2016 Earned Income Credit/child Tax Credit Eligibility Worksheet

ADVERTISEMENT

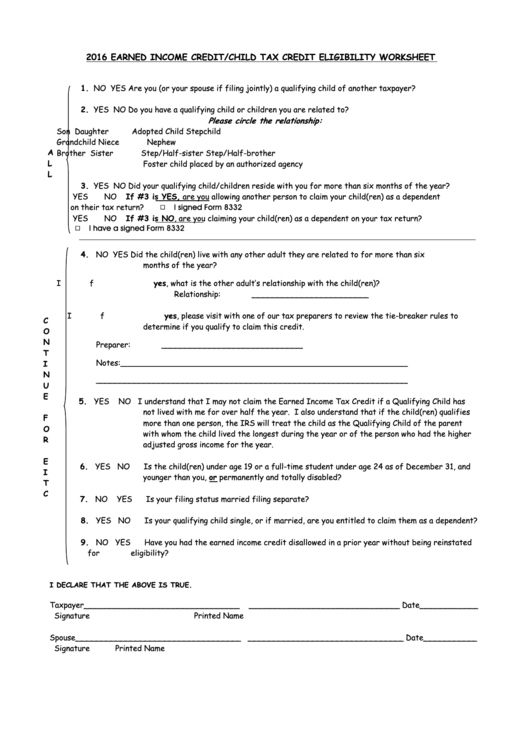

2016 EARNED INCOME CREDIT/CHILD TAX CREDIT ELIGIBILITY WORKSHEET

1. NO

YES

Are you (or your spouse if filing jointly) a qualifying child of another taxpayer?

2. YES NO

Do you have a qualifying child or children you are related to?

Please circle the relationship:

Son

Daughter

Adopted Child

Stepchild

Grandchild

Niece

Nephew

A

Brother

Sister

Step/Half-sister Step/Half-brother

L

Foster child placed by an authorized agency

L

3. YES NO

Did your qualifying child/children reside with you for more than six months of the year?

YES

NO

If #3 is YES, are you allowing another person to claim your child(ren) as a dependent

on their tax return?

I signed Form 8332

Q

YES

NO

If #3 is NO, are you claiming your child(ren) as a dependent on your tax return?

I have a signed Form 8332

Q

4. NO YES

Did the child(ren) live with any other adult they are related to for more than six

months of the year?

If yes, what is the other adult’s relationship with the child(ren)?

Relationship: ________________________

If yes, please visit with one of our tax preparers to review the tie-breaker rules to

C

determine if you qualify to claim this credit.

O

N

Preparer: _____________________________

T

Notes:___________________________________________________________

I

N

________________________________________________________________

U

E

5. YES

NO

I understand that I may not claim the Earned Income Tax Credit if a Qualifying Child has

not lived with me for over half the year. I also understand that if the child(ren) qualifies

F

more than one person, the IRS will treat the child as the Qualifying Child of the parent

O

with whom the child lived the longest during the year or of the person who had the higher

R

adjusted gross income for the year.

E

6. YES NO

Is the child(ren) under age 19 or a full-time student under age 24 as of December 31, and

I

younger than you, or permanently and totally disabled?

T

C

7. NO

YES

Is your filing status married filing separate?

8. YES NO

Is your qualifying child single, or if married, are you entitled to claim them as a dependent?

9. NO

YES

Have you had the earned income credit disallowed in a prior year without being reinstated

for eligibility?

I DECLARE THAT THE ABOVE IS TRUE.

Taxpayer________________________________

_______________________________ Date____________

Signature

Printed Name

Spouse__________________________________ ________________________________ Date___________

Signature

Printed Name

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2