Net Profit License Tax Return Form - City Of Pikeville Occupational Tax - 2014

ADVERTISEMENT

hc102306-City of Pikeville License Fee_Layout 1 12/3/14 8:29 AM Page 1

Revised 12/2014

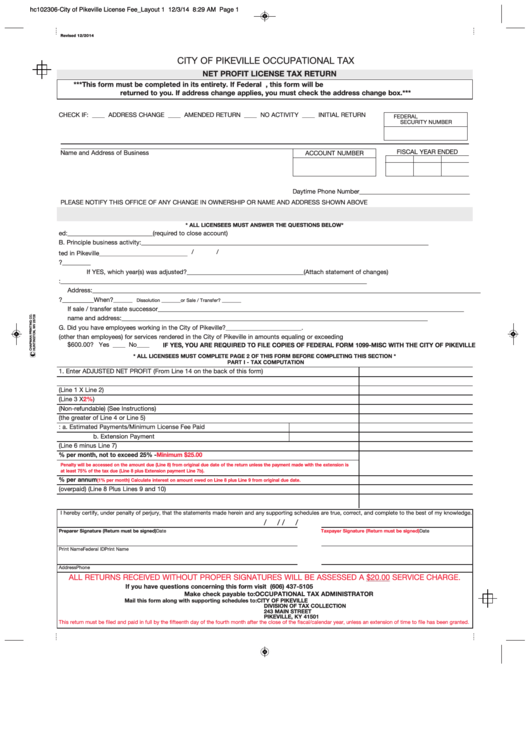

CITY OF PIKEVILLE OCCUPATIONAL TAX

NET PROFIT LICENSE TAX RETURN

***This form must be completed in its entirety. If Federal I.D. or Social Security Number is omitted, this form will be

returned to you. If address change applies, you must check the address change box.***

CHECK IF:

____ ADDRESS CHANGE

____ AMENDED RETURN

____ NO ACTIVITY

____ INITIAL RETURN

FEDERAL I.D. OR SOCIAL

SECURITY NUMBER

FISCAL YEAR ENDED

Name and Address of Business

ACCOUNT NUMBER

Mo.

Day

Year

Daytime Phone Number ___________________________________

PLEASE NOTIFY THIS OFFICE OF ANY CHANGE IN OWNERSHIP OR NAME AND ADDRESS SHOWN ABOVE

* ALL LICENSEES MUST ANSWER THE QUESTIONS BELOW*

A. If FINAL RETURN date operations ceased:___________________________(required to close account)

B. Principle business activity:

___________________________________________________________________________________________

/

/

C. Date business started in Pikeville____________________________

D. During the past year did Federal Authorities change or propose to change net income reported for that year or any prior year?

_________

If YES, which year(s) was adjusted? _____________________________________(Attach statement of changes)

E. Principle owner/administrative officer: _________________________________________________________________________________________________

Address:___________________________________________________________________________________________________________________________

F. Was business activity discontinued?

__________

When?

________

Dissolution ________ or Sale / Transfer? ________

If sale / transfer state successor

_________________________________________________________________________________________________

name and address:

_________________________________________________________________________________________________

G. Did you have employees working in the City of Pikeville?________________________.

H. Did you make payments to any individual (other than employees) for services rendered in the City of Pikeville in amounts equaling or exceeding

$600.00?

Yes ____ No____

IF YES, YOU ARE REQUIRED TO FILE COPIES OF FEDERAL FORM 1099-MISC WITH THE CITY OF PIKEVILLE

* ALL LICENSEES MUST COMPLETE PAGE 2 OF THIS FORM BEFORE COMPLETING THIS SECTION *

PART I - TAX COMPUTATION

1. Enter ADJUSTED NET PROFIT (From Line 14 on the back of this form)

2. Enter percentage from Line 17 or 18 Page 2

3. Net Profits Allocation (Line 1 X Line 2)

4. License Tax (Line 3 X 2%)

5. City Minimum License Tax (Non-refundable) (See Instructions)

6. License Tax Due (the greater of Line 4 or Line 5)

7. Credits: a. Estimated Payments/Minimum License Fee Paid

b. Extension Payment

8. License Tax Due (Line 6 minus Line 7)

9. Penalty - 5% per month, not to exceed 25% -

Minimum $25.00

Penalty will be accessed on the amount due (Line 8) from original due date of the return unless the payment made with the extension is

at least 75% of the tax due (Line 8 plus Extension payment Line 7b).

10. Interest - 12% per annum

(1% per month) Calculate interest on amount owed on Line 8 plus Line 9 from original due date.

11. Total amount due (overpaid) (Line 8 Plus Lines 9 and 10)

12. Overpayment

_______ Credit

_______ Refund

I hereby certify, under penalty of perjury, that the statements made herein and any supporting schedules are true, correct, and complete to the best of my knowledge.

/

/

/

/

Preparer Signature (Return must be signed)

Date

Taxpayer Signature (Return must be signed)

Date

Print Name

Federal ID

Print Name

Address

Phone No.

Title

Social Security No.

ALL RETURNS RECEIVED WITHOUT PROPER SIGNATURES WILL BE ASSESSED A $20.00 SERVICE CHARGE.

If you have questions concerning this form visit or call (606) 437-5105

Make check payable to:

OCCUPATIONAL TAX ADMINISTRATOR

Mail this form along with supporting schedules to:

CITY OF PIKEVILLE

DIVISION OF TAX COLLECTION

243 MAIN STREET

PIKEVILLE, KY 41501

This return must be filed and paid in full by the fifteenth day of the fourth month after the close of the fiscal/calendar year, unless an extension of time to file has been granted.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2