Form Tc106 - Application For Correction Of Assessement On Grounds Other Than, Or In Addition To, Overvaluation, Including Exemption Or Classification Claims - 2000

ADVERTISEMENT

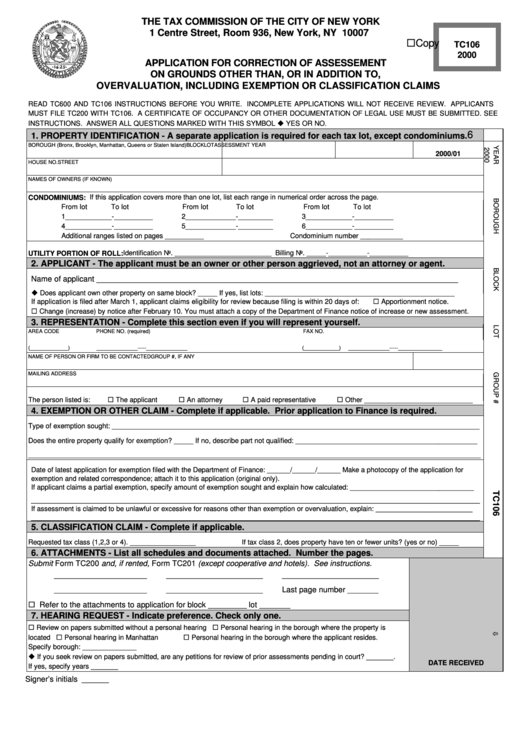

THE TAX COMMISSION OF THE CITY OF NEW YORK

1 Centre Street, Room 936, New York, NY 10007

!Copy

TC106

2000

APPLICATION FOR CORRECTION OF ASSESSEMENT

ON GROUNDS OTHER THAN, OR IN ADDITION TO,

OVERVALUATION, INCLUDING EXEMPTION OR CLASSIFICATION CLAIMS

READ TC600 AND TC106 INSTRUCTIONS BEFORE YOU WRITE. INCOMPLETE APPLICATIONS WILL NOT RECEIVE REVIEW. APPLICANTS

MUST FILE TC200 WITH TC106. A CERTIFICATE OF OCCUPANCY OR OTHER DOCUMENTATION OF LEGAL USE MUST BE SUBMITTED. SEE

INSTRUCTIONS. ANSWER ALL QUESTIONS MARKED WITH THIS SYMBOL " YES OR NO.

6

1. PROPERTY IDENTIFICATION - A separate application is required for each tax lot, except condominiums.

BOROUGH (Bronx, Brooklyn, Manhattan, Queens or Staten Island)

BLOCK

LOT

ASSESSMENT YEAR

2000/01

HOUSE NO.

STREET

NAMES OF OWNERS (IF KNOWN)

CONDOMINIUMS: If this application covers more than one lot, list each range in numerical order across the page.

From lot

To lot

From lot

To lot

From lot

To lot

1____________-__________

2_____________-_________

3____________-__________

4____________-__________

5_____________-_________

6____________-__________

Additional ranges listed on pages __________

Condominium number ___________

UTILITY PORTION OF ROLL: Identification No. _________________________ Billing No. _____-__________-__________

2. APPLICANT - The applicant must be an owner or other person aggrieved, not an attorney or agent.

Name of applicant __________________________________________________________________________________

" Does applicant own other property on same block? _____ If yes, list lots: _________________________________________________

! Apportionment notice.

If application is filed after March 1, applicant claims eligibility for review because filing is within 20 days of:

! Change (increase) by notice after February 10. You must attach a copy of the Department of Finance notice of increase or new assessment.

3. REPRESENTATION - Complete this section even if you will represent yourself.

AREA CODE

PHONE NO. (required)

FAX NO.

(_____________)

______________-----______________

(____________)

______________-----_______________

NAME OF PERSON OR FIRM TO BE CONTACTED

GROUP #, IF ANY

MAILING ADDRESS

! The applicant

! An attorney

! A paid representative

! Other ____________________________

The person listed is:

4. EXEMPTION OR OTHER CLAIM - Complete if applicable. Prior application to Finance is required.

Type of exemption sought: _______________________________________________________________________________________________

Does the entire property qualify for exemption? _____ If no, describe part not qualified: _______________________________________________

_____________________________________________________________________________________________________________________

Date of latest application for exemption filed with the Department of Finance: ______/______/______ Make a photocopy of the application for

exemption and related correspondence; attach it to this application (original only).

If applicant claims a partial exemption, specify amount of exemption sought and explain how calculated: ________________________________

____________________________________________________________________________________________________________________

If assessment is claimed to be unlawful or excessive for reasons other than exemption or overvaluation, explain: _________________________

____________________________________________________________________________________________________________________

5. CLASSIFICATION CLAIM - Complete if applicable.

Requested tax class (1,2,3 or 4). _________________

If tax class 2, does property have ten or fewer units? (yes or no) _____

6. ATTACHMENTS - List all schedules and documents attached. Number the pages.

Submit Form TC200 and, if rented, Form TC201 (except cooperative and hotels). See instructions.

________________________

_________________________

_________________________

Last page number

________________________

_________________________

________

! Refer to the attachments to application for block

lot

__________

________

7. HEARING REQUEST - Indicate preference. Check only one.

! Review on papers submitted without a personal hearing ! Personal hearing in the borough where the property is

#

located ! Personal hearing in Manhattan

! Personal hearing in the borough where the applicant resides.

Specify borough: ______________

" If you seek review on papers submitted, are any petitions for review of prior assessments pending in court? _______.

DATE RECEIVED

If yes, specify years _______

Signer’s initials

_______

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2