Claim For Exemption From Sterling Tax Form

ADVERTISEMENT

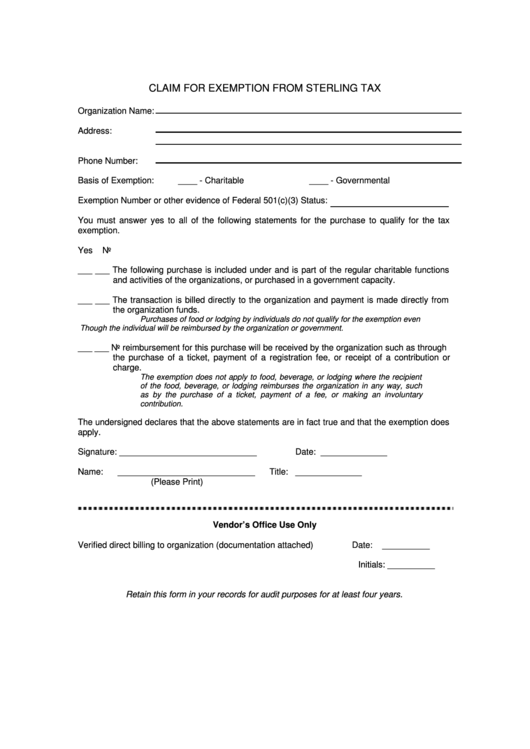

CLAIM FOR EXEMPTION FROM STERLING TAX

Organization Name:

Address:

Phone Number:

Basis of Exemption:

____ - Charitable

____ - Governmental

Exemption Number or other evidence of Federal 501(c)(3) Status:

You must answer yes to all of the following statements for the purchase to qualify for the tax

exemption.

Yes

No

___ ___ The following purchase is included under and is part of the regular charitable functions

and activities of the organizations, or purchased in a government capacity.

___ ___ The transaction is billed directly to the organization and payment is made directly from

the organization funds.

Purchases of food or lodging by individuals do not qualify for the exemption even

Though the individual will be reimbursed by the organization or government.

___ ___ No reimbursement for this purchase will be received by the organization such as through

the purchase of a ticket, payment of a registration fee, or receipt of a contribution or

charge.

The exemption does not apply to food, beverage, or lodging where the recipient

of the food, beverage, or lodging reimburses the organization in any way, such

as by the purchase of a ticket, payment of a fee, or making an involuntary

contribution.

The undersigned declares that the above statements are in fact true and that the exemption does

apply.

Signature: _____________________________

Date: ______________

Name:

_____________________________

Title: ______________

(Please Print)

Vendor’s Office Use Only

Verified direct billing to organization (documentation attached)

Date:

__________

Initials: __________

Retain this form in your records for audit purposes for at least four years.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1