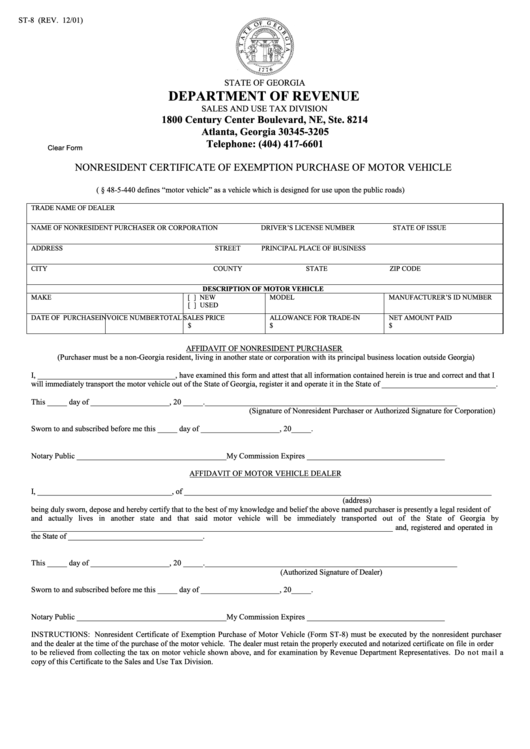

ST-8 (REV. 12/01)

STATE OF GEORGIA

DEPARTMENT OF REVENUE

SALES AND USE TAX DIVISION

1800 Century Center Boulevard, NE, Ste. 8214

Atlanta, Georgia 30345-3205

Telephone: (404) 417-6601

Clear Form

NONRESIDENT CERTIFICATE OF EXEMPTION PURCHASE OF MOTOR VEHICLE

(O.C.G.A. § 48-5-440 defines “motor vehicle” as a vehicle which is designed for use upon the public roads)

TRADE NAME OF DEALER

NAME OF NONRESIDENT PURCHASER OR CORPORATION

DRIVER’S LICENSE NUMBER

STATE OF ISSUE

ADDRESS

STREET

PRINCIPAL PLACE OF BUSINESS

CITY

COUNTY

STATE

ZIP CODE

DESCRIPTION OF MOTOR VEHICLE

MAKE

[ ] NEW

MODEL

MANUFACTURER’S ID NUMBER

[ ] USED

DATE OF PURCHASE

INVOICE NUMBER

TOTAL SALES PRICE

ALLOWANCE FOR TRADE-IN

NET AMOUNT PAID

$

$

$

AFFIDAVIT OF NONRESIDENT PURCHASER

(Purchaser must be a non-Georgia resident, living in another state or corporation with its principal business location outside Georgia)

I, ___________________________________, have examined this form and attest that all information contained herein is true and correct and that I

will immediately transport the motor vehicle out of the State of Georgia, register it and operate it in the State of _____________________________.

This _____ day of ____________________, 20 _____.

________________________________________________________________

(Signature of Nonresident Purchaser or Authorized Signature for Corporation)

Sworn to and subscribed before me this _____ day of ____________________, 20_____.

Notary Public ______________________________________

My Commission Expires ___________________________________

AFFIDAVIT OF MOTOR VEHICLE DEALER

I, ___________________________________, of ________________________________________________________________________________

(address)

being duly sworn, depose and hereby certify that to the best of my knowledge and belief the above named purchaser is presently a legal resident of

and actually lives in another state and that said motor vehicle will be immediately transported out of the State of Georgia by

______________________________________________________________________________________________ and, registered and operated in

the State of ___________________________________.

This _____ day of ____________________, 20 _____.

________________________________________________________________

(Authorized Signature of Dealer)

Sworn to and subscribed before me this _____ day of ____________________, 20_____.

Notary Public ______________________________________

My Commission Expires ___________________________________

INSTRUCTIONS: Nonresident Certificate of Exemption Purchase of Motor Vehicle (Form ST-8) must be executed by the nonresident purchaser

and the dealer at the time of the purchase of the motor vehicle. The dealer must retain the properly executed and notarized certificate on file in order

to be relieved from collecting the tax on motor vehicle shown above, and for examination by Revenue Department Representatives. Do not mail a

copy of this Certificate to the Sales and Use Tax Division.

1

1