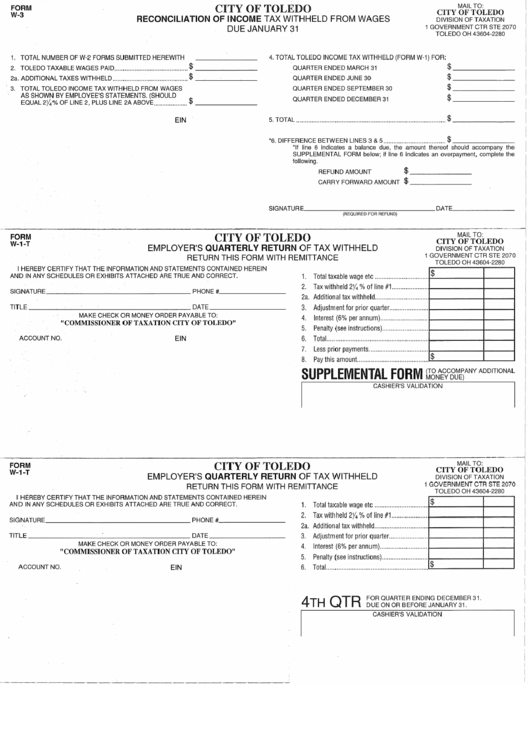

FORM

W-3

CITY OF TOLEDO

MAIL TO:

CITY OF TOLEDO

DIVISION OF TAXATION

RECONCILIATION OF INCOME TAX WITHHELD FROM WAGES

DUE JANUARY 31

1 GOVERNMENT CTR STE 2070

TOLEDO OH 43604-2280

1. TOTAL NUMBER OF W-2 FORMS SUBMITTED HEREWITH

4. TOTAL TOLEDO INCOME TAX WITHHELD (FORM W-1) FOR:

2. TOLEDO TAXABLE WAGES PAID ............................................

$ _ _ _ _ _ _ _

QUARTER ENDED MARCH 31

$ _ _ _ _ _ _

2a. ADDITIONAL TAXES WITHHELD .............................................

$ - - - - - - -

QUARTERENDEDJUNE30

$ ______ _

, 3. TOTAL TOLEDO INCOME TAX WITHHELD FROM WAGES

QUARTER ENDED SEPTEMBER 30

$ _ _ _ _ _ _ _

AS SHOWN BY EMPLOYEE'S STATEMENTS. (SHOULD

EQUAL 2%% OF LINE 2, PLUS LINE 2A ABOVE ....................

$ _ _ _ _ _ _ _

QUARTER ENDED DECEMBER 31

$ _ _ _ _ _ _ _

5. TOTAL .........................................................................................

$ - - - - - - -

*6. DIFFERENCE BETWEEN LINES 3 & 5 .....................................

$ _ _ _ _ _ _ _

*If line 6 indicates a balance due, the amount thereof should accompany the

SUPPLEMENTAL FORM below; if line 6 indicates an overpayment, complete the

following.

REFUND AMOUNT

$ _ _ _ _ _ _

CARRY FORWARD AMOUNT

$ _ _ _ _ _ _

SIGNATURE _ _ _ _ _ _ _ _ _ _ _ _ _ _ DATE _ _ _ _ _ _

(REQUIRED FOR REFUND)

FORM

W-1-T

CITY OF TOLEDO

MAIL TO:

CITY OF TOLEDO

DIVISION OFT AXATION

EMPLOYER'S QUARTERLY RETURN OF TAX WITHHELD

RETURN THIS FORM WITH REMITTANCE

1 GOVERNMENT CTR STE 2070

TOLEDO OH 43604-2280

I HEREBY CERTIFY THAT IHE INFORMATION AND STATEMENTS CONTAINED HEREIN

AND IN ANY SCHEDULES OR EXHIBITS ATTACHED ARE TRUE AND CORRECT.

SIGNATURE _ _ _ _ _ _

~

_ _ _ _ _ _ _ _ PHONE# _ _ _ _ _ _ _

TITLE _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ DATE _ _ _ _ _ _ _ _

MAKE CHECK OR MONEY ORDER PAYABLE TO:

"COMMISSIONER OF TAXATION CITY OF TOLEDO"

ACCOUNT NO.

$

1. Total taxable wage etc ................................. r:-------+-----1

2. Tax withheld 2%% of line #1 .....................

- 1 - - - - - - + - - - - t

2a. Additional tax withheld ................................

l-------+-----1

3. Adjustment for prior quarter ....................... J--------+-----1

4.

Interest (6% per annum) ............................ J--------+-----1

5.

Penalty (see instructions) ...........................

l-------+-----1

6. Totai. ........................................................... J--------+-----1

7.

Less prior payments ................................... J--------+-----1

8.

Pay this amount... .......................................

....,$ _ _ _ _ ____.,___ _

____.

SUPPLEMENTAL FORM

rrgNAE\cg~~ANY

ADDITIONAL

I

CASHIER'S VALIDATION

I

FORM

W-1-T

CITY OF TOLEDO

MAIL TO:

CITY OF TOLEDO

DIVISION OF TAXATION

EMPLOYER'S QUARTERLY RETURN OF TAX WITHHELD

RETURN THIS FORM WITH REMITTANCE

1 GOVERNMENT CTR STE 2070

TOLEDO OH 43604-2280

I HEREBY CERTIFY THAT THE INFORMATION AND STATEMENTS CONTAINED HEREIN

AND IN ANY SCHEDULES OR EXHIBITS ATTACHED ARE TRUE AND CORRECT.

SIGNATURE _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ PHONE# _ _ _ _ _ _ _

TITLE _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ DATE _ _ _ _ _ _ _ _

MAKE CHECK OR MONEY ORDER PAYABLE TO:

"COMMISSIONER OF TAXATION CITY OF TOLEDO"

ACCOUNT NO.

1. Total taxable wage etc .............................. .

$

2. Tax withheld 2%% of line #1 .................... .

2a. Additional tax withheld .............................. .

3. Adjustment for prior quarter ..................... .

4.

Interest (6% per annum) ........................... .

5.

Penalty (see instructions) ......................... .

6. Total .......................................................... .

$

4TH

QTR

FOR QUARTER ENDING DECEMBER 31.

DUE ON OR BEFORE JANUARY 31.

CASHIER'S VALIDATION

EIN

EIN

EIN

1

1