Application For New Business Tax License Form

ADVERTISEMENT

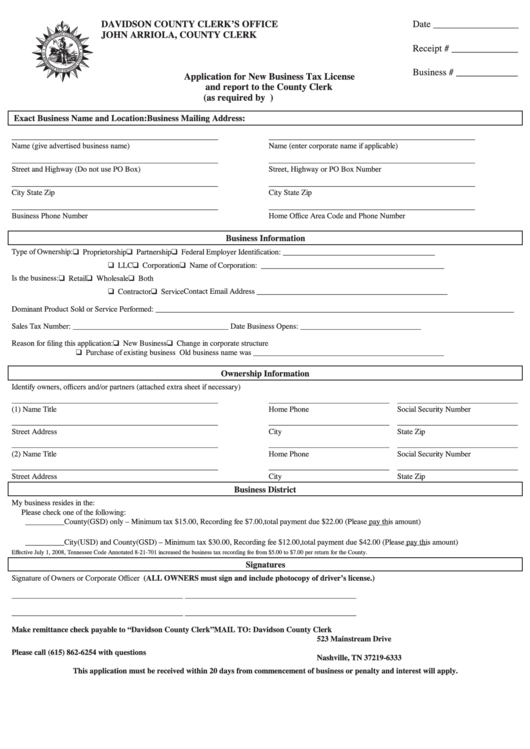

DAVIDSON COUNTY CLERK’S OFFICE

Date __________________

JOHN ARRIOLA, COUNTY CLERK

Receipt # ______________

Business # _____________

Application for New Business Tax License

and report to the County Clerk

(as required by T.C.A. 67-4-706)

Exact Business Name and Location:

Business Mailing Address:

_____________________________________________________

_____________________________________________________

Name (give advertised business name)

Name (enter corporate name if applicable)

_____________________________________________________

_____________________________________________________

Street and Highway (Do not use PO Box)

Street, Highway or PO Box Number

_____________________________________________________

_____________________________________________________

City

State

Zip

City

State

Zip

_____________________________________________________

_____________________________________________________

Business Phone Number

Home Office Area Code and Phone Number

Business Information

Type of Ownership:

❑ Proprietorship

❑ Partnership

❑ Federal Employer Identification: _______________________________________

❑ LLC

❑ Corporation

❑ Name of Corporation: _______________________________________________

Is the business:

❑ Retail

❑ Wholesale

❑ Both

❑ Contractor

❑ Service

Contact Email Address _________________________________________________

Dominant Product Sold or Service Performed: ____________________________________________________________________________________________

Sales Tax Number: ________________________________________ Date Business Opens: _______________________________

Reason for filing this application:

❑ New Business

❑ Change in corporate structure

❑ Purchase of existing business

Old business name was _________________________________________________

Ownership Information

Identify owners, officers and/or partners (attached extra sheet if necessary)

_____________________________________________________

_______________________________

_______________________________

(1) Name

Title

Home Phone

Social Security Number

_____________________________________________________

_______________________________

_______________________________

Street Address

City

State

Zip

_____________________________________________________

_______________________________

_______________________________

(2) Name

Title

Home Phone

Social Security Number

_____________________________________________________

_______________________________

_______________________________

Street Address

City

State

Zip

Business District

My business resides in the:

Please check one of the following:

__________County(GSD) only – Minimum tax $15.00, Recording fee $7.00, total payment due $22.00 (Please pay this amount)

__________City(USD) and County(GSD) – Minimum tax $30.00, Recording fee $12.00, total payment due $42.00 (Please pay this amount)

Effective July 1, 2008, Tennessee Code Annotated 8-21-701 increased the business tax recording fee from $5.00 to $7.00 per return for the County.

Signatures

Signature of Owners or Corporate Officer (ALL OWNERS must sign and include photocopy of driver’s license.)

____________________________________________

____________________________________________

____________________________________________

____________________________________________

Make remittance check payable to “Davidson County Clerk”

MAIL TO:

Davidson County Clerk

523 Mainstream Drive

P.O. Box 196333

Please call (615) 862-6254 with questions

Nashville, TN 37219-6333

This application must be received within 20 days from commencement of business or penalty and interest will apply.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1