Form G-2rp - Withholding On Sales Or Transfers Of Real Property And Associated Tangible Personal Property By Nonresidents - 2004

ADVERTISEMENT

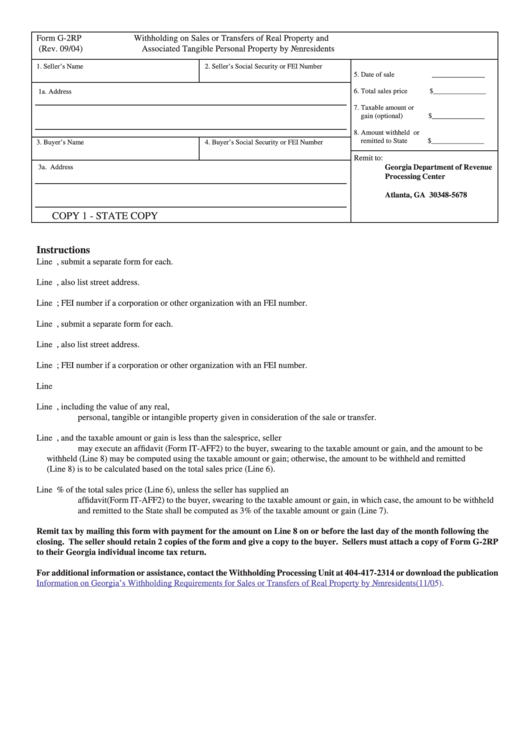

Form G-2RP

Withholding on Sales or Transfers of Real Property and

(Rev. 09/04)

Associated Tangible Personal Property by Nonresidents

1. Seller’s Name

2. Seller’s Social Security or FEI Number

5. Date of sale

_______________

6. Total sales price

$_______________

1a. Address

7. Taxable amount or

gain (optional)

$_______________

8. Amount withheld or

remitted to State

$_______________

3. Buyer’s Name

4. Buyer’s Social Security or FEI Number

Remit to:

Georgia Department of Revenue

3a. Address

Processing Center

P.O. Box 105678

Atlanta, GA 30348-5678

COPY 1 - STATE COPY

Instructions

Line 1.

If more than one seller, submit a separate form for each.

Line 1a.

If mailing address is a Post Office Box, also list street address.

Line 2.

Social security number if an individual; FEI number if a corporation or other organization with an FEI number.

Line 3.

If more than one buyer, submit a separate form for each.

Line 3a.

If mailing address is a Post Office Box, also list street address.

Line 4.

Social security number if an individual; FEI number if a corporation or other organization with an FEI number.

Line 5.

Date the sale or transfer of real property and associated tangible personal property took place.

Line 6.

Total amount paid for the real property and associated tangible personal property, including the value of any real,

personal, tangible or intangible property given in consideration of the sale or transfer.

Line 7.

If the taxable gain from the sale or transfer is known, and the taxable amount or gain is less than the sales

price, seller

may execute an affidavit (Form IT-AFF2) to the buyer, swearing to the taxable amount or gain, and the amount to be

withheld (Line 8) may be computed using the taxable amount or gain; otherwise, the amount to be withheld and remitted

(Line 8) is to be calculated based on the total sales price (Line 6).

Line 8.

Amount withheld and remitted to the State is 3% of the total sales price (Line 6), unless the seller has supplied an

affidavit (Form IT-AFF2) to the buyer, swearing to the taxable amount or gain, in which case, the amount to be withheld

and remitted to the State shall be computed as 3% of the taxable amount or gain (Line 7).

Remit tax by mailing this form with payment for the amount on Line 8 on or before the last day of the month following the

closing. The seller should retain 2 copies of the form and give a copy to the buyer. Sellers must attach a copy of Form G-2RP

to their Georgia individual income tax return.

For additional information or assistance, contact the Withholding Processing Unit at 404-417-2314 or download the publication

Information on Georgia’s Withholding Requirements for Sales or Transfers of Real Property by Nonresidents

(11/05).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1