Form 65-5300 - Employer'S Contribution & Payroll Report

ADVERTISEMENT

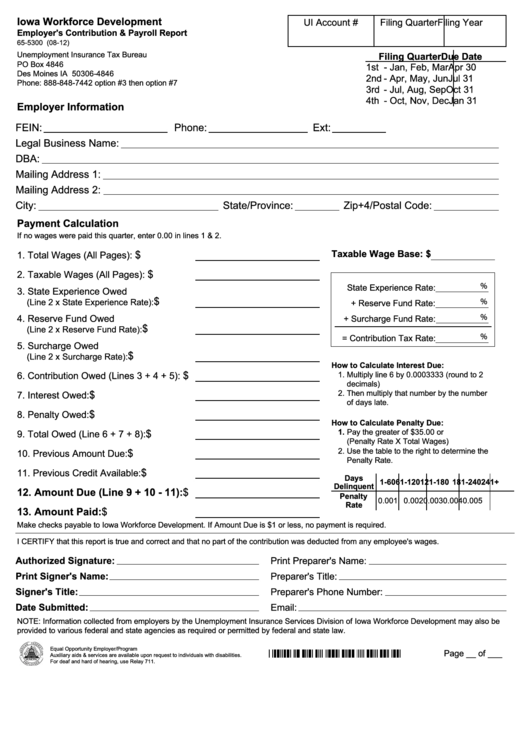

Iowa Workforce Development

UI Account #

Filing Quarter

Filing Year

Employer's Contribution & Payroll Report

65-5300 (08-12)

Unemployment Insurance Tax Bureau

Filing Quarter

Due Date

PO Box 4846

1st - Jan, Feb, Mar

Apr 30

Des Moines IA 50306-4846

2nd - Apr, May, Jun

Jul 31

Phone: 888-848-7442 option #3 then option #7

3rd - Jul, Aug, Sep

Oct 31

4th - Oct, Nov, Dec

Jan 31

Employer Information

FEIN:

Phone:

Ext:

Legal Business Name:

DBA:

Mailing Address 1:

Mailing Address 2:

City:

State/Province:

Zip+4/Postal Code:

Payment Calculation

If no wages were paid this quarter, enter 0.00 in lines 1 & 2.

Taxable Wage Base: $

$

1. Total Wages (All Pages):

$

2. Taxable Wages (All Pages):

%

State Experience Rate:

3. State Experience Owed

%

$

(Line 2 x State Experience Rate):

+ Reserve Fund Rate:

%

4. Reserve Fund Owed

+ Surcharge Fund Rate:

$

(Line 2 x Reserve Fund Rate):

%

= Contribution Tax Rate:

5. Surcharge Owed

$

(Line 2 x Surcharge Rate):

How to Calculate Interest Due:

$

1. Multiply line 6 by 0.0003333 (round to 2

6. Contribution Owed (Lines 3 + 4 + 5):

decimals)

2. Then multiply that number by the number

$

7. Interest Owed:

of days late.

$

8. Penalty Owed:

How to Calculate Penalty Due:

1. Pay the greater of $35.00 or

$

9. Total Owed (Line 6 + 7 + 8):

(Penalty Rate X Total Wages)

2. Use the table to the right to determine the

$

10. Previous Amount Due:

Penalty Rate.

$

11. Previous Credit Available:

Days

1-60 61-120 121-180 181-240 241+

Delinquent

12. Amount Due (Line 9 + 10 - 11): $

Penalty

0.001 0.002

0.003

0.004 0.005

Rate

13. Amount Paid:

$

Make checks payable to Iowa Workforce Development. If Amount Due is $1 or less, no payment is required.

I CERTIFY that this report is true and correct and that no part of the contribution was deducted from any employee's wages.

Authorized Signature:

Print Preparer's Name:

Print Signer's Name:

Preparer's Title:

Signer's Title:

Preparer's Phone Number:

Date Submitted:

Email:

NOTE: Information collected from employers by the Unemployment Insurance Services Division of Iowa Workforce Development may also be

provided to various federal and state agencies as required or permitted by federal and state law.

Equal Opportunity Employer/Program

Page __ of ___

Auxiliary aids & services are available upon request to individuals with disabilities.

For deaf and hard of hearing, use Relay 711.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1