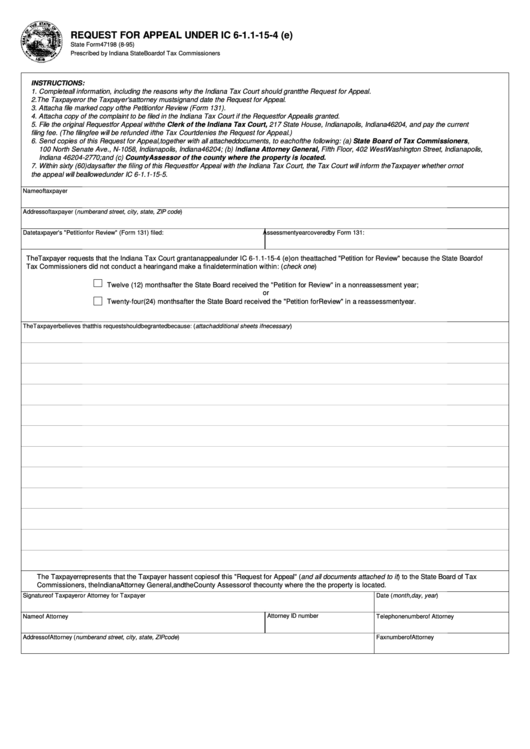

REQUEST FOR APPEAL UNDER IC 6-1.1-15-4 (e)

State Form 47198 (8-95)

Prescribed by Indiana State Board of Tax Commissioners

INSTRUCTIONS:

1. Complete all information, including the reasons why the Indiana Tax Court should grant the Request for Appeal.

2.The Taxpayer or the Taxpayer's attorney must sign and date the Request for Appeal.

3. Attach a file marked copy of the Petition for Review (Form 131).

4. Attach a copy of the complaint to be filed in the Indiana Tax Court if the Request for Appeal is granted.

5. File the original Request for Appeal with the Clerk of the Indiana Tax Court, 217 State House, Indianapolis, Indiana 46204, and pay the current

filing fee. (The filing fee will be refunded if the Tax Court denies the Request for Appeal.)

6. Send copies of this Request for Appeal, together with all attached documents, to each of the following: (a) State Board of Tax Commissioners,

100 North Senate Ave., N-1058, Indianapolis, Indiana 46204; (b) Indiana Attorney General, Fifth Floor, 402 West Washington Street, Indianapolis,

Indiana 46204-2770; and (c) County Assessor of the county where the property is located.

7. Within sixty (60) days after the filing of this Request for Appeal with the Indiana Tax Court, the Tax Court will inform the Taxpayer whether or not

the appeal will be allowed under IC 6-1.1-15-5.

Name of taxpayer

Address of taxpayer (number and street, city, state, ZIP code)

Date taxpayer's "Petition for Review" (Form 131) filed:

Assessment year covered by Form 131:

The Taxpayer requests that the Indiana Tax Court grant an appeal under IC 6-1.1-15-4 (e) on the attached "Petition for Review" because the State Board of

Tax Commissioners did not conduct a hearing and make a final determination within: (check one)

Twelve (12) months after the State Board received the "Petition for Review" in a nonreassessment year;

or

Twenty-four (24) months after the State Board received the "Petition for Review" in a reassessment year.

The Taxpayer believes that this request should be granted because: (attach additional sheets if necessary)

The Taxpayer represents that the Taxpayer has sent copies of this "Request for Appeal" (and all documents attached to it) to the State Board of Tax

Commissioners, the Indiana Attorney General, and the County Assessor of the county where the the property is located.

Signature of Taxpayer or Attorney for Taxpayer

Date (month, day, year)

Attorney ID number

Name of Attorney

Telephone number of Attorney

Address of Attorney (number and street, city, state, ZIP code)

Fax number of Attorney

1

1 2

2