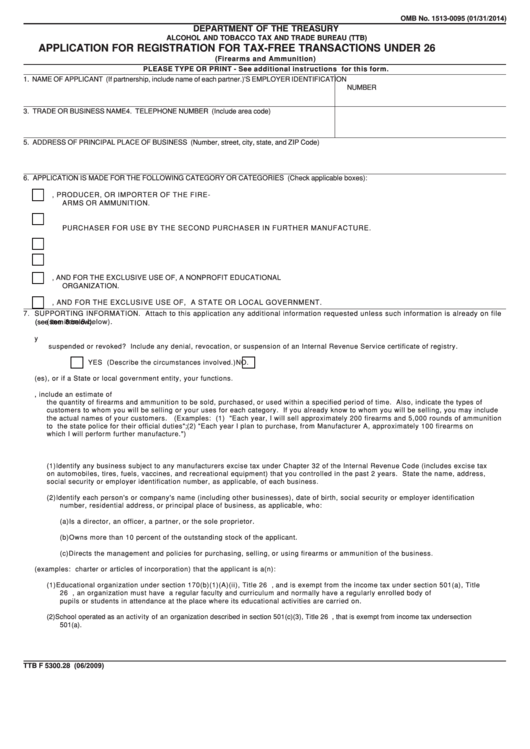

OMB No. 1513-0095 (01/31/2014)

DEPARTMENT OF THE TREASURY

ALCOHOL AND TOBACCO TAX AND TRADE BUREAU (TTB)

APPLICATION FOR REGISTRATION FOR TAX-FREE TRANSACTIONS UNDER 26 U.S.C. 4221

(Firearms and Ammunition)

PLEASE TYPE OR PRINT - See additional instructions for this form.

1. NAME OF APPLICANT (If partnership, include name of each partner.)

2. APPLICANT'S EMPLOYER IDENTIFICATION

NUMBER

3. TRADE OR BUSINESS NAME

4. TELEPHONE NUMBER (Include area code)

5. ADDRESS OF PRINCIPAL PLACE OF BUSINESS (Number, street, city, state, and ZIP Code)

6. APPLICATION IS MADE FOR THE FOLLOWING CATEGORY OR CATEGORIES (Check applicable boxes):

A. SELLING FIREARMS OR AMMUNITION TAX-FREE AS THE MANUFACTURER, PRODUCER, OR IMPORTER OF THE FIRE-

ARMS OR AMMUNITION.

B. PURCHASING FIREARMS OR AMMUNITION TAX-FREE FOR FURTHER MANUFACTURE OR FOR RESALE TO A SECOND

PURCHASER FOR USE BY THE SECOND PURCHASER IN FURTHER MANUFACTURE.

C. PURCHASING FIREARMS OR AMMUNITION FOR EXPORT OR FOR RESALE TO A SECOND PURCHASER FOR EXPORT.

D. PURCHASING FIREARMS OR AMMUNITION FOR USE AS SUPPLIES ON VESSELS AND AIRCRAFT.

E. PURCHASING FIREARMS OR AMMUNITION BY, AND FOR THE EXCLUSIVE USE OF, A NONPROFIT EDUCATIONAL

ORGANIZATION.

F. PURCHASING FIREARMS OR AMMUNITION BY, AND FOR THE EXCLUSIVE USE OF, A STATE OR LOCAL GOVERNMENT.

7. SUPPORTING INFORMATION. Attach to this application any additional information requested unless such information is already on file

(see item 8 below).

(see item 8 below).

A. ALL APPLICANTS - Have you ever had your application for a certificate of registry denied OR had your certificate of registry

suspended or revoked? Include any denial, revocation, or suspension of an Internal Revenue Service certificate of registry.

YES (Describe the circumstances involved.)

NO.

B. ALL APPLICANTS - Describe your business(es), or if a State or local government entity, your functions.

C. ALL APPLICANTS - Describe your need for each category for which you applied for in item 6. For each category, include an estimate of

the quantity of firearms and ammunition to be sold, purchased, or used within a specified period of time. Also, indicate the types of

customers to whom you will be selling or your uses for each category. If you already know to whom you will be selling, you may include

the actual names of your customers. (Examples: (1) "Each year, I will sell approximately 200 firearms and 5,000 rounds of ammunition

to the state police for their official duties"; (2) "Each year I plan to purchase, from Manufacturer A, approximately 100 firearms on

which I will perform further manufacture.")

D. BUSINESS APPLICANT -

(1) Identify any business subject to any manufacturers excise tax under Chapter 32 of the Internal Revenue Code (includes excise tax

on automobiles, tires, fuels, vaccines, and recreational equipment) that you controlled in the past 2 years. State the name, address,

social security or employer identification number, as applicable, of each business.

(2) Identify each person's or company's name (including other businesses), date of birth, social security or employer identification

number, residential address, or principal place of business, as applicable, who:

(a)

Is a director, an officer, a partner, or the sole proprietor.

(b)

Owns more than 10 percent of the outstanding stock of the applicant.

(c)

Directs the management and policies for purchasing, selling, or using firearms or ammunition of the business.

E. EDUCATIONAL ORGANIZATION - Supply proof (examples: charter or articles of incorporation) that the applicant is a(n):

(1) Educational organization under section 170(b)(1)(A)(ii), Title 26 U.S.C., and is exempt from the income tax under section 501(a), Title

26 U.S.C. To qualify, an organization must have a regular faculty and curriculum and normally have a regularly enrolled body of

pupils or students in attendance at the place where its educational activities are carried on.

(2) School operated as an activity of an organization described in section 501(c)(3), Title 26 U.S.C., that is exempt from income tax under section

501(a).

F. ALL APPLICANTS - Any other information that TTB requests to clarify the information requested by this application.

TTB F 5300.28 (06/2009)

1

1 2

2