Declaration Of Estimated Net Profits License Fee Form - City Of Russell, Kentucky

ADVERTISEMENT

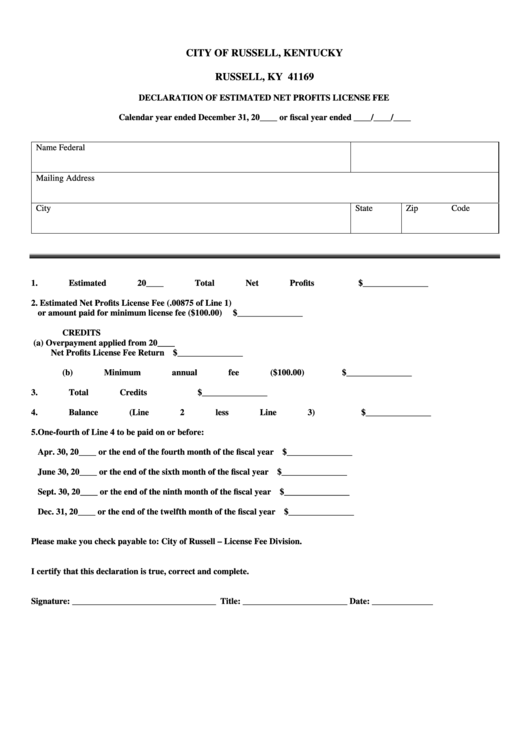

CITY OF RUSSELL, KENTUCKY

P.O. BOX 473

RUSSELL, KY 41169

DECLARATION OF ESTIMATED NET PROFITS LICENSE FEE

Calendar year ended December 31, 20____ or fiscal year ended ____/____/____

Name

Federal I.D. Number

Mailing Address

City

State

Zip Code

1.

Estimated 20____ Total Net Profits

$_______________

2.

Estimated Net Profits License Fee (.00875 of Line 1)

or amount paid for minimum license fee ($100.00)

$_______________

CREDITS

(a) Overpayment applied from 20____

Net Profits License Fee Return

$_______________

(b) Minimum annual fee ($100.00)

$_______________

3.

Total Credits

$_______________

4.

Balance (Line 2 less Line 3)

$_______________

5.

One-fourth of Line 4 to be paid on or before:

Apr. 30, 20____ or the end of the fourth month of the fiscal year

$_______________

June 30, 20____ or the end of the sixth month of the fiscal year

$_______________

Sept. 30, 20____ or the end of the ninth month of the fiscal year

$_______________

Dec. 31, 20____ or the end of the twelfth month of the fiscal year

$_______________

Please make you check payable to: City of Russell – License Fee Division.

I certify that this declaration is true, correct and complete.

Signature: _________________________________

Title: ________________________

Date: ______________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1