Maine Minimum Tax Worksheet Instructions Form - 2000

ADVERTISEMENT

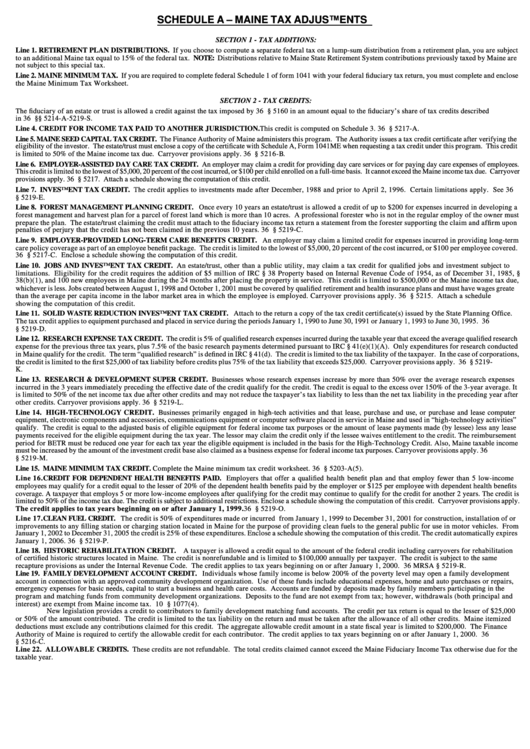

SCHEDULE A – MAINE TAX ADJUSTMENTS

SECTION 1 - TAX ADDITIONS:

Line 1. RETIREMENT PLAN DISTRIBUTIONS. If you choose to compute a separate federal tax on a lump-sum distribution from a retirement plan, you are subject

to an additional Maine tax equal to 15% of the federal tax. NOTE: Distributions relative to Maine State Retirement System contributions previously taxed by Maine are

not subject to this special tax.

Line 2. MAINE MINIMUM TAX. If you are required to complete federal Schedule 1 of form 1041 with your federal fiduciary tax return, you must complete and enclose

the Maine Minimum Tax Worksheet.

SECTION 2 - TAX CREDITS:

The fiduciary of an estate or trust is allowed a credit against the tax imposed by 36 M.R.S.A. § 5160 in an amount equal to the fiduciary’s share of tax credits described

in 36 M.R.S.A. §§ 5214-A-5219-S.

Line 4. CREDIT FOR INCOME TAX PAID TO ANOTHER JURISDICTION. This credit is computed on Schedule 3. 36 M.R.S.A. § 5217-A.

Line 5. MAINE SEED CAPITAL TAX CREDIT. The Finance Authority of Maine administers this program. The Authority issues a tax credit certificate after verifying the

eligibility of the investor. The estate/trust must enclose a copy of the certificate with Schedule A, Form 1041ME when requesting a tax credit under this program. This credit

is limited to 50% of the Maine income tax due. Carryover provisions apply. 36 M.R.S.A. § 5216-B.

Line 6. EMPLOYER-ASSISTED DAY CARE TAX CREDIT. An employer may claim a credit for providing day care services or for paying day care expenses of employees.

This credit is limited to the lowest of $5,000, 20 percent of the cost incurred, or $100 per child enrolled on a full-time basis. It cannot exceed the Maine income tax due. Carryover

provisions apply. 36 M.R.S.A. § 5217. Attach a schedule showing the computation of this credit.

Line 7. INVESTMENT TAX CREDIT. The credit applies to investments made after December, 1988 and prior to April 2, 1996. Certain limitations apply. See 36

M.R.S.A. § 5219-E.

Line 8. FOREST MANAGEMENT PLANNING CREDIT. Once every 10 years an estate/trust is allowed a credit of up to $200 for expenses incurred in developing a

forest management and harvest plan for a parcel of forest land which is more than 10 acres. A professional forester who is not in the regular employ of the owner must

prepare the plan. The estate/trust claiming the credit must attach to the fiduciary income tax return a statement from the forester supporting the claim and affirm upon

penalties of perjury that the credit has not been claimed in the previous 10 years. 36 M.R.S.A. § 5219-C.

Line 9. EMPLOYER-PROVIDED LONG-TERM CARE BENEFITS CREDIT. An employer may claim a limited credit for expenses incurred in providing long-term

care policy coverage as part of an employee benefit package. The credit is limited to the lowest of $5,000, 20 percent of the cost incurred, or $100 per employee covered.

36 M.R.S.A. § 5217-C. Enclose a schedule showing the computation of this credit.

Line 10. JOBS AND INVESTMENT TAX CREDIT. An estate/trust, other than a public utility, may claim a tax credit for qualified jobs and investment subject to

limitations. Eligibility for the credit requires the addition of $5 million of IRC § 38 Property based on Internal Revenue Code of 1954, as of December 31, 1985, §

38(b)(1), and 100 new employees in Maine during the 24 months after placing the property in service. This credit is limited to $500,000 or the Maine income tax due,

whichever is less. Jobs created between August 1, 1998 and October 1, 2001 must be covered by qualified retirement and health insurance plans and must have wages greater

than the average per capita income in the labor market area in which the employee is employed. Carryover provisions apply. 36 M.R.S.A. § 5215. Attach a schedule

showing the computation of this credit.

