Form 51a260 - Streamlined Sales And Use Tax Agreement-Certificate Of Exemption January 2012

ADVERTISEMENT

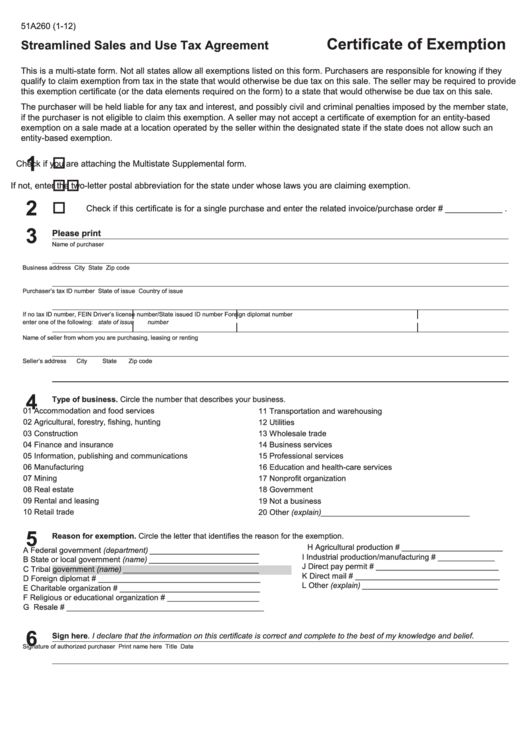

51A260 (1-12)

Certificate of Exemption

Streamlined Sales and Use Tax Agreement

This is a multi-state form. Not all states allow all exemptions listed on this form. Purchasers are responsible for knowing if they

qualify to claim exemption from tax in the state that would otherwise be due tax on this sale. The seller may be required to provide

this exemption certificate (or the data elements required on the form) to a state that would otherwise be due tax on this sale.

The purchaser will be held liable for any tax and interest, and possibly civil and criminal penalties imposed by the member state,

if the purchaser is not eligible to claim this exemption. A seller may not accept a certificate of exemption for an entity-based

exemption on a sale made at a location operated by the seller within the designated state if the state does not allow such an

entity-based exemption.

1

Check if you are attaching the Multistate Supplemental form.

If not, enter the two-letter postal abbreviation for the state under whose laws you are claiming exemption.

2

Check if this certificate is for a single purchase and enter the related invoice/purchase order # ____________ .

3

Please print

Name of purchaser

Business address

City

State

Zip code

Purchaser’s tax ID number

State of issue

Country of issue

If no tax ID number,

FEIN

Driver’s license number/State issued ID number

Foreign diplomat number

enter one of the following:

state of issue

number

Name of seller from whom you are purchasing, leasing or renting

Seller’s address

City

State

Zip code

4

Type of business. Circle the number that describes your business.

01 Accommodation and food services

11 Transportation and warehousing

02 Agricultural, forestry, fishing, hunting

12 Utilities

03 Construction

13 Wholesale trade

04 Finance and insurance

14 Business services

05 Information, publishing and communications

15 Professional services

06 Manufacturing

16 Education and health-care services

07 Mining

17 Nonprofit organization

08 Real estate

18 Government

09 Rental and leasing

19 Not a business

10 Retail trade

20 Other (explain)__________________________________

5

Reason for exemption. Circle the letter that identifies the reason for the exemption.

H Agricultural production # _______________________

A Federal government (department) _________________________

I

Industrial production/manufacturing # _____________

B State or local government (name) _________________________

J

Direct pay permit # ____________________________

C Tribal government (name) _______________________________

K Direct mail # _________________________________

D Foreign diplomat # _____________________________________

L Other (explain) _______________________________

E Charitable organization # ________________________________

F Religious or educational organization # _____________________

G Resale # _____________________________________________

6

Sign here. I declare that the information on this certificate is correct and complete to the best of my knowledge and belief.

Signature of authorized purchaser

Print name here

Title

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2