Unemployment Insurance Tax Refund Request Form - Idaho Department Of Labor

ADVERTISEMENT

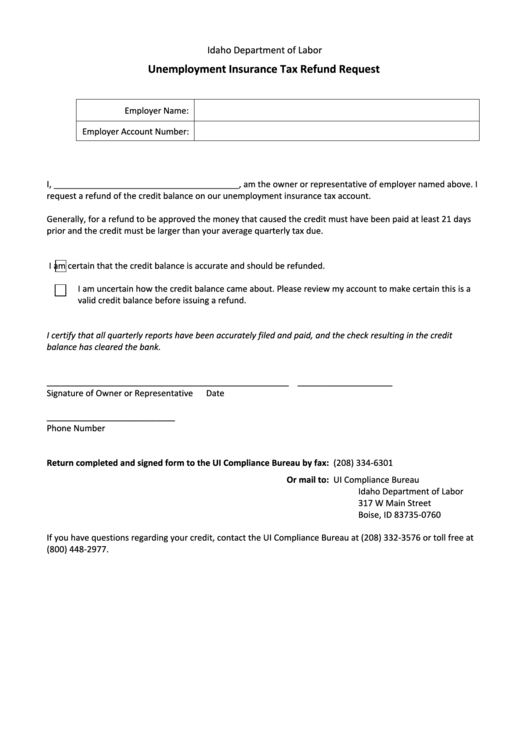

Idaho Department of Labor

Unemployment Insurance Tax Refund Request

Employer Name:

Employer Account Number:

I, _______________________________________, am the owner or representative of employer named above. I

request a refund of the credit balance on our unemployment insurance tax account.

Generally, for a refund to be approved the money that caused the credit must have been paid at least 21 days

prior and the credit must be larger than your average quarterly tax due.

I am certain that the credit balance is accurate and should be refunded.

I am uncertain how the credit balance came about. Please review my account to make certain this is a

valid credit balance before issuing a refund.

I certify that all quarterly reports have been accurately filed and paid, and the check resulting in the credit

balance has cleared the bank.

___________________________________________________

____________________

Signature of Owner or Representative

Date

___________________________

Phone Number

Return completed and signed form to the UI Compliance Bureau by fax:

(208) 334-6301

Or mail to:

UI Compliance Bureau

Idaho Department of Labor

317 W Main Street

Boise, ID 83735-0760

If you have questions regarding your credit, contact the UI Compliance Bureau at (208) 332-3576 or toll free at

(800) 448-2977.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1