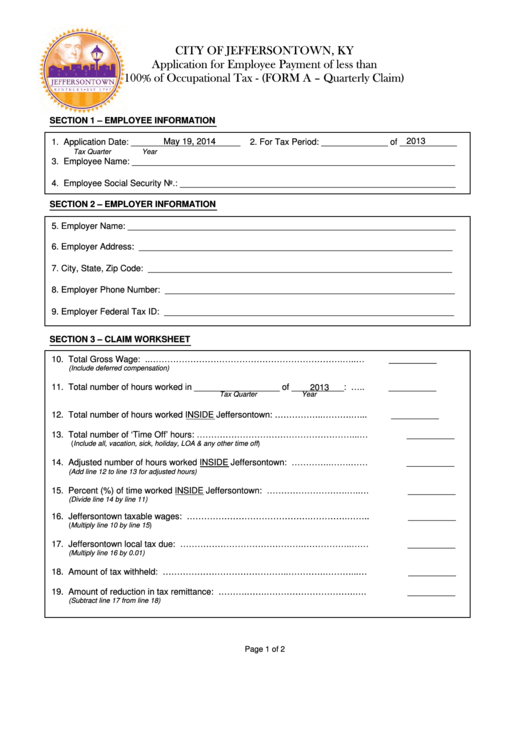

CITY OF JEFFERSONTOWN, KY

Application for Employee Payment of less than

100% of Occupational Tax - (FORM A – Quarterly Claim)

jeffersontownky.gov

SECTION 1 – EMPLOYEE INFORMATION

May 19, 2014

2013

1. Application Date: _______________________

2. For Tax Period: ______________ of ____________

Tax Quarter

Year

3. Employee Name: ____________________________________________________________________

4. Employee Social Security No.: __________________________________________________________

SECTION 2 – EMPLOYER INFORMATION

5. Employer Name: _____________________________________________________________________

6. Employer Address: __________________________________________________________________

7. City, State, Zip Code: ________________________________________________________________

8. Employer Phone Number: _____________________________________________________________

9. Employer Federal Tax ID: _____________________________________________________________

SECTION 3 – CLAIM WORKSHEET

10. Total Gross Wage: ..………………………………………………………….…..…

__________

(Include deferred compensation)

11. Total number of hours worked in __________________ of ___________: …..

2013

__________

Tax Quarter

Year

12. Total number of hours worked INSIDE Jeffersontown: ……………..……….…...

__________

13. Total number of ‘Time Off’ hours: ………………………………………………...…

__________

(Include all, vacation, sick, holiday, LOA & any other time off)

14. Adjusted number of hours worked INSIDE Jeffersontown: …………..…….……

__________

(Add line 12 to line 13 for adjusted hours)

15. Percent (%) of time worked INSIDE Jeffersontown: ……………………….…..…

__________

(Divide line 14 by line 11)

16. Jeffersontown taxable wages: …………………………………….………….……..

__________

(Multiply line 10 by line 15)

17. Jeffersontown local tax due: …………………………………….……………..……

__________

(Multiply line 16 by 0.01)

18. Amount of tax withheld: ……………………………………..………….………...…

__________

19. Amount of reduction in tax remittance: ……….…….………………………….….

__________

(Subtract line 17 from line 18)

Page 1 of 2

1

1 2

2