Line 11. SOLID WASTE REDUCTION INVESTMENT TAX CREDIT. Attach to the return a copy of the tax credit certificate(s) issued by the State Planning Office.

The tax credit applies to equipment purchased and placed in service during the periods January 1, 1990 to June 30, 1991 or January 1, 1993 to June 30, 1995. 36 M.R.S.A.

§ 5219-D.

Line 12. RESEARCH EXPENSE TAX CREDIT. The credit is 5% of qualified research expenses incurred during the taxable year that exceed the average qualified research

expense for the previous three tax years, plus 7.5% of the basic research payments determined pursuant to IRC § 41(e)(1)(A). Only expenditures for research conducted

in Maine qualify for the credit. The term “qualified research” is defined in IRC § 41(d). The credit is limited to the tax liability of the taxpayer. In the case of corporations,

the credit is limited to the first $25,000 of tax liability before credits plus 75% of the tax liability that exceeds $25,000. Carryover provisions apply. 36 M.R.S.A. § 5219-

K.

Line 13. RESEARCH & DEVELOPMENT SUPER CREDIT. Businesses whose research expenses increase by more than 50% over the average research expenses

incurred in the 3 years immediately preceding the effective date of the credit qualify for the credit. The credit is equal to the excess over 150% of the 3-year average. It

is limited to 50% of the net income tax due after other credits and may not reduce the taxpayer’s tax liability to less than the net tax liability in the preceding year after

other credits. Carryover provisions apply. 36 M.R.S.A. § 5219-L.

Line 14. HIGH-TECHNOLOGY CREDIT. Businesses primarily engaged in high-tech activities and that lease, purchase and use, or purchase and lease computer

equipment, electronic components and accessories, communications equipment or computer software placed in service in Maine and used in “high-technology activities”

qualify. The credit is equal to the adjusted basis of eligible equipment for federal income tax purposes or the amount of lease payments made (by lessee) less any lease

payments received for the eligible equipment during the tax year. The lessor may claim the credit only if the lessee waives entitlement to the credit. The reimbursement

period for BETR must be reduced one year for each tax year the eligible equipment is included in the basis for the High-Technology Credit. Also, Maine taxable income

must be increased by the amount of the investment credit base also claimed as a business expense for federal income tax purposes. Carryover provisions apply. 36 M.R.S.A.

§ 5219-M.

Line 15. MAINE MINIMUM TAX CREDIT. Complete the Maine minimum tax credit worksheet. 36 M.R.S.A. § 5203-A(5).

Line 16. CREDIT FOR DEPENDENT HEALTH BENEFITS PAID. Employers that offer a qualified health benefit plan and that employ fewer than 5 low-income

employees may qualify for a credit equal to the lesser of 20% of the dependent health benefits paid by the employer or $125 per employee with dependent health benefits

coverage. A taxpayer that employs 5 or more low-income employees after qualifying for the credit may continue to qualify for the credit for another 2 years. The credit is

limited to 50% of the income tax due. The credit is subject to additional restrictions. Enclose a schedule showing the computation of this credit. Carryover provisions apply.

The credit applies to tax years beginning on or after January 1, 1999. 36 M.R.S.A. § 5219-O.

Line 17. CLEAN FUEL CREDIT. The credit is 50% of expenditures made or incurred from January 1, 1999 to December 31, 2001 for construction, installation of or

improvements to any filling station or charging station located in Maine for the purpose of providing clean fuels to the general public for use in motor vehicles. From

January 1, 2002 to December 31, 2005 the credit is 25% of these expenditures. Enclose a schedule showing the computation of this credit. The credit automatically expires

January 1, 2006. 36 M.R.S.A. § 5219-P.

Line 18. HISTORIC REHABILITATION CREDIT.

A taxpayer is allowed a credit equal to the amount of the federal credit including carryovers for rehabilitation

of certified historic structures located in Maine. The credit is nonrefundable and is limited to $100,000 annually per taxpayer. The credit is subject to the same

recapture provisions as under the Internal Revenue Code. The credit applies to tax years beginning on or after January 1, 2000. 36 MRSA § 5219-R.

Line 19. FAMILY DEVELOPMENT ACCOUNT CREDIT. Individuals whose family income is below 200% of the poverty level may open a family development

account in connection with an approved community development organization. Use of these funds include educational expenses, home and auto purchases or repairs,

emergency expenses for basic needs, capital to start a business and health care costs. Accounts are funded by deposits made by family members participating in the

program and matching funds from community development organizations. Deposits to the fund are not exempt from tax; however, withdrawals (both principal and

interest) are exempt from Maine income tax. 10 M.R.S.A. § 1077(4).

New legislation provides a credit to contributors to family development matching fund accounts. The credit per tax return is equal to the lesser of $25,000

or 50% of the amount contributed. The credit is limited to the tax liability on the return and must be taken after the allowance of all other credits. Maine itemized

deductions must exclude any contributions claimed for this credit. The aggregate allowable credit amount in a state fiscal year is limited to $200,000. The Finance

Authority of Maine is required to certify the allowable credit for each contributor. The credit applies to tax years beginning on or after January 1, 2000. 36 M.R.S.A.

§ 5216-C.

Line 22. ALLOWABLE CREDITS . These credits are not refundable. The total credits claimed cannot exceed the Maine Fiduciary Income Tax otherwise due for the

taxable year.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4