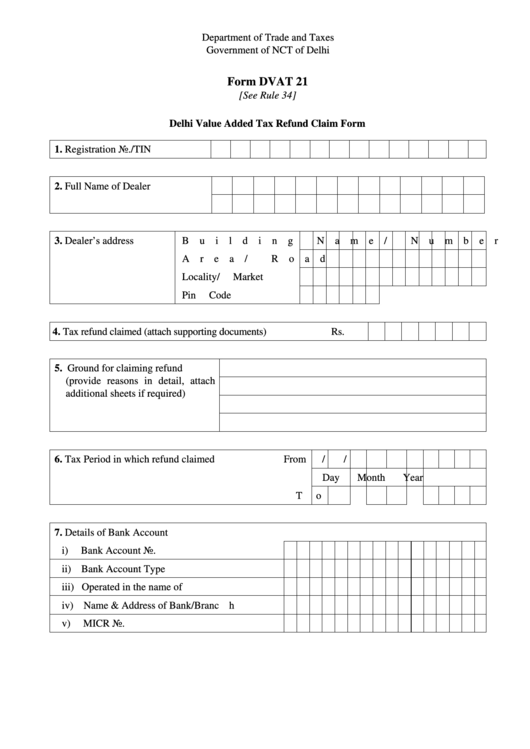

Form Dvat 21-Delhi Value Added Tax Refund Claim Form

ADVERTISEMENT

Department of Trade and Taxes

Government of NCT of Delhi

Form DVAT 21

[See Rule 34]

Delhi Value Added Tax Refund Claim Form

1. Registration No./TIN

2. Full Name of Dealer

3. Dealer’s address

Building Name/ Number

Area/ Road

Locality/ Market

Pin Code

4. Tax refund claimed (attach supporting documents)

Rs.

5. Ground for claiming refund

(provide reasons in detail, attach

additional sheets if required)

6. Tax Period in which refund claimed

From

/

/

Day

Month

Year

To

7. Details of Bank Account

i)

Bank Account No.

ii) Bank Account Type

iii) Operated in the name of

iv) Name & Address of Bank/Branch

v)

MICR No.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2