Lodger'S Tax Reporting Form

ADVERTISEMENT

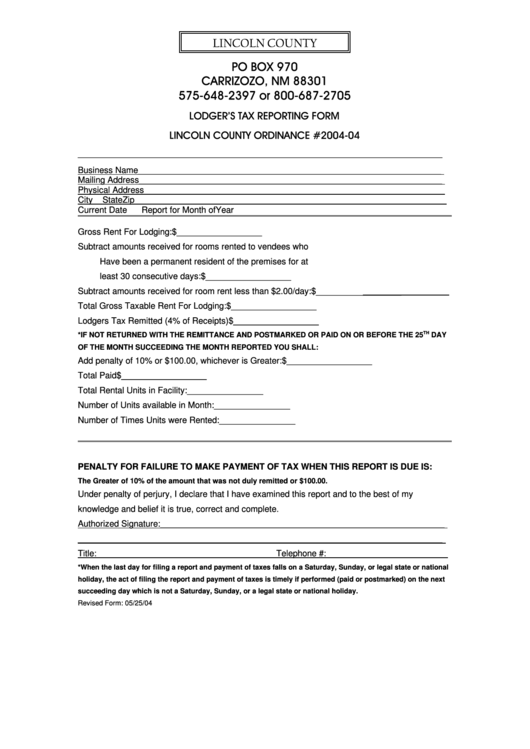

LINCOLN COUNTY

PO BOX 970

CARRIZOZO, NM 88301

575-648-2397 or 800-687-2705

LODGER’S TAX REPORTING FORM

LINCOLN COUNTY ORDINANCE #2004-04

_____________________________________________________________________________

Business Name________________________________________________________________

Mailing Address________________________________________________________________

Physical Address_______________________________________________________________

City

State

Zip________________

Current Date

Report for Month of

Year

Gross Rent For Lodging:

$__________________

Subtract amounts received for rooms rented to vendees who

Have been a permanent resident of the premises for at

least 30 consecutive days:

$__________________

Subtract amounts received for room rent less than $2.00/day:

$__________________

Total Gross Taxable Rent For Lodging:

$__________________

Lodgers Tax Remitted (4% of Receipts)

$__________________

TH

*IF NOT RETURNED WITH THE REMITTANCE AND POSTMARKED OR PAID ON OR BEFORE THE 25

DAY

OF THE MONTH SUCCEEDING THE MONTH REPORTED YOU SHALL:

Add penalty of 10% or $100.00, whichever is Greater:

$__________________

Total Paid

$__________________

Total Rental Units in Facility:

________________

Number of Units available in Month:

________________

Number of Times Units were Rented:

________________

PENALTY FOR FAILURE TO MAKE PAYMENT OF TAX WHEN THIS REPORT IS DUE IS:

The Greater of 10% of the amount that was not duly remitted or $100.00.

Under penalty of perjury, I declare that I have examined this report and to the best of my

knowledge and belief it is true, correct and complete.

Authorized Signature:____________________________________________________________

_____________________________________________________________________________

Title:______________________________________Telephone #:_________________________

*When the last day for filing a report and payment of taxes falls on a Saturday, Sunday, or legal state or national

holiday, the act of filing the report and payment of taxes is timely if performed (paid or postmarked) on the next

succeeding day which is not a Saturday, Sunday, or a legal state or national holiday.

Revised Form: 05/25/04

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1