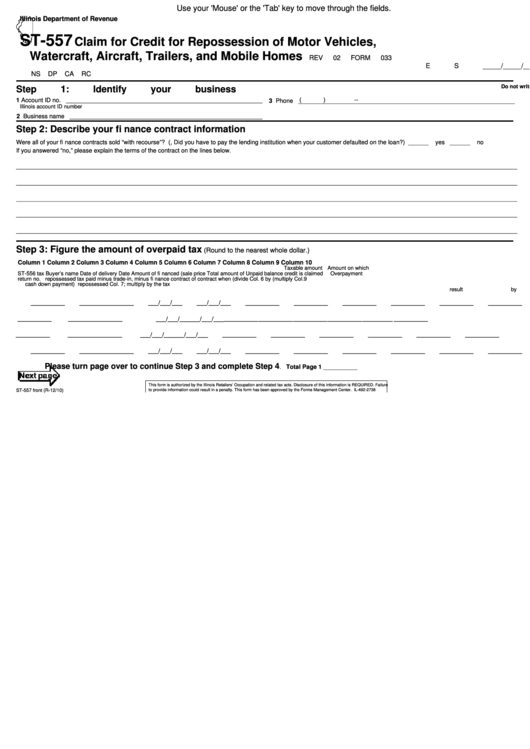

Use your 'Mouse' or the 'Tab' key to move through the fields.

Illinois Department of Revenue

ST-557

Claim for Credit for Repossession of Motor Vehicles,

Watercraft, Aircraft, Trailers, and Mobile Homes

REV

02

FORM 033

E S

_____/_____/_____

NS

DP

CA

RC

Do not write above this line

Step 1: Identify your business

(

)

--

1 Account ID no. __________________________________________________________

3

Phone ________________________________________________________________

Illinois account ID number

2 Business name _________________________________________________________

__

Step 2: Describe your fi nance contract information

Were all of your fi nance contracts sold “with recourse”? (i.e., Did you have to pay the lending institution when your customer defaulted on the loan?)

______

yes ______

no

If you answered “no,” please explain the terms of the contract on the lines below.

____________________________________________________________________________________________________________________________________________________

____________________________________________________________________________________________________________________________________________________

____________________________________________________________________________________________________________________________________________________

____________________________________________________________________________________________________________________________________________________

____________________________________________________________________________________________________________________________________________________

Step 3: Figure the amount of overpaid tax

(Round to the nearest whole dollar.)

Column 1

Column 2

Column 3

Column 4

Column 5

Column 6

Column 7

Column 8

Column 9

Column 10

Taxable amount

Amount on which

ST-556 tax

Buyer’s name

Date of delivery

Date

Amount of

fi nanced (sale price

Total amount of

Unpaid balance

credit is claimed

Overpayment

return no.

repossessed

tax paid

minus trade-in, minus fi nance contract

of contract when

(divide Col. 6 by

(multiply Col.9

cash down payment)

repossessed

Col. 7; multiply

by the tax

result by Col.8.)

rate)

__________

________________

___/___/___

___/___/___

__________

__________

__________

__________

__________

__________

__________

________________

___/___/___

___/___/___

__________

__________

__________

__________

_________

__________

__________

________________

___/___/___

___/___/___

__________

__________

__________

__________

__________

__________

__________

________________

___/___/___

___/___/___

__________

__________

__________

__________

__________

__________

Please turn page over to continue Step 3 and complete Step 4

.

Total Page 1

__________

This form is authorized by the Illinois Retailers’ Occupation and related tax acts. Disclosure of this information is REQUIRED. Failure

ST-557 front (R-12/10)

to provide information could result in a penalty. This form has been approved by the Forms Management Center.

IL-492-2738

1

1 2

2