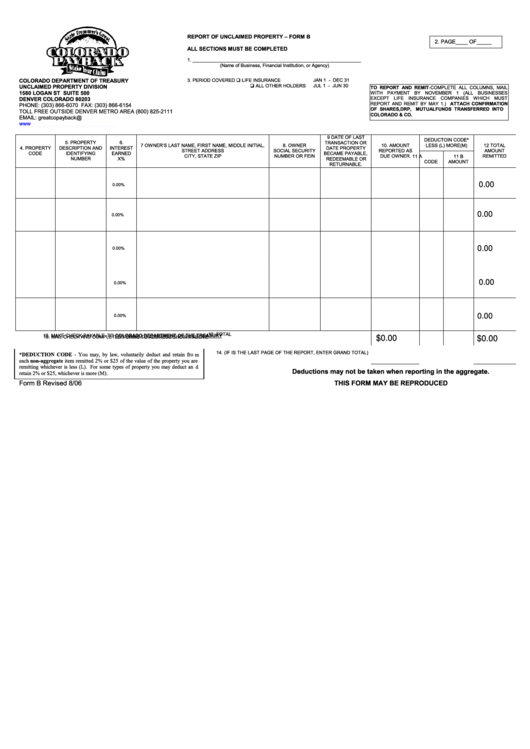

REPORT OF UNCLAIMED PROPERTY – FORM B

2. PAGE____ OF_____

ALL SECTIONS MUST BE COMPLETED

1. ________________________________________________________________

(Name of Business, Financial Institution, or Agency)

COLORADO DEPARTMENT OF TREASURY

3. PERIOD COVERED

LIFE INSURANCE

JAN 1 - DEC 31

ALL OTHER HOLDERS

JUL 1 - JUN 30

UNCLAIMED PROPERTY DIVISION

TO REPORT AND REMIT-COMPLETE ALL COLUMNS, MAIL

1580 LOGAN ST SUITE 500

WITH PAYMENT BY NOVEMBER 1 (ALL BUSINESSES

DENVER COLORADO 80203

EXCEPT LIFE INSURANCE COMPANIES WHICH MUST

REPORT AND REMIT BY MAY 1.) ATTACH CONFIRMATION

PHONE: (303) 866-6070 FAX: (303) 866-6154

OF SHARES, DRP, MUTUAL FUNDS TRANSFERRED INTO

TOLL FREE OUTSIDE DENVER METRO AREA (800) 825-2111

COLORADO & CO.

EMAIL: greatcopayback@state.co.us

9 DATE OF LAST

DEDUCTOIN CODE*

5. PROPERTY

6.

TRANSACTION OR

7 OWNER’S LAST NAME, FIRST NAME, MIDDLE INITIAL,

8. OWNER

10. AMOUNT

LESS (L) MORE(M)

12 TOTAL

4. PROPERTY

DESCRIPTION AND

INTEREST

DATE PROPERTY

STREET ADDRESS

SOCIAL SECURITY

REPORTED AS

AMOUNT

CODE

IDENTIFYING

EARNED

BECAME PAYABLE,

CITY, STATE ZIP

NUMBER OR FEIN

DUE OWNER.

11 A

11 B

REMITTED

NUMBER

X%

REDEEMABLE OR

CODE

AMOUNT

RETURNABLE.

0.00

0.00%

0.00

0.00%

0.00

0.00%

0.00

0.00%

0.00

0.00%

15. MAKE CHECK PAYABLE TO COLORADO DEPARTMENT OF THE TREASURY

$0.00

$0.00

13. TOTAL

16. MAIL CHECK AND COMPLETED FORMS TO ADDRESS SHOWN ABOVE

*DEDUCTION CODE - You may, by law, voluntarily deduct and retain from

14. (IF IS THE LAST PAGE OF THE REPORT, ENTER GRAND TOTAL)

each non-aggregate item remitted 2% or $25 of the value of the property you are

remitting whichever is less (L). For some types of property you may deduct and

Deductions may not be taken when reporting in the aggregate.

retain 2% or $25, whichever is more (M).

Form B Revised 8/06

THIS FORM MAY BE REPRODUCED

1

1