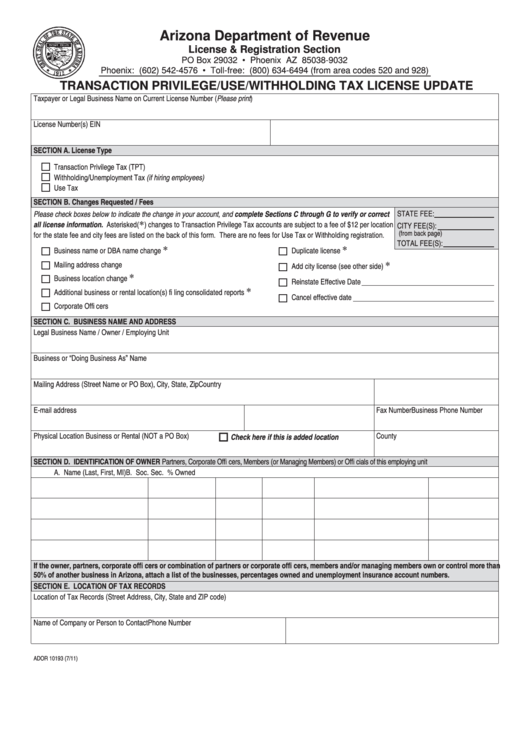

Arizona Department of Revenue

License & Registration Section

PO Box 29032 • Phoenix AZ 85038-9032

Phoenix: (602) 542-4576 • Toll-free: (800) 634-6494 (from area codes 520 and 928)

TRANSACTION PRIVILEGE/USE/WITHHOLDING TAX LICENSE UPDATE

Taxpayer or Legal Business Name on Current License Number (Please print)

License Number(s)

EIN

SECTION A. License Type

Transaction Privilege Tax (TPT)

Withholding/Unemployment Tax (if hiring employees)

Use Tax

SECTION B. Changes Requested / Fees

STATE FEE:

Please check boxes below to indicate the change in your account, and complete Sections C through G to verify or correct

all license information. Asterisked (

) changes to Transaction Privilege Tax accounts are subject to a fee of $12 per location

*

CITY FEE(S):

(from back page)

for the state fee and city fees are listed on the back of this form. There are no fees for Use Tax or Withholding registration.

TOTAL FEE(S):

Business name or DBA name change

Duplicate license

*

*

Mailing address change

Add city license (see other side)

*

Business location change

*

Reinstate Effective Date

Additional business or rental location(s) fi ling consolidated reports

*

Cancel effective date

Corporate Offi cers

SECTION C. BUSINESS NAME AND ADDRESS

Legal Business Name / Owner / Employing Unit

Business or “Doing Business As” Name

Mailing Address (Street Name or PO Box), City, State, Zip

Country

E-mail address

Business Phone Number

Fax Number

Physical Location Business or Rental (NOT a PO Box)

County

Check here if this is added location

SECTION D. IDENTIFICATION OF OWNER Partners, Corporate Offi cers, Members (or Managing Members) or Offi cials of this employing unit

A. Name (Last, First, MI)

B. Soc. Sec. No.

C. Title

D. % Owned

E. Complete Residence Address

F. Phone Number

If the owner, partners, corporate offi cers or combination of partners or corporate offi cers, members and/or managing members own or control more than

50% of another business in Arizona, attach a list of the businesses, percentages owned and unemployment insurance account numbers.

SECTION E. LOCATION OF TAX RECORDS

Location of Tax Records (Street Address, City, State and ZIP code)

Name of Company or Person to Contact

Phone Number

ADOR 10193 (7/11)

1

1 2

2