Form Wv/bus-App - West Virginia Office Of Business Registration, West Virginia State Tax Department Taxpayer Assistance Locations

ADVERTISEMENT

Page 1 of 4

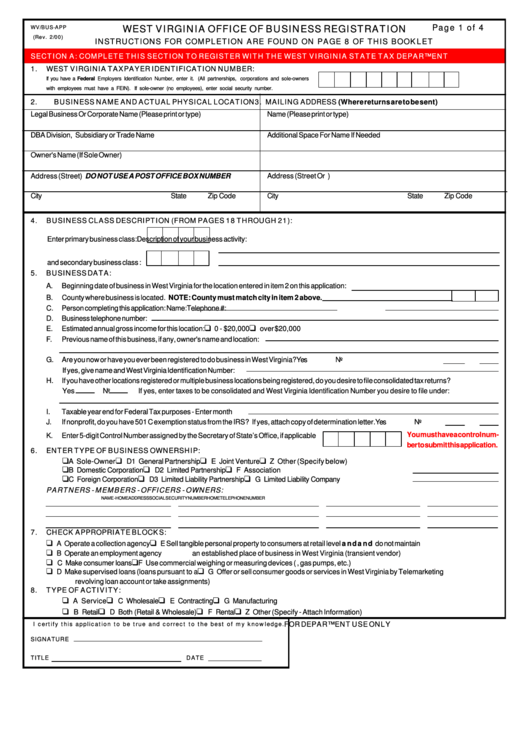

WEST VIRGINIA OFFICE OF BUSINESS REGISTRATION

WV/BUS-APP

(Rev. 2/00)

INSTRUCTIONS FOR COMPLETION ARE FOUND ON PAGE 8 OF THIS BOOKLET

SECTION A: COMPLETE THIS SECTION TO REGISTER WITH THE WEST VIRGINIA STATE TAX DEPARTMENT

1.

WEST VIRGINIA TAXPAYER IDENTIFICATION NUMBER:

If you have a Federal Employers Identification Number, enter it. (All partnerships, corporations and sole-owners

with employees must have a FEIN). If sole-owner (no employees), enter social security number.

2.

BUSINESS NAME AND ACTUAL PHYSICAL LOCATION

3. MAILING ADDRESS (Where returns are to be sent)

Legal Business Or Corporate Name (Please print or type)

Name (Please print or type)

DBA Division, Subsidiary or Trade Name

Additional Space For Name If Needed

Owner's Name (If Sole Owner)

Address (Street) DO NOT USE A POST OFFICE BOX NUMBER

Address (Street Or P.O. Box)

City

State

Zip Code

City

State

Zip Code

4.

BUSINESS CLASS DESCRIPTION (FROM PAGES 18 THROUGH 21):

Enter primary business class:

Description of your business activity:

and secondary business class :

5.

BUSINESS DATA:

A.

Beginning date of business in West Virginia for the location entered in item 2 on this application:

B.

County where business is located. NOTE: County must match city in item 2 above.

C.

Person completing this application: Name:

Telephone #:

D.

Business telephone number:

K

K

E.

Estimated annual gross income for this location:

0 - $20,000

over $20,000

F.

Previous name of this business, if any, owner's name and location:

G.

Are you now or have you ever been registered to do business in West Virginia? ................................................................... Yes

No

If yes, give name and West Virginia Identification Number:

H.

If you have other locations registered or multiple business locations being registered, do you desire to file consolidated tax returns?

Yes

No

If yes, enter taxes to be consolidated and West Virginia Identification Number you desire to file under:

I.

Taxable year end for Federal Tax purposes - Enter month

J.

If nonprofit, do you have 501 C exemption status from the IRS? If yes, attach copy of determination letter. .......................... Yes

No

You must have a control num-

K.

Enter 5-digit Control Number assigned by the Secretary of State’s Office, if applicable

ber to submit this application.

6.

ENTER TYPE OF BUSINESS OWNERSHIP:

K

K

K

K

A Sole-Owner

D1 General Partnership

E Joint Venture

Z Other (Specify below)

K

K

K

B Domestic Corporation

D2 Limited Partnership

F Association

K

K

K

C Foreign Corporation

D3 Limited Liability Partnership

G Limited Liability Company

PARTNERS - MEMBERS - OFFICERS - OWNERS:

NAME -

HOME ADDRESS

SOCIAL SECURITY NUMBER

HOME TELEPHONE NUMBER

7.

CHECK APPROPRIATE BLOCKS:

E Sell tangible personal property to consumers at retail level and

and do not maintain

K

K

A Operate a collection agency

K

B Operate an employment agency

an established place of business in West Virginia (transient vendor)

K

K

C Make consumer loans

F Use commercial weighing or measuring devices (i.e. scales, gas pumps, etc.)

K

K

D Make supervised loans (loans pursuant to a

G Offer or sell consumer goods or services in West Virginia by Telemarketing

revolving loan account or take assignments)

8.

TYPE OF ACTIVITY:

K

K

K

K

A Service

C Wholesale

E Contracting

G Manufacturing

K

K

K

K

B Retail

D Both (Retail & Wholesale)

F Rental

Z Other (Specify - Attach Information)

FOR DEPARTMENT USE ONLY

I certify this application to be true and correct to the best of my knowledge.

SIGNATURE

TITLE

D A T E

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Life

1

1 2

2 3

3 4

4 5

5