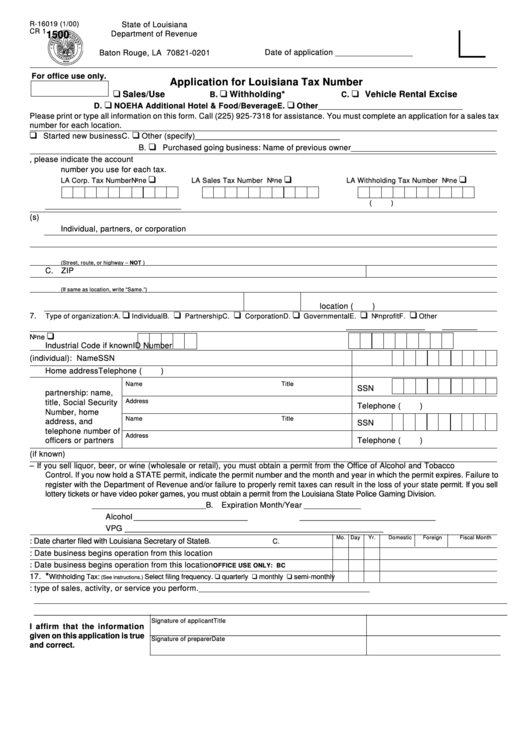

Form R-16019 Cr 1 - Application For Louisiana Tax Number

ADVERTISEMENT

R-16019 (1/00)

State of Louisiana

CR 1

1500

Department of Revenue

P.O. Box 201

Date of application _________________

Baton Rouge, LA 70821-0201

For office use only.

Application for Louisiana Tax Number

Sales/Use

Withholding*

Vehicle Rental Excise

1.A.

B.

C.

D.

NOEHA Additional Hotel & Food/Beverage

E.

Other _________________________________

Please print or type all information on this form. Call (225) 925-7318 for assistance. You must complete an application for a sales tax

number for each location.

2.

Reason for applying

A.

Started new business

C.

Other (specify) _________________________________

B.

Purchased going business: Name of previous owner

_________________________________

3.

A. If you are presently filing tax forms with the Louisiana Department of Revenue for a business, please indicate the account

number you use for each tax.

LA Corp. Tax Number

None

LA Sales Tax Number None

LA Withholding Tax Number None

(

)

B. How many other locations in LA _____

C. Telephone number at business

_______________________________

4.

A. Legal name(s)

Individual, partners, or corporation

B. Trade name of business

5.

A. Business location address

(Street, route, or highway – NOT P.O. Box or General Delivery)

B. City and state

C. ZIP

6.

A. Address for receiving tax forms and correspondence

(If same as location, write “Same.”)

B. City and state

C. ZIP

D. Telephone number if different from number at

location (

)

7.

Type of organization: A.

Individual

B.

Partnership

C.

Corporation

D.

Governmental

E.

Nonprofit

F.

Other

_________

_________

________

8.

Federal Standard

9.

Federal Employer

None

Industrial Code if known

ID Number

10. If sole owner (individual): Name

SSN

Home address

Telephone (

)

11. If corporation or

Name

Title

SSN

partnership: name,

Address

title, Social Security

Telephone (

)

Number, home

Name

Title

address, and

SSN

telephone number of

Address

Telephone (

)

officers or partners

12. A. Louisiana Charter Number (if known)

B. State of incorporation if not Louisiana

13. Permits – If you sell liquor, beer, or wine (wholesale or retail), you must obtain a permit from the Office of Alcohol and Tobacco

Control. If you now hold a STATE permit, indicate the permit number and the month and year in which the permit expires. Failure to

register with the Department of Revenue and/or failure to properly remit taxes can result in the loss of your state permit. If you sell

lottery tickets or have video poker games, you must obtain a permit from the Louisiana State Police Gaming Division.

A. Lottery __________________________

B. Expiration Month/Year _____________

Alcohol __________________________

_______________________________

VPG ____________________________

_______________________________

Mo. Day

Yr.

Domestic

Foreign

Fiscal Month

14. A. Corporation Income/Franchise: Date charter filed with Louisiana Secretary of State

B.

C.

15. Sales/NOEHA/Veh. Rental: Date business begins operation from this location

16. Sales or Use Tax: Date business begins operation from this location

OFFICE USE ONLY: BC

*

17.

Withholding Tax:

Select filing frequency.

quarterly

monthly

semi-monthly

(See instructions.)

18. Describe in detail your business: type of sales, activity, or service you perform. _______________________________________

____________________________________________________________________________________________________________

____________________________________________________________________________________________________________

Signature of applicant

Title

I affirm that the information

________________________________________________________________________________

given on this application is true

Signature of preparer

Date

and correct.

________________________________________________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1