Form St-8 - Certificate Of Exempt Capital Improvement

ADVERTISEMENT

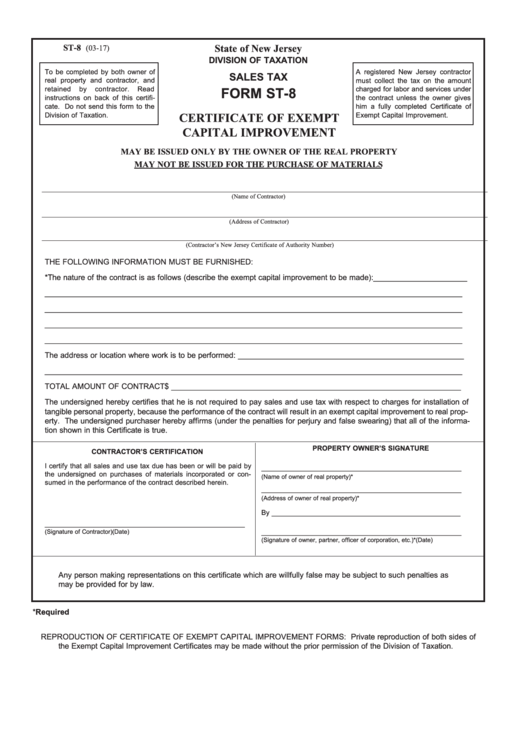

ST-8

State of New Jersey

(03-17)

DIVISION OF TAXATION

To be completed by both owner of

A registered New Jersey contractor

SALES TAX

real property and contractor, and

must collect the tax on the amount

retained

by

contractor.

Read

charged for labor and services under

FORM ST-8

instructions on back of this certifi-

the contract unless the owner gives

cate. Do not send this form to the

him a fully completed Certificate of

Division of Taxation.

Exempt Capital Improvement.

CERTIFICATE OF EXEMPT

CAPITAL IMPROVEMENT

MAY BE ISSUED ONLY BY THE OWNER OF THE REAL PROPERTY

MAY NOT BE ISSUED FOR THE PURCHASE OF MATERIALS

_______________________________________________________________________________________________________________

(Name of Contractor)

_______________________________________________________________________________________________________________

(Address of Contractor)

_______________________________________________________________________________________________________________

(Contractor’s New Jersey Certificate of Authority Number)

THE FOLLOWING INFORMATION MUST BE FURNISHED:

*The nature of the contract is as follows (describe the exempt capital improvement to be made):______________________

__________________________________________________________________________________________________

__________________________________________________________________________________________________

__________________________________________________________________________________________________

__________________________________________________________________________________________________

The address or location where work is to be performed: _____________________________________________________

__________________________________________________________________________________________________

TOTAL AMOUNT OF CONTRACT $ ____________________________________________________________________

The undersigned hereby certifies that he is not required to pay sales and use tax with respect to charges for installation of

tangible personal property, because the performance of the contract will result in an exempt capital improvement to real prop-

erty. The undersigned purchaser hereby affirms (under the penalties for perjury and false swearing) that all of the informa-

tion shown in this Certificate is true.

PROPERTY OWNER’S SIGNATURE

CONTRACTOR’S CERTIFICATION

I certify that all sales and use tax due has been or will be paid by

_____________________________________________________

the undersigned on purchases of materials incorporated or con-

(Name of owner of real property)*

sumed in the performance of the contract described herein.

_____________________________________________________

(Address of owner of real property)*

By __________________________________________________

_____________________________________________________

(Signature of Contractor)

(Date)

_____________________________________________________

(Signature of owner, partner, officer of corporation, etc.)*

(Date)

Any person making representations on this certificate which are willfully false may be subject to such penalties as

may be provided for by law.

*Required

REPRODUCTION OF CERTIFICATE OF EXEMPT CAPITAL IMPROVEMENT FORMS: Private reproduction of both sides of

the Exempt Capital Improvement Certificates may be made without the prior permission of the Division of Taxation.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1