Form Au-302 - Motor Vehicle Fuels Tax Exemption

ADVERTISEMENT

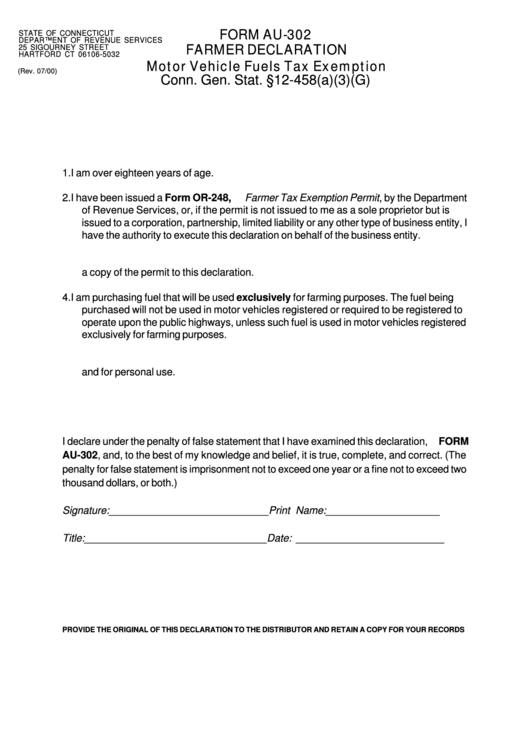

FORM AU-302

STATE OF CONNECTICUT

DEPARTMENT OF REVENUE SERVICES

FARMER DECLARATION

25 SIGOURNEY STREET

HARTFORD CT 06106-5032

Motor Vehicle Fuels Tax Exemption

(Rev. 07/00)

Conn. Gen. Stat. §12-458(a)(3)(G)

1.

I am over eighteen years of age.

I have been issued a Form OR-248, Farmer Tax Exemption Permit , by the Department

2.

of Revenue Services, or, if the permit is not issued to me as a sole proprietor but is

issued to a corporation, partnership, limited liability or any other type of business entity, I

have the authority to execute this declaration on behalf of the business entity.

3.

The Farmer Tax Exemption Permit referenced above is currently in effect. I have attached

a copy of the permit to this declaration.

4.

I am purchasing fuel that will be used exclusively for farming purposes. The fuel being

purchased will not be used in motor vehicles registered or required to be registered to

operate upon the public highways, unless such fuel is used in motor vehicles registered

exclusively for farming purposes.

5.

The fuel being purchased will not be delivered to a tank in which I keep fuel both for farm

and for personal use.

I declare under the penalty of false statement that I have examined this declaration, FORM

AU-302, and, to the best of my knowledge and belief, it is true, complete, and correct. (The

penalty for false statement is imprisonment not to exceed one year or a fine not to exceed two

thousand dollars, or both.)

Signature: ____________________________ Print Name: ____________________

Title: ________________________________ Date: __________________________

PROVIDE THE ORIGINAL OF THIS DECLARATION TO THE DISTRIBUTOR AND RETAIN A COPY FOR YOUR RECORDS

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1