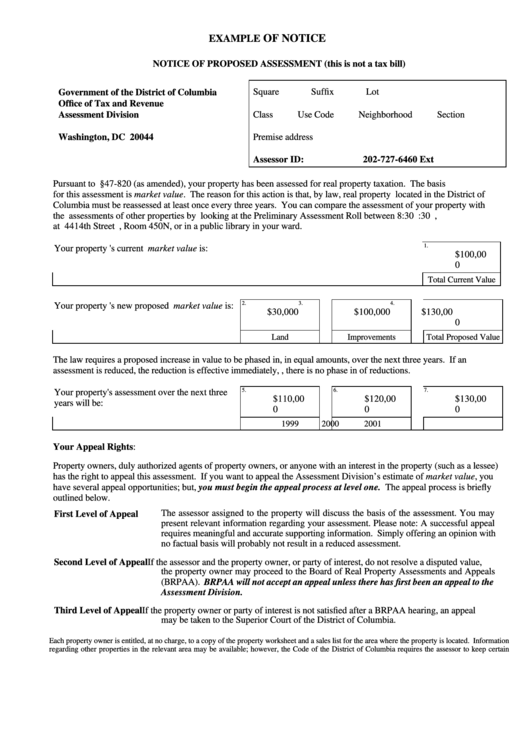

OF NOTICE

EXAMPLE

NOTICE OF PROPOSED ASSESSMENT (this is not a tax bill)

Government of the District of Columbia

Square

Suffix

Lot

Office of Tax and Revenue

Class

Use Code

Neighborhood

Section

Assessment Division

P.O. Box 176

Washington, DC 20044

Premise address

Assessor ID:

202-727-6460 Ext

Pursuant to D.C. Code §47-820 (as amended), your property has been assessed for real property taxation. The basis

for this assessment is market value. The reason for this action is that, by law, real property located in the District of

Columbia must be reassessed at least once every three years. You can compare the assessment of your property with

the assessments of other properties by looking at the Preliminary Assessment Roll between 8:30 a.m. and 4:30 p.m.,

at 441 4th Street N.W., Room 450N, or in a public library in your ward.

1.

Your property 's current market value is:

$100,00

0

Total Current Value

2.

3.

4.

Your property 's new proposed market value is:

$30,000

$100,000

$130,00

0

Land

Improvements

Total Proposed Value

The law requires a proposed increase in value to be phased in, in equal amounts, over the next three years. If an

assessment is reduced, the reduction is effective immediately, i.e., there is no phase in of reductions.

5.

6.

7.

Your property's assessment over the next three

$110,00

$120,00

$130,00

years will be:

0

0

0

1999

2000

2001

Your Appeal Rights:

Property owners, duly authorized agents of property owners, or anyone with an interest in the property (such as a lessee)

has the right to appeal this assessment. If you want to appeal the Assessment Division’s estimate of market value, you

have several appeal opportunities; but, you must begin the appeal process at level one. The appeal process is briefly

outlined below.

The assessor assigned to the property will discuss the basis of the assessment. You may

First Level of Appeal

present relevant information regarding your assessment. Please note: A successful appeal

requires meaningful and accurate supporting information. Simply offering an opinion with

no factual basis will probably not result in a reduced assessment.

If the assessor and the property owner, or party of interest, do not resolve a disputed value,

Second Level of Appeal

the property owner may proceed to the Board of Real Property Assessments and Appeals

(BRPAA). BRPAA will not accept an appeal unless there has first been an appeal to the

Assessment Division.

Third Level of Appeal

If the property owner or party of interest is not satisfied after a BRPAA hearing, an appeal

may be taken to the Superior Court of the District of Columbia.

Each property owner is entitled, at no charge, to a copy of the property worksheet and a sales list for the area where the property is located. Information

regarding other properties in the relevant area may be available; however, the Code of the District of Columbia requires the assessor to keep certain

1

1 2

2