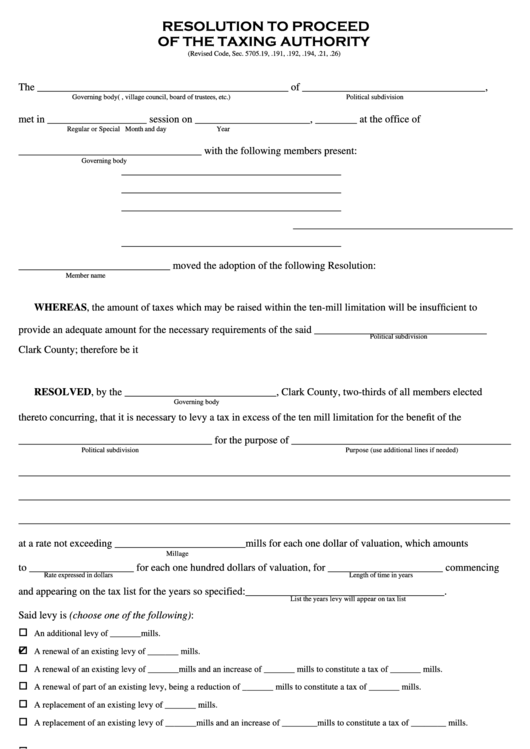

RESOLUTION TO PROCEED

OF THE TAXING AUTHORITY

(Revised Code, Sec. 5705.19, .191, .192, .194, .21, .26)

The ________________________________________________ of ___________________________________,

Governing body (e.g., village council, board of trustees, etc.)

Political subdivision

met in ___________________ session on ______________________, ________ at the office of

Regular or Special

Month and day

Year

___________________________________ with the following members present:

Governing body

__________________________________________

__________________________________________

__________________________________________

__________________________________________

__________________________________________

_____________________________ moved the adoption of the following Resolution:

Member name

WHEREAS, the amount of taxes which may be raised within the ten-mill limitation will be insufficient to

provide an adequate amount for the necessary requirements of the said _________________________________

Political subdivision

Clark County; therefore be it

RESOLVED, by the _____________________________, Clark County, two-thirds of all members elected

Governing body

thereto concurring, that it is necessary to levy a tax in excess of the ten mill limitation for the benefit of the

_____________________________________ for the purpose of __________________________________________

Political subdivision

Purpose (use additional lines if needed)

______________________________________________________________________________________________

______________________________________________________________________________________________

______________________________________________________________________________________________

at a rate not exceeding _________________________mills for each one dollar of valuation, which amounts

Millage

to ____________________ for each one hundred dollars of valuation, for ______________________ commencing

Rate expressed in dollars

Length of time in years

and appearing on the tax list for the years so specified:______________________________________.

List the years levy will appear on tax list

Said levy is (choose one of the following):

An additional levy of _______ mills.

A renewal of an existing levy of _______ mills.

A renewal of an existing levy of _______ mills and an increase of _______ mills to constitute a tax of _______ mills.

A renewal of part of an existing levy, being a reduction of _______ mills to constitute a tax of _______ mills.

A replacement of an existing levy of _______ mills.

A replacement of an existing levy of _______mills and an increase of ________mills to constitute a tax of ________ mills.

A replacement of part of an existing levy, being a reduction of ________ mills, to constitute a tax of ________ mills.

RESOLVED, that the question of levying additional taxes be submitted to the electors of said

__________________ at the ____________________ election to be held at the usual voting places

Political subdivision

General, Primary, Special

within said ___________________ on the _______ day of ___________________, __________; and be it further

Political subdivision

Day

Month

Year

1

1 2

2