Form R-6465-Application For Extension Of Time To File-Signature And Verification September 1999

ADVERTISEMENT

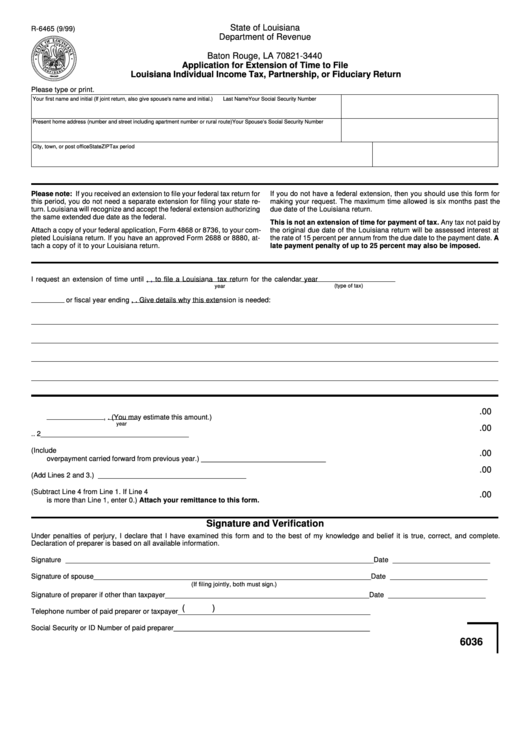

State of Louisiana

R-6465 (9/99)

Department of Revenue

P.O. Box 3440

Baton Rouge, LA 70821-3440

Application for Extension of Time to File

Louisiana Individual Income Tax, Partnership, or Fiduciary Return

Please type or print.

Your first name and initial (If joint return, also give spouse's name and initial.)

Last Name

Your Social Security Number

Present home address (number and street including apartment number or rural route)

Your Spouse‘s Social Security Number

City, town, or post office

State

ZIP

Tax period

Please note: If you received an extension to file your federal tax return for

If you do not have a federal extension, then you should use this form for

this period, you do not need a separate extension for filing your state re-

making your request. The maximum time allowed is six months past the

turn. Louisiana will recognize and accept the federal extension authorizing

due date of the Louisiana return.

the same extended due date as the federal.

This is not an extension of time for payment of tax. Any tax not paid by

Attach a copy of your federal application, Form 4868 or 8736, to your com-

the original due date of the Louisiana return will be assessed interest at

pleted Louisiana return. If you have an approved Form 2688 or 8880, at-

the rate of 15 percent per annum from the due date to the payment date. A

tach a copy of it to your Louisiana return.

late payment penalty of up to 25 percent may also be imposed.

I request an extension of time until

,

,

to file a Louisiana

tax return for the calendar year

(type of tax)

year

or fiscal year ending

,

. Give details why this extension is needed:

1.

Print total Louisiana income tax liability for tax year ended.

.00

,

. (You may estimate this amount.) .................................................... 1 ______________________________________

year

.00

2.

Print total Louisiana income tax withheld ...................................................................................... 2 ______________________________________

3.

Print total estimated tax payments. (Include

.00

overpayment carried forward from previous year.) ........................................................................ 3 ______________________________________

.00

4.

Print total prepayments (Add Lines 2 and 3.) ................................................................................ 4 ______________________________________

5.

Print income tax balance due. (Subtract Line 4 from Line 1. If Line 4

.00

is more than Line 1, enter 0.) Attach your remittance to this form. .......................................... 5 ______________________________________

Signature and Verification

Under penalties of perjury, I declare that I have examined this form and to the best of my knowledge and belief it is true, correct, and complete.

Declaration of preparer is based on all available information.

Signature _______________________________________________________________________________

Date _________________________

Signature of spouse _______________________________________________________________________

Date _________________________

(If filing jointly, both must sign.)

Signature of preparer if other than taxpayer ____________________________________________________

Date _________________________

(

)

Telephone number of paid preparer or taxpayer _________________________________________________

Social Security or ID Number of paid preparer __________________________________________________

6036

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1