Form St-16 - Sales And Use Tax Certificate Of Exemption

ADVERTISEMENT

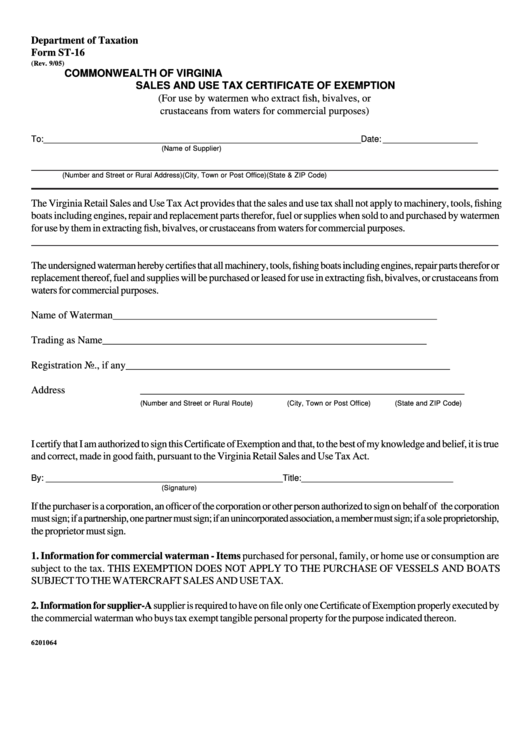

Department of Taxation

Form ST-16

(Rev. 9/05)

COMMONWEALTH OF VIRGINIA

SALES AND USE TAX CERTIFICATE OF EXEMPTION

(For use by watermen who extract fish, bivalves, or

crustaceans from waters for commercial purposes)

To: ___________________________________________________________________ Date: ____________________

(Name of Supplier)

(Number and Street or Rural Address)

(City, Town or Post Office)

(State & ZIP Code)

The Virginia Retail Sales and Use Tax Act provides that the sales and use tax shall not apply to machinery, tools, fishing

boats including engines, repair and replacement parts therefor, fuel or supplies when sold to and purchased by watermen

for use by them in extracting fish, bivalves, or crustaceans from waters for commercial purposes.

The undersigned waterman hereby certifies that all machinery, tools, fishing boats including engines, repair parts therefor or

replacement thereof, fuel and supplies will be purchased or leased for use in extracting fish, bivalves, or crustaceans from

waters for commercial purposes.

Name of Waterman

______________________________________________________________

Trading as Name

______________________________________________________________

Registration No., if any

______________________________________________________________

Address

______________________________________________________________

(Number and Street or Rural Route)

(City, Town or Post Office)

(State and ZIP Code)

I certify that I am authorized to sign this Certificate of Exemption and that, to the best of my knowledge and belief, it is true

and correct, made in good faith, pursuant to the Virginia Retail Sales and Use Tax Act.

By: __________________________________________________

Title: ________________________________

(Signature)

If the purchaser is a corporation, an officer of the corporation or other person authorized to sign on behalf of the corporation

must sign; if a partnership, one partner must sign; if an unincorporated association, a member must sign; if a sole proprietorship,

the proprietor must sign.

1. Information for commercial waterman - Items purchased for personal, family, or home use or consumption are

subject to the tax. THIS EXEMPTION DOES NOT APPLY TO THE PURCHASE OF VESSELS AND BOATS

SUBJECT TO THE WATERCRAFT SALES AND USE TAX.

2. Information for supplier-A supplier is required to have on file only one Certificate of Exemption properly executed by

the commercial waterman who buys tax exempt tangible personal property for the purpose indicated thereon.

6201064

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1